- The Sovereign Signal

- Posts

- 100% of COMEX November Gold Contracts Stood For Delivery Yesterday, 9 Weeks Until China Silver Inventories Are Drained, Options Market Screaming Large Upside Move Ahead for SLV

100% of COMEX November Gold Contracts Stood For Delivery Yesterday, 9 Weeks Until China Silver Inventories Are Drained, Options Market Screaming Large Upside Move Ahead for SLV

Physical stress, delivery pressure, and options-market positioning are converging into the same singular signal: the metals market is entering an explosive, supply-driven repricing phase.

737 November gold contracts traded yesterday. 737 stood for delivery. 100%.

That’s not trading, that’s a quiet physical raid.

Somebody big just said: “Don’t roll it, deliver it.”

That almost never happens — which means a player with real size thinks December gold is about to reprice and wants metal in hand before it does.

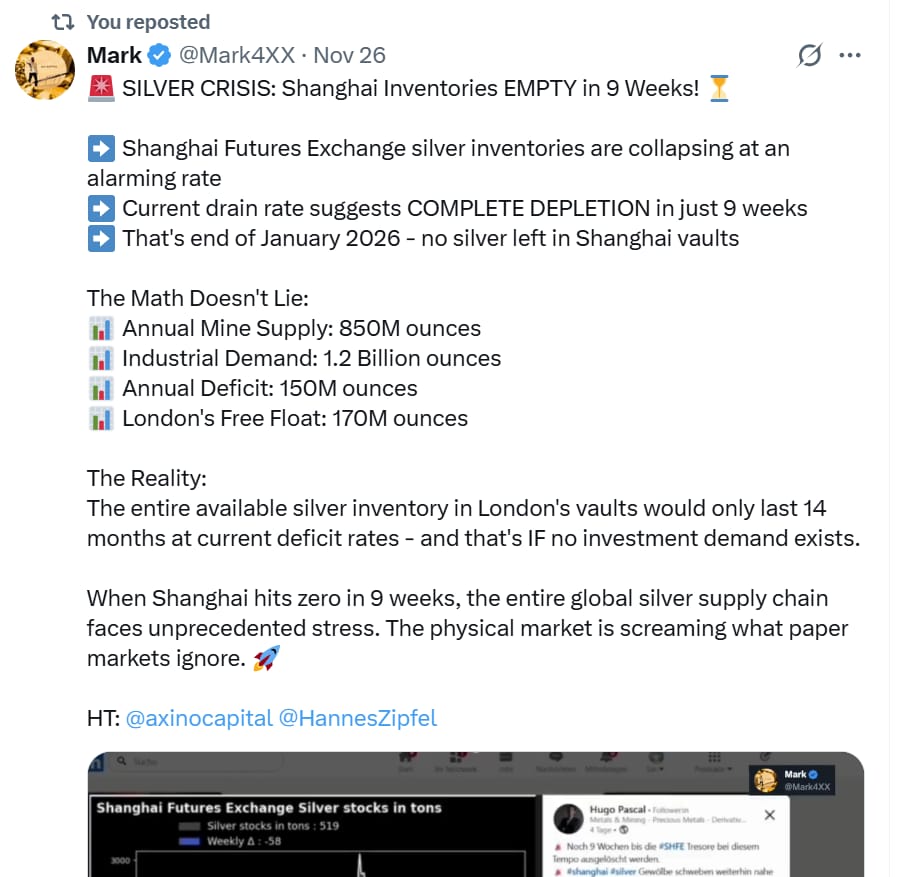

Shanghai running out of silver in nine weeks isn’t a chart—it’s a fire alarm.

If the biggest physical hub in Asia hits zero, every downstream link in the global supply chain gets stress-tested at once.

London’s float barely covers a year of normal deficits. Add investment demand? The system snaps faster.

This is the kind of setup where price doesn’t “re-rate”… it lurches. The paper market can pretend; the physical market can’t.

Silver isn’t drifting higher because of vibes or hype. It’s being dragged higher by physics-level constraints.

Chinese stockpiles hitting decade lows, London getting emergency inflows just to stay functional, and global industrial demand blowing past mine supply by hundreds of millions of ounces—that’s the recipe.

When a market runs persistent deficits and both major vault systems start flashing empty, price doesn’t gently adjust.

It jumps to whatever level forces demand to cool and supply to surface. That’s why $75 → $100 isn’t a prediction; it’s a pressure valve.

The squeeze is structural. The move is inevitable.

Backwardation at LBMA flipping into contango while COMEX is bleeding physical out the door means something very simple but very explosive:

U.S. buyers are no longer recycling metal back into the global pool—they’re hoarding it.

And when investors start keeping the bars inside the U.S. system instead of exporting them to London, it tells you two things:

Physical tightness is now undeniable.

People only hoard metal when they believe tomorrow’s supply will be worse than today’s.The LBMA is losing control of price discovery.

London relies on metal flowing back to its vaults.

When COMEX withdrawals surge and the U.S. refuses to release metal back to London, LBMA gets starved.

All of it funnels into one conclusion:

Physical silver is migrating out of the “paper liquidity” world (LBMA) and into the “real possession” world (COMEX + U.S. investors).

That’s why this flip—from backwardation to contango—matters so much.

It’s the market whispering:

The scramble for real metal has started, and London is the first to feel the choke.

This is the options market confirming the physical market’s alarm bells.

Everything we’ve been tracking—Shanghai emptying out, China paying premiums, COMEX withdrawals exploding, LBMA losing metal, delivery demand spiking—has been the physical market screaming that silver is tight.

Now the options market is starting to echo the same message.

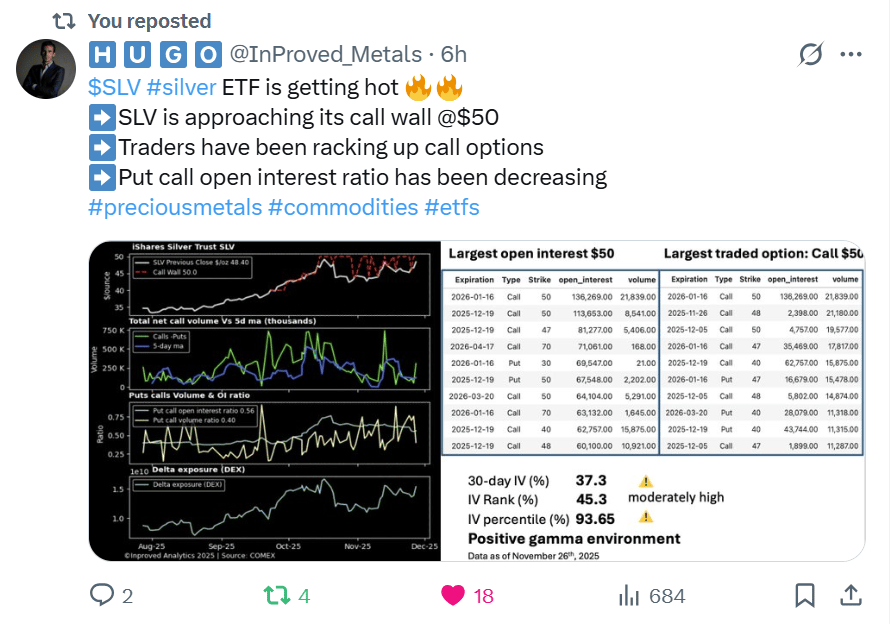

What this chart shows:

• SLV is running straight into a massive call wall at $50

• Call buying is accelerating

• Put interest collapsing

• Gamma exposure flipping positive

• Open interest stacking up at higher strikes

Translation: Traders are positioning for a violent upside move, not a fade.

Why this matters in the broader context:

Physical stress → Options aggression.

When metal is clearly vanishing from Shanghai, London, and COMEX, smart money stops selling upside and starts leveraging it.Call walls break when underlying demand is real.

A $50 call wall normally holds—unless actual supply is vanishing.Options traders are betting the physical crunch hits the ETF next.

If SLV has to source physical in tight markets, the pressure cascades.A positive gamma regime accelerates moves.

Market makers must hedge by buying SLV as price rises → self-reinforcing melt-up.

In other words:

The derivatives market is finally waking up to what the physical market has been shouting for months.

The fuse was lit in Shanghai, carried through COMEX, and now the options market is catching fire.

This is the point in a supply crunch where price stops drifting and starts running.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply