- The Sovereign Signal

- Posts

- 1971→Now: >2% inflation everywhere; China premiums flip; 1.84M oz silver drained; gold warrants go vertical; India’s 10:1 silver-collateral rule; 92 BOJ liquidity shots

1971→Now: >2% inflation everywhere; China premiums flip; 1.84M oz silver drained; gold warrants go vertical; India’s 10:1 silver-collateral rule; 92 BOJ liquidity shots

The greatest leverage regime in recorded history is turning into a collateral regime—why price discovery is migrating East, why float is shrinking, why volatility is set to rise, and why even small allocation shifts can send gold and monetary silver much higher.

Fiat currency is doing what it ALWAYS does: exponentially decline in value over time.

It’s not gold and silver that are going up. It’s fiat currencies that are going down.

Not one fiat currency has survived historically. Not. One. Since ’71, every country has averaged inflation >2%; even Switzerland couldn’t hold the line.

That means your cash is in a permanent bear market, while debts get silently lighter and asset prices get juiced by LEVERAGE.

When the unit of account is guaranteed to shrink, the whole system is pushed toward borrowing, chasing yield, and marking things up—until funding stress hits and volatility explodes.

The antidote isn’t a slogan; it’s base-layer collateral that can’t be printed—gold (and monetary silver). In a world where the yardstick keeps shortening, owning the ruler—not what’s measured by it—is the edge.

China’s paying up for silver again.

When Shanghai trades above London, it means real buyers in the world’s biggest factory floor are tugging bars East.

In a max-leverage system, premiums = gravity: price discovery drifts toward the venue with cash-and-carry demand, not the one with the loudest futures dump.

London’s “slam” power fades when Asia bids over LBMA—paper can push quotes, but it can’t beat a premium plus freight.

Arbitrage turns one-way: traders buy in the West, fly it East, and the West gets tighter. Tight float = bigger, faster moves.

Structural tell: factories + savers want atoms, not IOUs. That’s why backwardation/lease stress keep popping—LEVERAGE can spoof, but it can’t mint bars.

A positive China premium is the market whispering, “send metal here, now.” That’s the setup for squeezier dips and stair-step higher highs in monetary silver.

China’s vaults just flashed the signal—again.

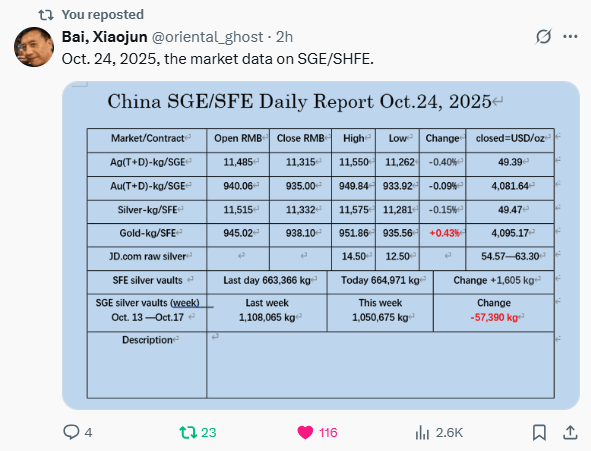

Weekly drain: −57,390 kg (≈ 1.84 million oz) left SGE vaults; a tiny +1,605 kg (~52k oz) daily uptick is noise against that torrent.

Prices: SGE silver closed ¥11,332/kg (−1.6%) ≈ $49.47/oz; SFE gold +0.43% ≈ $4,095/oz.

Read: inventories are sliding while price holds high—the tradable float is shrinking.

Implications (plain English):

Less metal on hand = bigger moves on small buys. As Shanghai’s stock falls, premiums and price discovery migrate to where the bars are, pulling metal from London/NY.

Paper can still smack quotes for a day, but it can’t refill empty shelves—which is why squeezes snap back and why monetary silver keeps a structural bid.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −16.95 bps | Still negative → swaps trade at a premium to cash Treasuries; funding/credit tension persists. | 🟠 Orange |

3-Year SOFR–OIS | 27.15 bps | Elevated but eased a touch; mid-term funding stress remains. | 🔴 Red |

UST–JGB 10-Year | 2.348% | Wide trans-Pacific gap; fuels global basis/carry distortions. | 🟠 Orange |

Reverse Repos (RRP) | $6.941B | Safety valve still near empty—very little spare cash buffer. | 🔴 Red |

USD/JPY | 152.95 | Carry trade supercharging, setting up for a vicious eventual unwind. | 🔴 Red |

USD/CHF | 0.7962 | Bid for “hardest fiat” persists; safety flows in play. | 🔴 Red |

SOFR Overnight | 4.21% | Elevated—overnight funding stress lingering. | 🟠 Orange |

SOFR-VOL (o/n usage) | $2.956T | Heavy reliance on overnight pipes to keep markets greased. | 🟠 Orange |

SLV Borrow Rate | 3.26% (4.6M avail., 0.85% rebate) | Borrow loosening vs. recent squeeze → short pressure abating for now. | 🟠 Orange |

COMEX Silver Registered | 167.99M oz | Deliverable stock keeps bleeding—physical still tight. | 🔴 Red |

COMEX Silver Volume | 73,250 | Big drop—longs looked scared; price discovery thin. | 🟡 Yellow |

COMEX Silver Open Interest | 166,416 | Lighter positioning—de-leveraging after volatility. | 🟡 Yellow |

GLD Borrow Rate | 0.59% (6.6M avail., 3.52% rebate) | Easier to borrow than at peak stress; lending looser. | 🟡 Yellow |

COMEX Gold Registered | 19.95M oz | Thin but steady base layer; still not abundant. | 🟠 Orange |

COMEX Gold Volume | 288,886 | Huge drop—two-way flow cooled; thinner tape. | 🟡 Yellow |

COMEX Gold Open Interest | 475,588 | Still high—macro hedging alive despite volume fade. | 🟠 Orange |

Japan 30-Year | 3.048% | Long-end stress elevated; BOJ boxed in. | 🔴 Red |

US 30-Year | 4.589% | Long-end funding still pricey; duration-sensitive risk assets vulnerable. | 🟠 Orange |

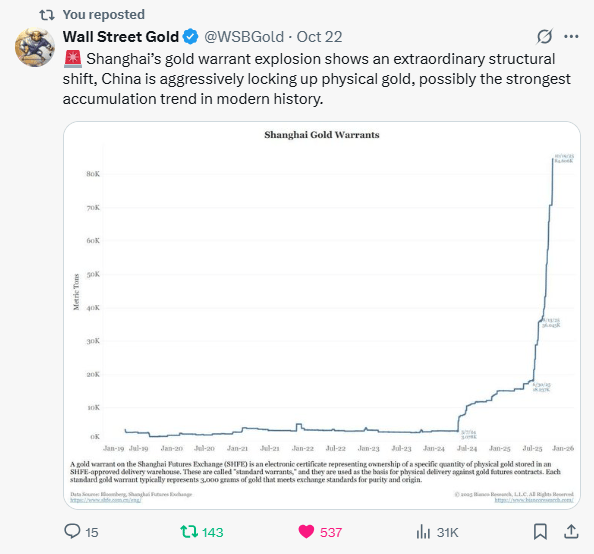

Shanghai just flipped the gold game from “traded” to “tied up.”

Those warrant spikes = claims on specific bars in SHFE vaults. When warrants go vertical, metal stops floating—it’s spoken for, locked, and unusable to cushion paper sell-offs.

What it really signals:

Collateral grab: China is turning gold into balance-sheet ammo. In a max-LEVERAGE world, the side with collateral sets the rules.

Float shrink: Fewer free bars in the West → wider spreads, stickier premia, faster upside moves on tiny real bids.

Price power migrates East: Price discovery follows the vault with atoms, not the venue with algorithms.

Squeeze physics: Paper can slam quotes for a day; warrants + withdrawals mean fewer bars to deliver tomorrow. That’s how air-pocket drops become rocket snap-backs.

This is structural—not a meme. Gold is being re-monetized by practice (warrants, reserves, delivery), and that’s quietly bullish for gold now…and reflexively bullish for monetary silver next as the collateral shortage rolls downhill.

This is absolutely massive because it flips silver from “jewelry/industry” to bank collateral in the world’s biggest silver-buying nation.

Credit switch flipped: If banks can lend against silver (with a 10:1 gold–silver rule), households and businesses will pledge bars to get loans.

That turns silver into a balance-sheet asset—not just a commodity.

Float shrinks, price leverage rises: Collateralized bars sit in vaults backing loans, not on dealer shelves.

Less tradable supply = bigger upside moves on small net buying and stickier dips.

Import engine ignites: To grow credit, banks need collateral—so India pulls in physical from everywhere, competing with London/NY just as those inventories are thinning.

Monetary status upgrade: A G20/BRICS heavyweight just signaled silver is money-like, standardizable collateral.

Macro punchline: In a world drowning in LEVERAGE, the scarce thing is good collateral.

India just added silver to that club.

That’s massively structurally bullish, accelerates the squeeze dynamics, and shifts price discovery toward the places with the atoms—not the algorithms.

Japan just hit the money button again—another ~¥100B “liquidity sprinkle,” the 92nd shot this year.

Here’s the read, simple and sharp:

Fuel for the carry trade.

BOJ keeps yen rates near zero → funds borrow yen cheap → buy everything (US stocks, EM credit, commodities).

It props prices—until it doesn’t.

Weaker yen = exported volatility.

A sliding yen imports inflation into Japan and sprays hot money across the world.

When the yen snaps back, those trades unwind fast.

The weak link risk.

Japan is the #4 economy and the largest foreign holder of U.S. Treasuries.

If JGB stress rises or the yen rips, Japan Inc. may dump Treasuries or hedge harder → higher U.S. yields, tighter global liquidity.

Feedback loop.

Higher yields hit banks, housing, and buybacks; margin goes up; forced sellers appear.

That’s how LEVERAGE turns a drizzle into a squall.

Positive takeaway.

In a world running on interventions, the assets that don’t need anyone’s promise—gold and monetary silver—gain structural bid.

When we see the next leg of the largest carry trade unwind, real collateral ultimately wins.

BOJ’s “sprinkles” levitate today and load tail risk for tomorrow. The most interconnected market ever is riding Japan’s balance sheet.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply