- The Sovereign Signal

- Posts

- 250M-oz/Day Machine, 153M-oz Pool: Silver Primed For More Explosive Moves While Base Layer Rotation Back To Gold Continues To Accelerate

250M-oz/Day Machine, 153M-oz Pool: Silver Primed For More Explosive Moves While Base Layer Rotation Back To Gold Continues To Accelerate

London “turns over” ~250M oz of silver daily on a free float ~153M oz—even a 25–35M oz top-off is hours, not a fix. 100–150 tons of Chinese silver (≈3.2–4.8M oz) are being tugged East as India repatriates 576/880 tons (65%+) of its gold and lifts gold to 13.9% of reserves. With repo taps flickering, swap-spreads drifting negative, and CTAs puking while gold remains ~0.5% of U.S. assets vs ~2% long-run, price discovery is migrating to where bars live. Expect thinner float, faster snap-backs, and a slow-motion reserve shift from IOUs to atoms.

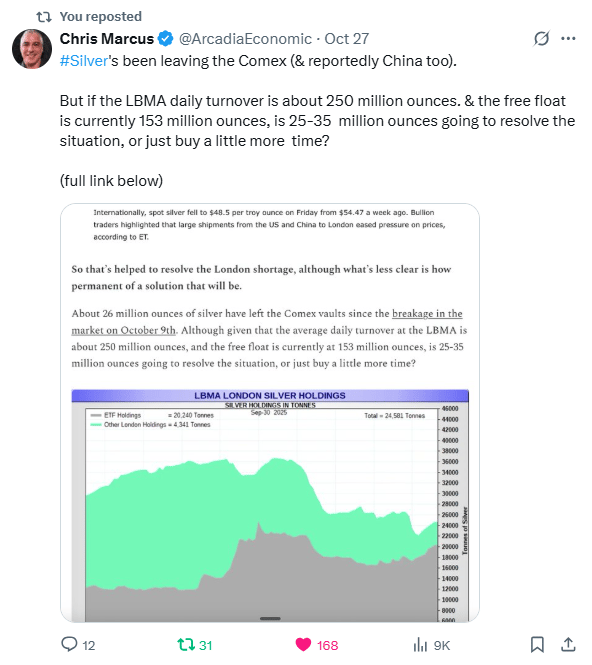

London turns over ~250M oz of silver a day.

The “free float” left in LBMA vaults is ~153M oz.

Even if 25–35M oz arrives from COMEX/elsewhere, you’re talking hours to a couple of days of normal turnover—not a fix, just a brief top-off.

Read between the lines (plain English):

Float is razor-thin. The market trades a firehose on a kiddie pool.

Leverage > atoms. Paper can show “liquidity,” but delivery depends on actual bars—and the pool is shrinking.

Why now? Eastward pull (SGE/India premiums), solar/EV demand, ETF/vault withdrawals, and funding stress pushing savers toward hard collateral.

Result: Each real bid moves price more; dips snap back faster; price discovery follows the metal, not the loudest futures print.

Wake-up math: When a global system leans on 250M oz/day but has ~153M oz of freely movable stock, 25–35M oz is a timer, not a solution. In a max-LEVERAGE market, availability—not quotes—writes the rules.

The tell behind the Reuters blurb

Size check:

“100–150 tons” of Chinese silver moving = ~3.2–4.8M oz.

Against London’s ~250M oz/day turnover and a free float near ~153M oz, that’s minutes of flow—but it matters because the pool is shallow.

Two buyers, one hose:

Not all of that metal heads to London—India is bidding hard, paying record premiums and even air-freighting bars.

Result: East vs. West tug-of-war for the same ounces.

Leverage vs. atoms:

Western banks don’t wrangle 1,000 mom-and-pop dealers; they lease from big Chinese banks (e.g., ICBC, an LBMA clearer).

That’s paper access to physical, not new mine supply—recall risk lives there.

Float is shrinking:

Each bar routed to India/China is one less cushion for LBMA/COMEX.

With ~153M oz of truly “free” silver, losing a few million more tightens the noose on leveraged structures.

Why now?

Industrial pull (solar/EV), festival demand in India, funding stress in the dollar system, and Asia’s willingness to pay premiums.

Price discovery follows the venue with cash-and-carry demand, not the one with the loudest futures print.

Wake-up line: In a market trading hundreds of millions of ounces a day on screens but sitting on a low-hundreds-million free float, those 3–5M oz shifts are not noise—they’re the grains of sand that trigger the avalanche when leverage leans too hard.

India just sent a clear signal: “hold the atoms at home.”

Repatriation:

The RBI now stores 65%+ of its gold domestically (576 / 880 tons), double the home-held share since 2022.

Gold is ~13.9% of India’s reserves.

Why now:

2022’s reserve freezes proved custody risk is real.

In a max-LEVERAGE system with rising sanctions risk, claims ≠ bars.

Holistic playbook:

India isn’t just hoarding gold; it’s also soaking up silver (record premiums, air-freight, bank-eligible collateral).

That’s a base-layer upgrade across both metals.

Strategic goal:

Bring collateral onshore → reduce dependency on foreign pipes → anchor the rupee’s credibility → support domestic credit with hard assets.

Market read:

Each ton repatriated and each silver bar diverted East shrinks Western float and pulls price discovery toward the venues with cash-and-carry demand.

Bottom line:

India is fortifying its balance sheet with ruler assets (gold & monetary silver) while the world leans on borrowed speed.

Wake up: In a world built on leverage, the player holding the metal at home writes more of the rules.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −15.23 bps | Still negative → swaps priced richer than cash Treasuries; funding/credit tension persists. | 🟠 Orange |

3-Year SOFR–OIS | 28.05 bps | Elevated mid-tenor funding stress. | 🔴 Red |

UST–JGB 10-Year | 2.34% | Wide trans-Pacific gap → basis/carry distortions. | 🟠 Orange |

Reverse Repos (RRP) | $14.096B | Safety valve still near empty → very limited spare cash buffer. | 🔴 Red |

USD/JPY | 152.23 | Carry trade still supercharged; unwind risk building. | 🔴 Red |

USD/CHF | 0.7961 | Bid for “hardest fiat” persists; safety flows in play. | 🔴 Red |

SOFR Overnight | 4.27% | High carry / tighter overnight funding. | 🟠 Orange |

SOFR Transaction Volume | $3.019T | Heavy plumbing usage; funding engine running hot. | 🟠 Orange |

SLV Borrow (fee / avail / rebate) | 2.31% / 2.9M / 1.80% | Availability improved vs prior; squeeze risk eased but watch borrow. | 🟡 Yellow |

COMEX Silver Registered | 166.31M oz | Thin deliverable pool keeps premia/basis firm. | 🔴 Red |

COMEX Silver Volume | 89,021 | Quieter tape; moves can gap on headlines. | 🟡 Yellow |

COMEX Silver Open Interest | 158,446 | Lighter positioning; room for expansion/squeezes. | 🟡 Yellow |

GLD Borrow (fee / avail / rebate) | 0.53% / 6.5M / 3.58% | Ample shares; shorting moderate cost. | 🟡 Yellow |

COMEX Gold Registered | 19.81M oz | Tight deliverable pool; supports firm basis. | 🟠 Orange |

COMEX Gold Volume | 365,142 | Healthy flow; volatility can gap on stress. | 🟡 Yellow |

COMEX Gold Open Interest | 469,520 | Solid participation; susceptible to funding shocks. | 🟠 Orange |

Japan 30-Year JGB | 3.047% | Elevated long end stresses JGB convexity/carry. | 🔴 Red |

US 30-Year UST | 3.99% | Long end eased, but financial conditions still firm. | 🟡 Yellow |

BTC vs. Gold flows = a heartbeat of risk.

Why they flip:

When liquidity is easy and stories run hot, money chases high-beta (BTC behaves like tech-on-steroids).

When funding tightens and collateral matters, flows rotate to gold, the asset that settles without anyone’s promise.

Today’s tell:

Repo taps, negative swap-spread drift, and yen carry strain = leverage stress.

In that regime, markets prefer atoms over narratives—hence the inverse pulse you’re seeing.

Different first principles:

Gold: final settlement, no counterparty, works with the power off.

Bitcoin: programmatic scarcity, but access depends on rails (internet, exchanges, custody).

That’s not “risk-free”; it’s infrastructure-dependent.

Holistic read: This isn’t anti-BTC; it’s pro-fit plumbing.

When the system runs hot on leverage, base-layer collateral attracts flows while speculative rails breathe in and out with liquidity.

Wake up: You’re watching capital choose between speed and settlement—and the choice flips with the cost of money.

This dip isn’t “gold believers bailing”—it’s machines clearing inventory.

Who’s selling?

CTAs/algos dump on momentum and volatility triggers.

They don’t read balance sheets or geopolitics; they follow signals and hit the same exits together.

Who’s not selling?

Investors.

Gold is still massively under-owned—roughly ~0.5% of U.S. assets vs a ~2% four-decade mean. That’s a wide gap and a big tell.

Why now?

Funding stress flickers → vol pops → systematic sellers de-risk. Thin liquidity turns small red candles into fast flushes. That’s a plumbing move, not a thesis change.

Read between the lines:

Paper pukes; atoms don’t.

Physical premiums and official-sector buying keep the base bid alive.

Under-ownership + mechanical selling = misread dip.

The crowd most likely to panic (algos) just did; the cohort that matters (long-horizon capital) hasn’t.

Wake up: You’re watching LEVERAGE unwind, not conviction collapse. When machines finish, the story resets to the same foundation: scarce, bearer collateral that doesn’t need anyone’s promise.

The quiet earthquake: reserves are rotating from IOUs to atoms.

What the chart whispers:

Decade by decade, gold’s share of global reserves is rising while the dollar’s share drifts lower.

It’s slow, persistent, and one-way.

Why now:

• Leverage fatigue. A world built on debt needs collateral that doesn’t depend on anyone’s promise.

• Sanction risk & geopolitics. Countries want value they can hold without permission.

• Plumbing stress. Funding wobbles, negative spreads, and cash shortfalls reward assets that settle on contact.What it really means:

This is a base-layer rotation—from paper claims to the best real collateral.

When the system runs hot on LEVERAGE, balance sheets quietly reach for the anchor.

Translation:

The scoreboard is telling you where trust is migrating. Atoms are reclaiming the rulebook; IOUs are losing the pen. Wake up.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply