- The Sovereign Signal

- Posts

- 220% Buffett Indicator. $37T Debt. $22T Money Supply. And Now SHFE Prepares Gold to Replace Treasuries as Collateral

220% Buffett Indicator. $37T Debt. $22T Money Supply. And Now SHFE Prepares Gold to Replace Treasuries as Collateral

Jobs revised down 900K. $18T household debt. 446 bankruptcies — the most in 15 years. With bonds buckling under impossible leverage and China testing gold for repo/high quality liquid assets status, the 54-year fiat base layer is unraveling. The question isn’t if gold reclaims its role as the ultimate collateral — it’s how explosively the transition ends up being.

Jamie Dimon already warned in June that the bond market will “crack” — and when it does, “you’re going to panic.”

That’s because bonds aren’t just another asset; they’re the base layer of the global financial system.

They collateralize everything else. Debt is snowballing further and further ahead of GDP, meaning every dollar of “growth” requires even more leverage to keep the machine running.

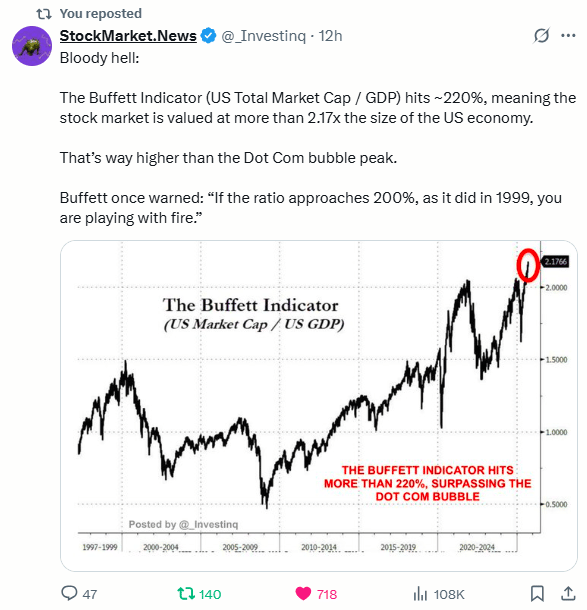

Markets are pretending AI will close the gap — that productivity miracles will outrun compounding debt.

But in reality, it’s the debt itself that props up current valuations. More debt = higher stock multiples = fragile equilibrium.

The moment the bond market buckles, the whole structure shakes. Cuts to Social Security and Medicare aren’t policy choices anymore — they’re symptoms of the bond market dictating terms.

When the buyers of debt revolt, governments are forced to bend. And here’s the bigger picture: debt as the base layer is only 54 years old (since Nixon severed gold in 1971).

That’s a blink compared to the thousands of years gold served as the monetary foundation. Every cycle of synthetic collateral ends the same way: back to real money.

The implication is explosive: as the bond market staggers under its own weight, gold isn’t just a hedge — it’s the next base layer.

The shift from debt to gold as collateral won’t be a smooth transition. It will be groundbreaking, sudden, and generational — and markets are sleepwalking right into it.

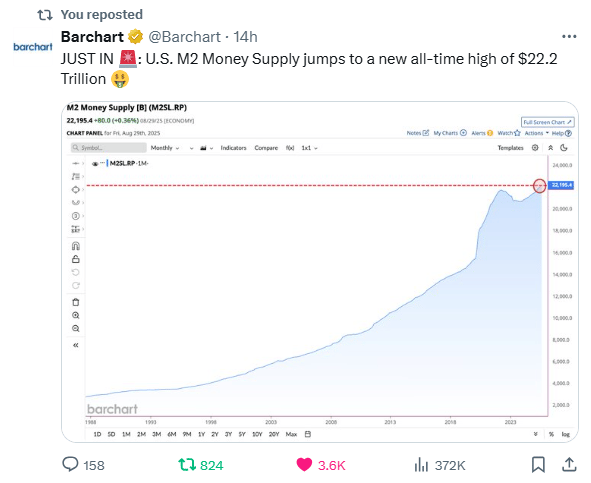

M2 Money Supply just ripped to $22.2 trillion — a new all-time high. 💥

That’s not growth. That’s currency dilution. Every new dollar printed makes the one in your pocket worth less.

Debt keeps ballooning, goods demand is cracking, and money supply keeps hitting records.

👉 Gold & silver aren’t “investments” in this environment. They’re survival.

M2 just hit a record $22.2T. Bonds are cracking under $37.5T+ in debt.

And now the Buffett Indicator is screaming at 220%—valuations more than 2.2× the size of the U.S. economy. That’s even higher than the Dot-Com bubble peak.

This isn’t growth—it’s leverage on leverage, fueled by currency creation.

👉 Debt is outpacing GDP, markets are floating on fantasy multiples, and the Fed is trapped.

The cycle can only end one way: with gold & silver re-emerging as the collateral of last resort.

🔹 Liquidity & Funding Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –24.85 bps | Deeply negative; dealers still preferring swaps over cash Treasuries → collateral scarcity persists. | 🟠 Orange |

Reverse Repos (RRP) | $14.402B | Safety buffer effectively gone—any shock must clear in stressed markets. | 🔴 Red |

USD/JPY | 148.31 | Hovering in danger zone; carry-trade fragility elevated. | 🟠 Orange |

USD/CHF | 0.7943 | Still sub-0.80 → safe-haven bid/systemic stress visible. | 🔴 Red |

3-Year SOFR–OIS Spread | 28.03 bps | Anxiety premium remains high; pressure lines intact. | 🔴 Red |

SOFR Overnight Rate | 4.14% | Converging toward policy rate—front-end stress contained for now. | 🟡 Yellow |

🔹 Silver & Gold Market Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

SLV Borrow Rate | 2.37% (1.1M shares avail.) | Borrow stress steady; cost climbing into breakout shows tightening physical/ETF conditions. | 🟠 Orange |

COMEX Silver Registered | 193.35M oz | Thin cushion versus leverage. | 🟠 Orange |

COMEX Silver Volume | 82,009 | Active turnover; confirms breakout participation. | 🟡 Yellow |

COMEX Silver Open Interest | 166,182 | Rising price with higher volume + OI → conviction trend, not just short-covering. | 🟠 Orange |

COMEX Gold Registered | 21.54M oz | Lean but stable vs. paper contracts. | 🟡 Yellow |

COMEX Gold Volume | 330,734 | Heavy participation; liquidity surging into breakout. | 🟡 Yellow |

COMEX Gold Open Interest | 530,760 | Elevated—leverage remains high. | 🟠 Orange |

🔹 Global Yield Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

UST–JGB 10Y Spread | 2.455% | Hedged returns deteriorating. | 🟠 Orange |

Japan 30Y Yield | 3.16% | Elevated; BoJ defense increasingly costly. | 🔴 Red |

US 30Y Yield | 4.72% | Long end heavy; debt-service drag building. | 🟠 Orange |

🔹 1930 → 1980: From the ashes of the Great Depression to Volcker’s rate shock, silver went vertical — a 55X move as faith in paper collapsed.

🔹 2001 → now: We’re running the same play again. The measured Cup & Handle move targets ~$666/oz, a potential 15X run.

The historical Dow/Silver ratio actually suggests much higher.

And again:

Money supply is growing exponentially.

Debt is 37.5T and growing faster than GDP.

Bonds — the “base layer” for 54 years — are buckling under the weight.

Gold and silver are being repositioned as collateral, not just commodities.

This isn’t a random fractal. It’s history rhyming. The chart is whispering that every time the leverage pyramid wobbles, the world reaches back for something real.

👉 A $666 silver target isn’t just a price call. It’s the market quietly admitting:

Fiat cycles end.

Debt dies in real money.

And the pressure valve for 5+ decades of distortion is about to blow wide open.

This post is a quiet bombshell if you read between the lines.

The suggestion that SHFE (Shanghai Futures Exchange) gold warrants are being tested for HQLA (High-Quality Liquid Asset) status and repo eligibility is essentially about gold being re-positioned as systemic collateral — the very function U.S. Treasuries currently serve.

Implications:

China’s Endgame – If SHFE gold is repo-ready, that means China is preparing gold to act as a substitute to Treasuries in the financial plumbing.

That’s not just a commodity play; it’s a monetary system redesign.

U.S.–China Prisoner’s Dilemma – Both know debt-backed collateral is crumbling.

If one side makes gold repo-ready and the other hesitates, the first mover gets the trust premium.

Neither can fully trust the other, but the game forces escalation.

Systemic Repricing – Once gold is treated as collateral equal to Treasuries, demand won’t just come from central banks—it will come from repo desks, dealers, and sovereigns needing reliable collateral.

That’s a structural bid unlike anything seen in decades.

The Signal – Combine this with JPMorgan openly recommending gold, silver, and platinum over base metals, and it looks less like theory and more like preparation.

The market’s “plumbing engineers” are signaling that debt isn’t enough anymore.

💡 Translation: Gold isn’t just insurance here. It’s being re-integrated into the base layer of the global financial system.

This post is basically screaming: the U.S. economy is cracking in real time.

Let’s read between the lines:

Jobs revised down ~900K → The “strong labor market” narrative is fiction. Reality: labor is weakening fast.

$18T household debt → Consumers are tapped out, fueling today with tomorrow’s credit.

446 big bankruptcies (most in 15 years) → Corporate America is breaking under higher rates + debt service.

$1.6T deficit in 11 months → Washington is spending like it’s wartime… but this is peacetime.

$37T debt record → The sovereign balance sheet is spiraling, debt outpacing GDP relentlessly.

🔑 The chart underneath shows the kicker: historically, when the Fed cuts rates outside of recessions, it’s because the recession is already here.

The “growth” story is an illusion built on credit expansion.

When debt is the base layer and it starts failing, policymakers have only one option left—currency debasement.

And in that cycle, gold and silver stop being “hedges.” They return to their ancient role as the only true collateral.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply