- The Sovereign Signal

- Posts

- $29,000 Gold Equilibrium— The Great Re-Collateralization Has Begun

$29,000 Gold Equilibrium— The Great Re-Collateralization Has Begun

The fiat debt supercycle is fracturing under its own weight — liquidity evaporating, collateral imploding, and truth repricing itself in ounces. From Japan’s yield-curve panic to record physical shorting and central banks hoarding gold at 50-year highs, the message is clear: the world’s money is migrating back to matter. Gold is becoming the new denominator of trust — and silver, the torque that makes the system snap back to reality.

The greatest global fiat debt bender in history is ending and the collateral of trust is rotating back to gold.

For ~80 years, fiat credit expanded without a hard brake. The bill is due. With debt at choking levels, policymakers can’t run Volcker-style real rates; they must dilute.

When the denominator (currency) weakens structurally, the numéraire (gold) doesn’t “rally”—it re-prices higher to reflect the swollen stock of paper claims. That’s arithmetic, not hype.

Central banks know it; they’ve been swapping Treasuries risk for metal, rebuilding a base layer that doesn’t depend on anyone’s promise. That’s the tell.

As discipline returns, gold resumes its ancient job: monetary governor and settlement asset. The price must rise until it can credibly collateralize a bigger, more leveraged system.

Practical read-through: this is a regime shift, not a trade. Allocation gaps (institutions still underweight), sovereign demand, and currency debasement form a flywheel.

If gold is the anchor, silver is the torque—monetary beta with industrial scarcity. Both benefit, but gold leads the reset; silver amplifies it.

Bottom line: we’re not watching a bubble inflate—we’re watching money reassert itself.

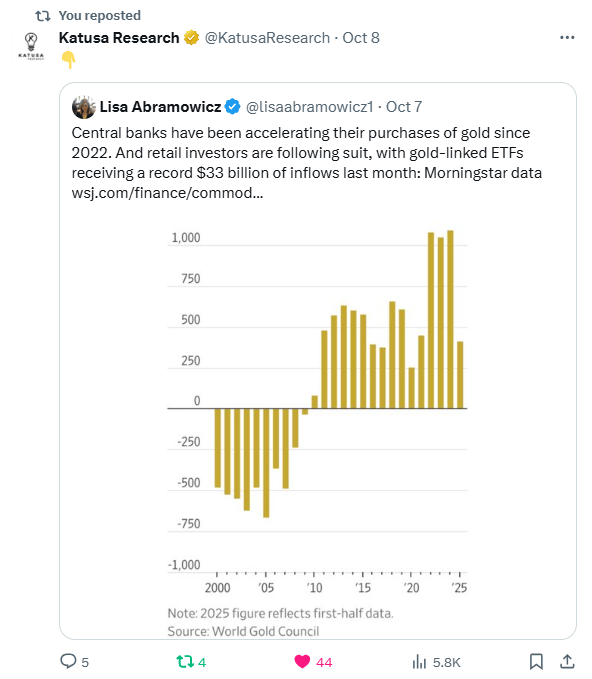

Central banks — the deepest-pocketed, most informed traders on Earth — are front-running the failure of fiat currencies.

Since 2022, they’ve been buying gold like it’s 1971 all over again — accelerating accumulation at a pace not seen in modern history.

Why? Because they see what’s coming before anyone else: the collapse of trust in paper collateral.

Gold ETF inflows of $33 billion in a single month are just the surface-level echo. Retail is finally following the insiders.

When both sovereign and civilian capital move in the same direction, it’s not speculation — it’s migration.

The implication is enormous:

Central banks are preparing for the end of fiat.

Retail flows are validating the signal — not creating it.

The monetary system is quietly re-pegging itself to something real.

This isn’t a trade. It’s a changing of civilizations’ collateral base.

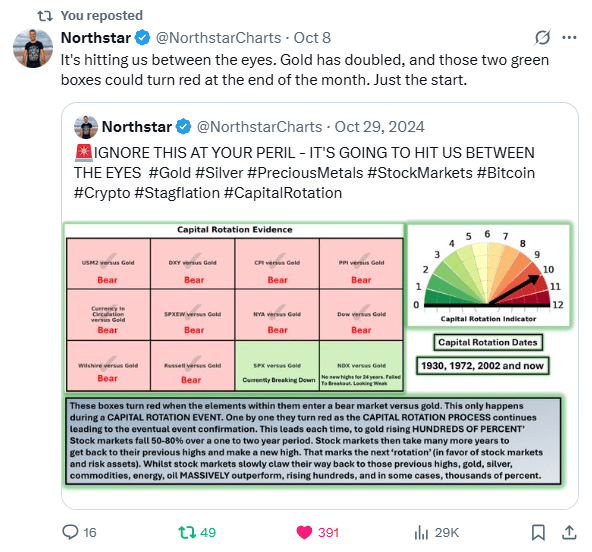

Northstar’s chart isn’t just technical — it’s civilizational.

The green boxes turning red mark the moment when paper wealth begins to hemorrhage into hard collateral.

Stocks, bonds, and fiat instruments are quietly entering bear markets versus gold — the true denominator of value.

When every quadrant turns red, it means the system has shifted from inflating assets to revaluing reality.

It happened in 1930, 1972, 2002, and now again — every time marking a regime reset: currency debasement, yield inversion, and global capital flight into tangible stores of energy and trust.

Gold doubling is not the story — it’s the signal.

It tells us the rotation is accelerating: synthetic capital → real capital, leverage → liquidity, faith → physics.

The next stage?

Silver follows, commodities ignite, and fiat illusions begin to burn off like morning fog.

This isn’t the start of a bull market — it’s the end of a 54-year fantasy.

⚠️ Liquidity & Funding Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –20.35 bps | Still deeply negative — the collateral premium remains extreme; dealers prefer synthetic exposure over real Treasuries. | 🟠Orange |

Reverse Repos (RRP) | $5.231B | Collateral buffer nearly gone — Fed’s balance sheet pressure valve is seconds from dry. | 🔴Red |

USD/JPY | 152.61 | Yen intervention line blown through — Treasury liquidation risk is flashing red. | 🔴Red |

USD/CHF | 0.8007 | Hovering near sub-0.80 — capital quietly rotating to hard collateral safe zones. | 🟠Orange |

3-Year SOFR–OIS Spread | 27.77 bps | Persistent elevation — front-end stress holding firm, cracks spreading under the surface. | 🔴Red |

SOFR Overnight Rate | 4.14 % | Stability masking strain — liquidity compression continues beneath policy optics. | 🟡Yellow |

SOFR VOL | $2.946 T | Massive interbank funding volume — markets running hot to maintain basic flow. | 🟠Orange |

🪙 Gold & Silver Market Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

SLV Borrow Rate | 9.62 % (400K shares avail, –5.53 % rebate) | Borrowing at crisis levels — synthetic shorting is hitting a wall of physical scarcity. | 🔴Red |

COMEX Silver Registered | 186.51 M oz | Big drop — deliverable supply vanishing; the physical floor is caving in. | 🔴Red |

COMEX Silver Volume | 109,818 | Elevated churn — market battling over dwindling ounces. | 🟠Orange |

COMEX Silver Open Interest | 164,322 | Slight decline — positions rolling under pressure; short side strained. | 🟠Orange |

GLD Borrow Rate | 0.61 % (3.5 M shares, 3.48 % rebate) | Tightening modestly — institutional accumulation continues steadily. | 🟡Yellow |

COMEX Gold Registered | 21.8 M oz | Stable near lows — physical backing remains razor-thin. | 🟠Orange |

COMEX Gold Volume | 383,245 (HOLY SH*T) | Unprecedented volume — institutions repositioning en masse toward real collateral. | 🔴Red |

COMEX Gold Open Interest | 493,030 | Climbing — conviction strengthening as metals reclaim monetary primacy. | 🟠Orange |

🌍 Global Yield Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

UST–JGB 10-Year Spread | 2.432 % | Wide and sticky — Japan’s bond market dysfunction bleeding into global funding. | 🟠Orange |

Japan 30-Year Yield | 3.195 % | Climbing again — BOJ yield control cracking even as they print to defend it. | 🔴Red |

U.S. 30-Year Yield | 4.714 % | Long-end repricing hard — collateral layer shaking as global liquidity contracts. | 🟠Orange |

This post is the quiet thunderclap beneath every chart you’ve seen lately.

It’s not a joke — it’s mathematical reconciliation.

If gold were to fully backstop today’s global money supply — to re-anchor every dollar, yen, and euro in existence — it would need to trade around $29,000 per ounce.

It means:

The system isn’t broken — it’s mispriced.

Fiat has been stretched 15–20x beyond its collateral base.

The “missing gold” isn’t a conspiracy — it’s the gap between reality and illusion.

So when central banks and sovereign wealth funds hoard bullion, they’re not speculating.

They’re quietly repricing money back toward truth. $29,000 gold isn’t fantasy — it’s equilibrium. And the world is accelerating toward it, one day at a time.

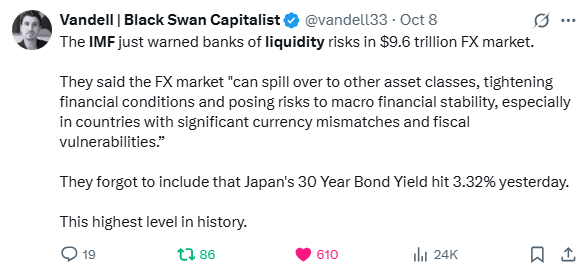

This is the IMF whispering what history will one day scream.

The world’s $9.6 trillion FX market — the deepest ocean of liquidity on Earth — is starting to ripple with stress.

The IMF’s warning wasn’t casual: “spillover to other asset classes” is code for systemic contagion. Once the plumbing clogs here, everything — credit, equities, bonds — begins to seize.

And Japan’s 30-year yield hitting 3.32%, its highest in history, is the flashing red confirmation light.

Japan is the pressure valve of the global system — its bond market is the quiet fulcrum holding up the carry trade and $7 trillion of USD funding.

When those yields blow out, it’s not “just Japan.” It’s the anchor slipping on the global liquidity chain.

The message between the lines?

The world’s largest funding markets are destabilizing in real time.

What follows isn’t a market correction — it’s a revaluation of what “liquidity” even means.

When Tim says “Silver could be days away from being suspended from trading,” he’s not exaggerating — he’s describing what happens when a fractional-reserve metal system collides with physical reality.

The global paper silver market is a derivatives machine that trades hundreds of ounces for every real one available for delivery in vaults.

If a single whale — a sovereign fund, a bullion bank, or even a few coordinated investors — decides to stand for delivery, the illusion evaporates.

Why now? Because the setup is perfect — and terrifying:

45-year cup-and-handle pattern nearing breakout.

Record short interest creating a powder keg of forced buying.

Warehouse inventories at historic lows relative to open interest.

One serious bid for metal could drain the vaults overnight. If silver breaks, it’s not just a market story. It’s a monetary revelation — the moment paper promises collide with elemental truth.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply