- The Sovereign Signal

- Posts

- 3rd Straight Record High in Margin Debt, 3rd Straight Global Equity ‘Sell Signal’: The Leverage Bubble Meets the Liquidity Trap

3rd Straight Record High in Margin Debt, 3rd Straight Global Equity ‘Sell Signal’: The Leverage Bubble Meets the Liquidity Trap

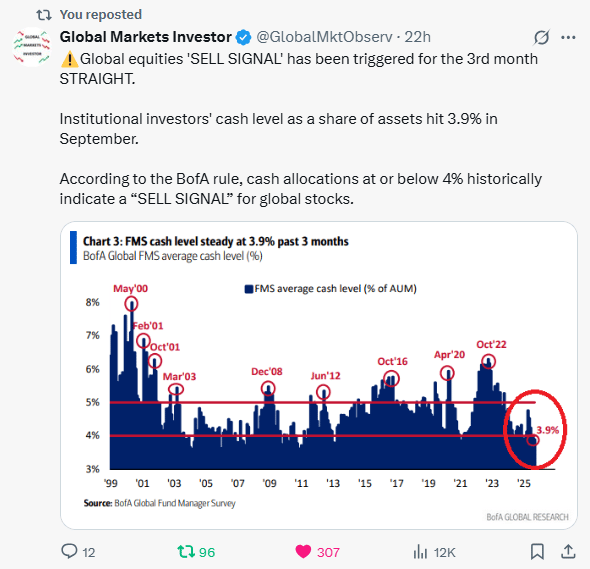

U.S. margin debt has surged to $1.06T—its 3rd monthly record high in a row—while institutional cash levels at 3.9% have triggered a global equities sell signal for the 3rd straight month. History is unambiguous: this combination of record leverage and record-low cash precedes explosive drawdowns. The stage is set for forced liquidations—and for capital to seek refuge in the only assets without counterparty risk: gold and silver.

Powell’s speech revealed the Fed’s trap in plain sight.

Unemployment is climbing, job creation is below breakeven, growth is stalling—yet inflation is still “somewhat elevated” and tariffs are pushing expectations higher.

In other words: the economy is slowing, but prices aren’t.

The Fed is cutting rates not because inflation is tamed, but because the labor market is cracking.

That means monetary easing collides with sticky inflation—a recipe for weaker dollars, negative real yields, and financial repression.

Translation: The Fed just admitted it’s cornered. They’re sacrificing the dollar to cushion jobs.

And when debt is the base layer of the system, that choice can only accelerate the rush back to hard collateral—gold and silver.

The Fed cut 25 bps with dovish guidance, and the market immediately priced 2.5 more cuts by year-end.

Why? Because the combination of a swollen $7T+ balance sheet and an economy leaning on debt makes higher-for-longer impossible.

Read between the lines: the Fed isn’t tightening into strength anymore—they’re cushioning weakness with cheap money even as inflation lingers. The “pivot” isn’t coming. It’s already here.

Implication: This is the same playbook every time debt overwhelms growth—financial repression, currency erosion, and capital forced into hard collateral.

Gold and silver aren’t just hedges here—they’re the natural escape hatch from a policy regime that has chosen debasement over discipline.

Japan is the weak link in the hyper-interconnected global financial system.

With debt at 237% of GDP, it must keep bond yields suppressed or implode fiscally.

But defending bonds means printing yen, and defending the yen means selling Treasuries—the BoJ can’t do both.

Add in the massive yen carry trade, where markets borrowed cheap yen to lever into global assets, and the setup is clear: once stress forces an unwind, it can ricochet through Treasuries, currencies, and funding markets.

As the 4th largest economy and biggest foreign holder of U.S. Treasuries, Japan isn’t just a local risk—it’s the pressure point that could trigger a global cascade.

Liquidity & Funding Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –24.9 bps | Still deeply negative; dealers preferring synthetic swaps over Treasuries → collateral scarcity intact. | 🟠 Orange |

Reverse Repos (RRP) | $13.963B (new low since 2021) | Buffer nearly exhausted; any funding shock must clear directly in stressed markets. | 🔴 Red |

USD/JPY | 147.37 | Anchored in danger zone; carry-trade fragility remains high. | 🟠 Orange |

USD/CHF | 0.7886 | Below 0.80 — systemic stress and safe-haven demand highly visible. | 🔴 Red |

3-Year SOFR–OIS Spread | 25.45 bps | Anxiety premium still embedded; pressure lines not easing. | 🔴 Red |

SOFR Overnight Rate | 4.39% | Elevated overnight costs; reflexive pressure remains. If trend accelerates, liquidity crisis risk rises sharply. | 🔴 Red |

SOFR Daily Volume (SOFRVOL) | $2.857T | Entrenched dependency; trillions rolling nightly like paycheck-to-paycheck financing. | 🟠 Orange |

Silver & Gold Market Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

SLV Borrow Rate | 1.49% (0 shares avail. since Aug 16, 8:42:13PM EDT) | Scarcity extreme: no borrowable shares for a full month. Collateral-chain strain persists. | 🔴 Red |

COMEX Silver Registered | 194.33M oz | Thin cushion relative to leverage. | 🟠 Orange |

COMEX Silver Volume | 97,120 | Turnover rising — active trading after recent volatility. | 🟡 Yellow |

COMEX Silver Open Interest | 160,956 | Leverage high; directional conviction intact. | 🟠 Orange |

GLD Borrow Rate | 0.44% (3.6M shares avail.) | Availability steady; no acute ETF stress. | 🟡 Yellow |

COMEX Gold Registered | 21.4M oz | Stable but lean relative to contracts. | 🟡 Yellow |

COMEX Gold Volume | 279,690 | Elevated turnover — participation strong. | 🟡 Yellow |

COMEX Gold Open Interest | 517,961 | High and persistent — leverage remains elevated. | 🟠 Orange |

Global Yield Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

UST–JGB 10Y Spread | 2.415% | Cross-border hedged returns deteriorating. | 🟠 Orange |

Japan 30Y Yield | 3.197% | Elevated; global duration pain intensifying. | 🔴 Red |

US 30Y Yield | 4.657% | Heavy long end; debt-service strain mounting at the global base layer. | 🟠 Orange |

Here’s what this really means:

Institutional cash levels just hit 3.9%, the third straight month below the 4% “sell signal” threshold.

History is blunt—every time investors get this underweight cash, it’s followed by major equity pain (2000, 2008, 2022).

Why? Because low cash means investors are all-in, fully levered, and out of dry powder. There’s no buffer left to buy dips or absorb shocks.

In a world of rising debt, sticky inflation, and fragile funding markets, that’s tinder piled high.

Translation: equities are stretched to the breaking point. With cash on the sidelines at record lows, the next spark—whether from Japan, the Fed, or credit markets—could turn a correction into a cascade.

This isn’t just a sell signal for stocks—it’s a flashing green light for gold and silver, the only assets outside this overleveraged game.

Margin debt just hit a record $1.06 trillion—up $140B in just three months, the 2nd-highest share of GDP in history. That’s not healthy growth, that’s pure leverage mania.

When margin debt spikes, it means investors aren’t buying with cash—they’re buying with borrowed money. It creates the illusion of strength while actually laying dynamite under the market.

The higher it climbs, the thinner the ice gets. History is unforgiving here: every major peak in margin debt—from 2000 to 2008 to 2021—was followed by brutal equity drawdowns. Borrowed money works until it doesn’t—then forced selling accelerates the collapse.

Bottom line: This isn’t just speculation; it’s a leverage powder keg sitting on top of already fragile markets. One shock—Japan, the Fed, debt stress—and margin calls could turn a dip into an avalanche.

Foreign-owned U.S. Treasuries held at the Fed have collapsed to levels below even the 2020 crash.

History shows every sharp drop here signals a liquidity crisis—foreign governments and banks are dumping Treasuries because they desperately need dollars.

That creates a vicious loop: selling Treasuries drives yields higher, tightening financial conditions right when the Fed is already trapped between inflation and recession. The “world’s safest asset” becomes the pressure point.

Translation: The foundation of the system—the dollar’s role as global collateral—is cracking.

Every forced sale abroad pushes the Fed closer to another rescue operation, and every rescue erodes confidence further. This isn’t a local problem—it’s the epicenter of the next global liquidity event.

Connecting The Dots

Liquidity is draining, foreign Treasuries are being dumped, margin debt has exploded past $1T, institutional cash is at a sell-signal low of 3.9%, and banks plus sovereigns are straining under record leverage.

That’s a powder keg: over-leveraged markets, underfunded safety nets, and a global dollar system bleeding collateral.

When debt is this fragile and liquidity this scarce, central banks always choose inflation over collapse. That means financial repression, currency debasement, and systemic volatility.

Gold and Silver are the last safe harbor—the only assets with no counterparty risk, the only base layer that has outlasted every paper regime.

The dots connect to one conclusion: the setup for monetary metals is not just bullish—it’s truly unprecedented.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply