- The Sovereign Signal

- Posts

- 2.5× annual global silver production traded in one day, Shanghai silver premium blows out to record highs, COMEX silver available for delivery continues to decline, Silver backwardation (scarcity indicator) persists despite a sell off of statistically impossible magnitude

2.5× annual global silver production traded in one day, Shanghai silver premium blows out to record highs, COMEX silver available for delivery continues to decline, Silver backwardation (scarcity indicator) persists despite a sell off of statistically impossible magnitude

Just when you think it can't get any weirder.

Focus on the fundamentals.

This isn’t price discovery — it’s balance‑sheet theater.

When paper turnover dwarfs annual mine supply, you’re no longer trading metal; you’re trading claims on confidence.

This is exactly what a system looks like when financial claims have grown far larger than the collateral underneath them.

Debt super-cycles end this way: velocity explodes in paper because no one wants to be left holding the wrong claim when trust breaks.

The market isn’t liquid. It’s panicking efficiently.

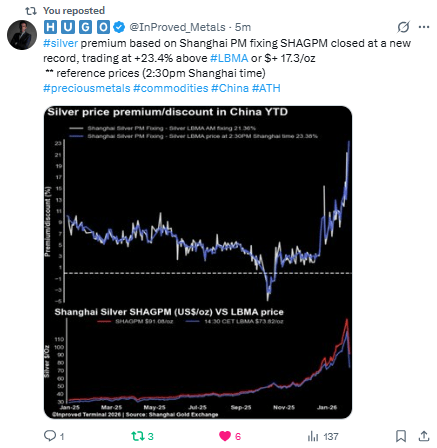

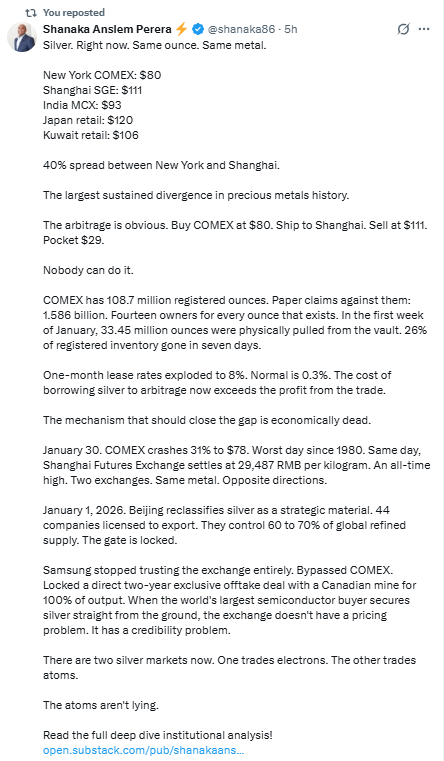

(Shanghai Futures Exchange vs LBMA)

Same ounce. Same metal.

Radically different price.

That’s not arbitrage — that’s a credibility gap.

This is the collateral swap in real time.

When sovereign debt becomes politicized and sanction‑prone, atoms start winning over promises.

China is pricing silver as strategic inventory.

The West is pricing it as derivative exposure.

COMEX Registered keeps falling while Eligible rises

Registered is what’s actually available for delivery.

So who cares if eligible is rising while registered declines?

Metal is leaving the exchange even as price collapses.

A sell off that is statistically impossible in terms of the magnitude, yet the run on physical silver continues.

This breaks the illusion that price controls demand.

Low prices aren’t curing scarcity — they’re accelerating withdrawal.

Borrow rates explode, arbitrage dies

(40% NY–Shanghai spread, leasing rates ~8%)

The mechanism that’s supposed to equalize prices is economically broken.

This is the system admitting it can’t self‑heal anymore.

Every “fix” (margin hikes, liquidity pulls, paper dumps) raises fragility elsewhere.

Classic crisis → intervention → worse plumbing pattern.

Two silver markets now exist. One trades electrons. One trades atoms.

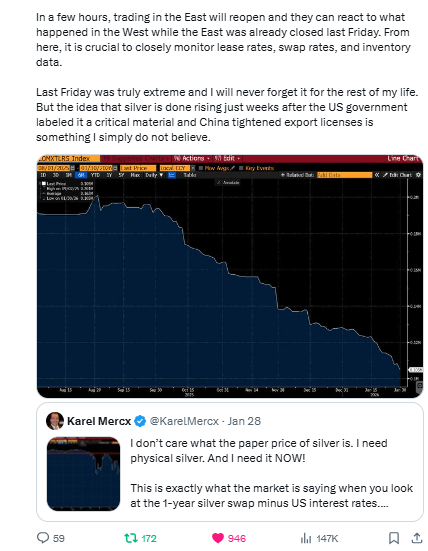

Backwardation persists despite the smash

Even after one of the largest selloffs in centuries, near‑term physical is still more valuable than future promises.

Backwardation is a red alert in a debt‑heavy system.

It means time itself has a premium, because counterparties don’t fully trust future delivery.

That’s what late‑cycle monetary stress looks like.

Major Western dealers go dark (Baird & Co)

Retail access disappears exactly when price collapses.

The largest London-based gold refiner suspended silver sales this weekend.

If you saw the sell off last Friday you’d expect there were plenty more sellers and plenty available to buy, right?

That’s not what’s happening.

That’s what happens when paper volatility collides with physical scarcity.

The market shuts doors not because demand vanished — but because it didn’t.

Liquidity didn’t fail. Inventory did.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply