- The Sovereign Signal

- Posts

- $17.9B Reverse Repos, $2.947T SOFRVOL (Overnight Funding Volume), 4.39% SOFR (Overnight Financing Rate) — The Fragility Trifecta

$17.9B Reverse Repos, $2.947T SOFRVOL (Overnight Funding Volume), 4.39% SOFR (Overnight Financing Rate) — The Fragility Trifecta

The Fed’s overflow tank has run dry, nightly funding dependence has hit an all-time record, and the cost of rolling debt is spiking. This is the epitome of structural fragility — a coiled spring where every day of distortion builds pressure for explosive reallocation into real collateral, led by gold and silver.

With the safety net (reverse repos) empty, the nightly roll (SOFRVOL) at a record, and the cost of rolling (SOFR overnight rate) spiking, stability won’t fade—it’ll snap.

That’s what structural fragility looks like in the plumbing, and it’s exactly the backdrop that lifts real collateral (gold/silver) from “hedge” to “benchmark.”

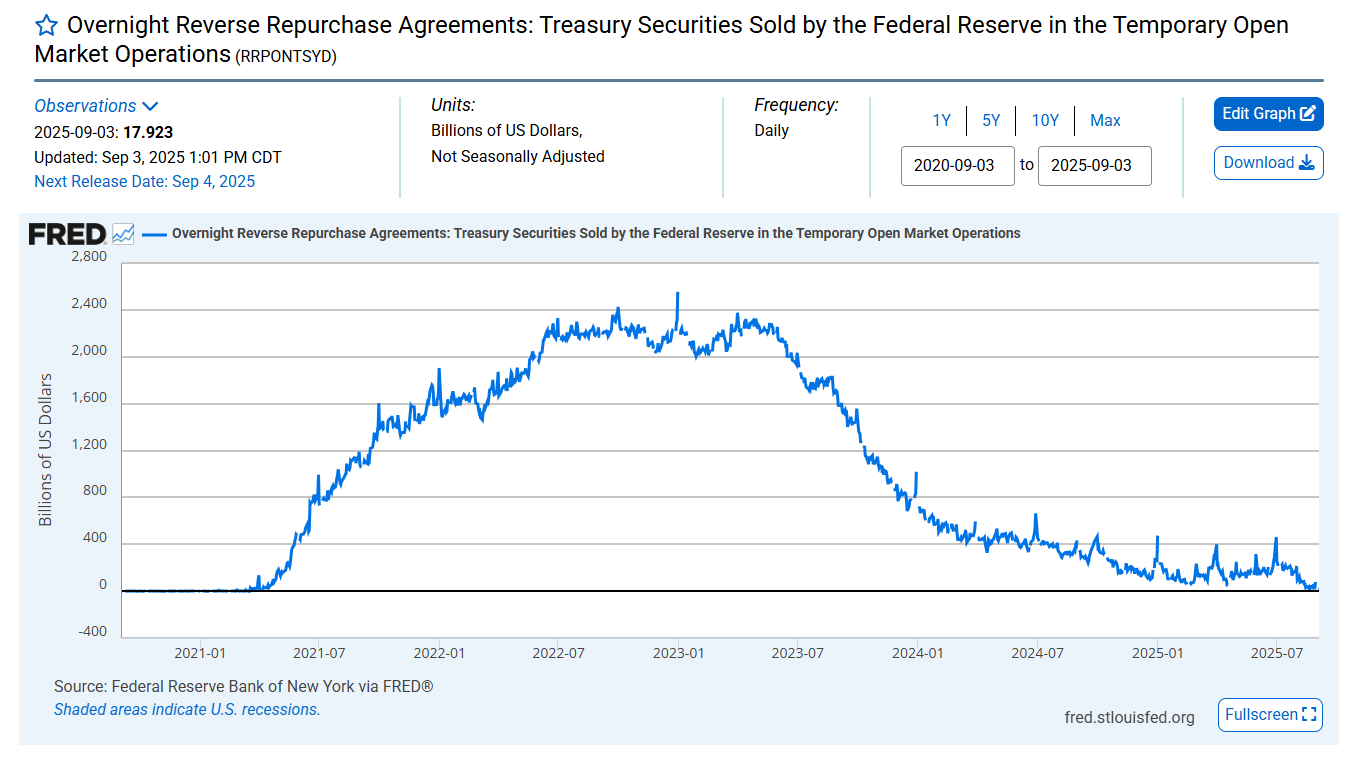

The safety net is gone. RRP at $17.9B means the Fed’s overflow tank is basically empty.

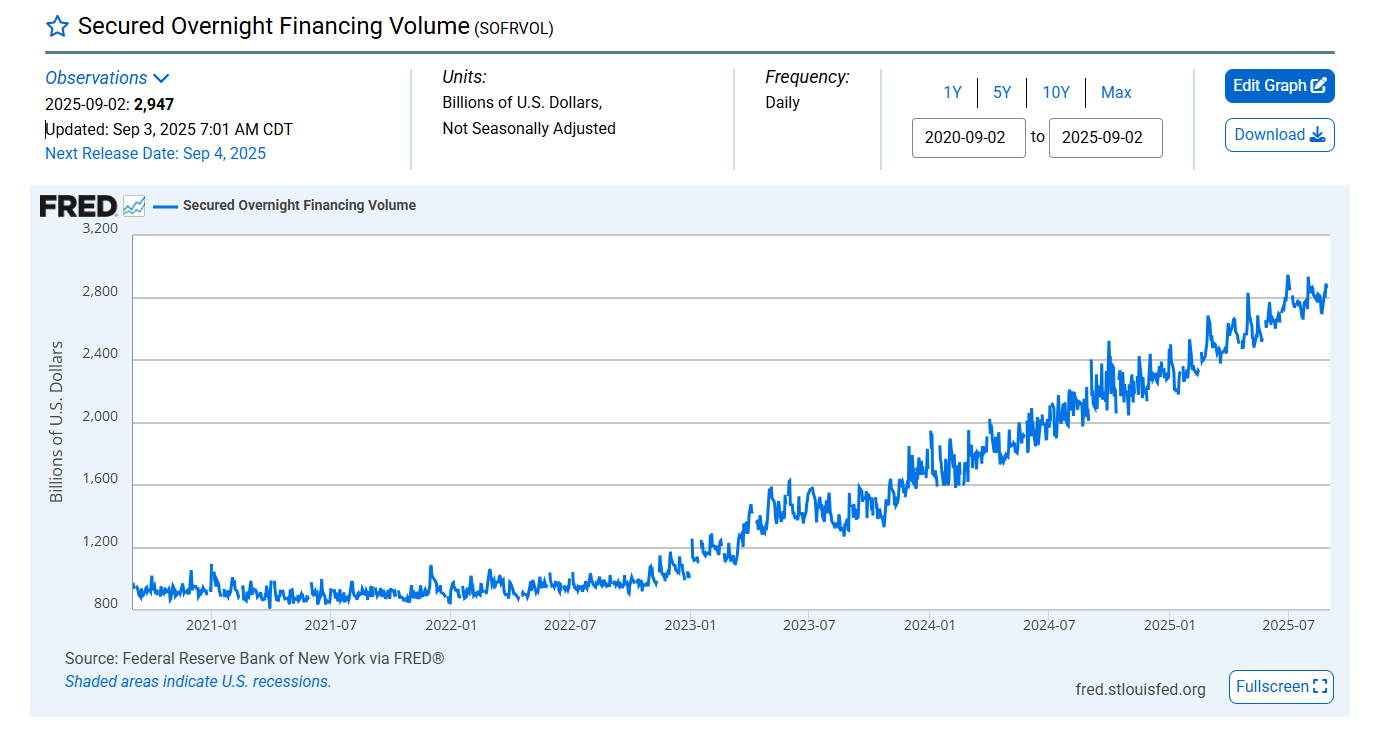

We live day-to-day. SOFR volume at a record $2.947T says more money than ever must be rolled every single night just to keep the machine humming.

Source - newyorkfed.org

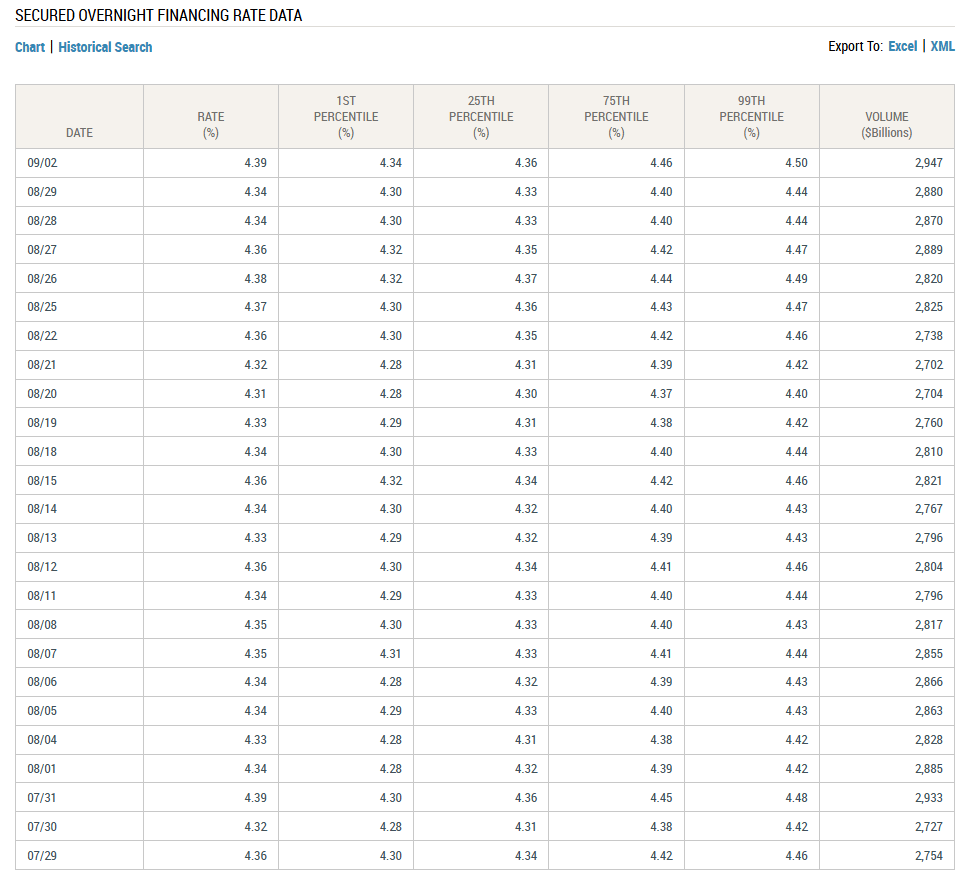

And the rent just went up. SOFR at 4.39% means that nightly roll is expensive and getting pricier.

That’s not three fun facts. It’s a system diagram.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –25.9 bps | Still deeply negative. Confirms ongoing impairment in cash Treasuries: dealers continue preferring swaps (synthetic exposure) over warehousing real bonds. | 🔴 Red |

Reverse Repos (RRP) | $17.93B (fresh low) | The Fed’s “overflow tank” is nearly empty. Cushion effectively gone, meaning every dollar of funding demand must now be met in the wild market. Signals elevated collateral velocity and brittle liquidity. | 🔴 Red |

USD/JPY | 148.32 | Danger band intact; edging higher toward critical tripwires. Carry trade fragility persists, volatility risk elevated. | 🟠 Orange |

USD/CHF | 0.8051 | Hovering just above the 0.80 danger line. Safe-haven demand still strong—flows show persistent systemic fragility. | 🟠 Orange |

3-Year SOFR–OIS Spread | 25.83 bps | Eased slightly but remains highly elevated versus calm norms. Lenders continue charging a heavy “future anxiety premium.” Term-funding stress entrenched. | 🔴 Red |

SOFR Overnight Rate | 4.39% (tied for highest since July 29) | Funding costs remain sticky at the top of the range. Even with supposed “ample reserves,” repo pipes are running tight. | 🔴 Red |

SOFR Daily Volume (SOFRVOL) | $2.947T (new all-time high, just barely) | Market chained to record nightly rollovers — dependency keeps rising. Paycheck-to-paycheck liquidity regime entrenched. | 🔴 Red |

SLV Borrow Rate | 0.62% (1.8M avail.) | Borrow costs ticking higher while availability shrinks materially. Signals tighter conditions in the silver collateral chain. | 🟠 Orange |

COMEX Silver Registered | 192.627M oz | Cushion slipping again. Stocks remain razor-thin relative to massive paper leverage. | 🟠 Orange |

COMEX Silver Volume | 69,090 | Activity cooled from the prior jump, suggesting consolidation after momentum surge. | 🟡 Yellow |

COMEX Silver Open Interest | 158,282 | Still elevated, leverage sustained. Market maintaining significant directional positioning. | 🟠 Orange |

GLD Borrow Rate | 0.29% (6.6M avail.) | Costs eased further, availability higher. Funding remains loose for now. | 🟡 Yellow |

COMEX Gold Registered | 21.32M oz | Stocks ticked lower, staying wafer-thin against paper exposures. | 🟡 Yellow |

COMEX Gold Volume | 243,321 | High turnover confirms active positioning and significant liquidity. | 🟠 Orange |

COMEX Gold Open Interest | 496,385 | Elevated, showing robust leverage and participation in gold futures. | 🟠 Orange |

UST–JGB 10Y Spread | 2.601% | Still inside the danger zone. Below 2.5% → carry fragility; above 3% → weaker UST demand. Hovering mid-band. | 🟠 Orange |

Japan 30Y Yield | 3.255% | Near fresh highs. Persistent upward pressure threatens global bond stability. | 🔴 Red |

US 30Y Yield | 4.88% | Long-end still heavy. Debt fragility at the global base layer remains severe. | 🟠 Orange |

Why this trifecta = structural fragility

No buffer → every shock hits the street.

When reverse repos are full, a funding pinch gets absorbed quietly.At $17.9B, there’s no cushion; every new dollar of demand for cash or collateral must clear in live markets.

Record daily roll → dependence is maximal.

$2.947T rolling nightly is financial “paycheck-to-paycheck.”If funding tightens even a little, a lot of positions need to shrink fast. That’s convexity: small nudge → big move.

Higher overnight rate → the nudge is already here.

At 4.39%, the cost of keeping positions alive is rising.When “carry” thins, marginal trades stop working; they get unwound.

Unwinds demand cash and clean collateral—precisely what’s scarce with reverse repos empty.

Put together: no buffer + maximum dependence + rising cost turns routine ripples into forced de-risking. That’s “fragility,” not vibes.

A simple picture

Imagine a circus act: three performers on one tightrope.

The net below them? That’s reverse repo balances. It’s gone.

The pole keeping balance? That’s nightly SOFR (overnight funding) volume. It just got longer and heavier.

The wind picking up? That’s the 4.39% rate. Even a small gust matters now.

No catastrophe required. Just gravity doing its job.

How it actually snaps in markets

Funding gets a touch tighter → lenders demand slightly more margin or haircuts.

Highly levered trades (cash–futures basis, relative value, curve trades) go from “carry” to “drag.”

They de-lever: sell what’s liquid (often Treasuries) to raise cash.

Dealers are already balance-sheet-tight (10y swap spread deeply negative), so depth vanishes right when you need it.

Prices gap, volatility jumps, more margin calls fire…you’ve seen this movie.

That’s how small cost changes + no buffer = big moves.

Why this matters beyond the bond pit

Mortgages and credit: don’t expect smooth rate relief while the overnight cost is climbing and the system is rolling record size every night.

Equities: funding-linked strategies are the quiet buyers of dips; as carry compresses, that bid fades.

Gold & silver: you don’t need a crash—this setup already shifts capital toward real collateral. If a snap happens, metals often lead as trust migrates to the base layer.

Hardly anyone is paying attention.

The headlines talk about stocks, inflation, elections — but the real story is in the plumbing.

Reverse repos drained to $17.9B, SOFR (overnight funding rate) at 4.39%, and SOFRVOL (overnight funding volume) hitting a new all-time high aren’t random datapoints.

Together, they are the epitome of structural fragility.

Think about it:

The safety net is gone.

The system is more leveraged to overnight funding than ever.

The rent on that leverage is spiking.

That’s not stability — that’s a coiled spring.

And history tells us one thing with certainty: the more fragility accumulates, and the longer markets are held in artificial balance, the more explosive the release becomes.

Every distortion sows the seed of its own unwind.

When it comes, capital doesn’t disappear — it rotates.

And it will flow out of overvalued, over-financialized paper and into the only base layer collateral that has outlasted every monetary system: gold and silver.

Gold and silver’s breakouts are not the end of the story — they’re the beginning of a massive, cyclical reallocation.

The longer the distortions last, the deeper they go, and the more explosive these reallocations will be.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply