- The Sovereign Signal

- Posts

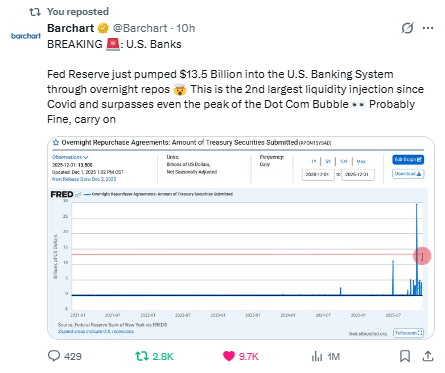

- 41% of COMEX’s Silver Is Spoken For, Rumor Is China May Be A Large Part Of That Drain, Banks Tap 2nd Largest Liquidity Injection Since COVID and 38.5 Billion Total Yesterday, Japanese Rates Continue To Rise, Are Metals Warning Of Global Leverage Unwind Via Yen Carry Trade?

41% of COMEX’s Silver Is Spoken For, Rumor Is China May Be A Large Part Of That Drain, Banks Tap 2nd Largest Liquidity Injection Since COVID and 38.5 Billion Total Yesterday, Japanese Rates Continue To Rise, Are Metals Warning Of Global Leverage Unwind Via Yen Carry Trade?

Physical silver is vanishing, bullion banks are scrambling for cash, China may be quietly draining the vaults, and Japan—the linchpin of the global leverage machine—is flashing red. Rising JGB yields threaten the yen carry trade, and gold and silver are behaving like accelerants poured on a debt-soaked financial system. The pressure is building.

Eight thousand December ’25 contracts have now stood for physical—41% of COMEX’s free-float is spoken for.

And 2,361 contracts are still open.

If even a fraction of those stand, COMEX will be forced to drain what’s left, tap London, or bid against Shanghai—all while SHFE inventories are at decade-lows.

This isn’t normal delivery. This is a run on the vaults.

Alasdair is basically saying:

the “mystery Asian whale” wasn’t in Shanghai — it was on COMEX… and likely Chinese.

7,330 Dec ’25 contracts = 36.65M oz already demanded.

Now total delivery requests are 8,305 contracts (~41.5M oz) — almost one-third of all COMEX registered silver.

Rumor: a Chinese entity hit the delivery button, and CME yanked the plug while the metal was being scrambled together.

If true, this isn’t just bullish.

It’s the opening move of a sovereign-level run on the remaining physical stack.

Asia isn’t waiting for the West’s “paper” price anymore. Asia is taking the silver.

Shanghai just lost ~29 tonnes of physical in one week.

SHFE silver is still priced above Western spot, meaning arbitragers are sucking metal out of the West and shipping it East.

Meanwhile, COMEX just saw 8,305 contracts (~41.5M oz) demanded for delivery… right after China was rumored to be the massive buyer.

Put together, the message is unmistakable:

China is draining global physical inventories while Western markets are still trading digital promises.

This is the first time in decades that physical flow, not futures manipulation, is dictating price direction.

The paper world is wobbling. The physical world is taking over.

What this feels like when you line it up with the last three posts:

China is yanking real metal out of Shanghai and very likely stood for a monster Dec-25 COMEX delivery.

COMEX registered is thin, and one or several large players just grabbed ~41% of the estimated free float.

Now, banks suddenly rush to the Fed’s standing repo window for $38.5B in a day—right as silver rips and shorts are under water.

Here’s what’s likely happening:

…big players short paper silver are getting squeezed, collateral stress is building, and the Fed’s hose just kicked on to keep someone from blowing up while Asia keeps draining the physical.

Now Barchart shows this: one of the largest overnight repo injections since Covid, bigger than at the peak of the Dot-Com bubble.

Put together, it looks less like “routine plumbing” and more like this:

📉 Collateral tied to short, leveraged trades is getting torched.

💦 The Fed is quietly backstopping someone’s margin stress.

🥈 Silver’s vertical move is not a sideshow — it may be one of the sparks exposing how fragile the whole debt-soaked system really is.

This is the other half of the story snapping into place.

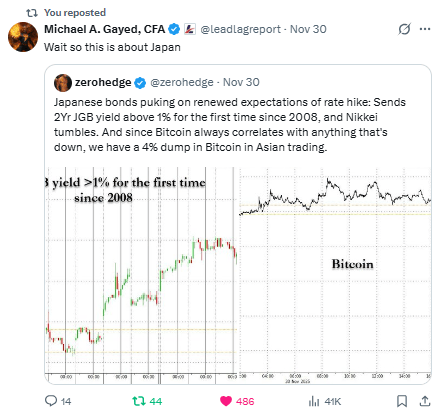

JGB 2-year >1% for the first time since 2008 = the BOJ is losing control of the “free money” leg of the yen carry trade.

When your funding currency stops being zero-cost, every leveraged bet built on it starts to wobble:

US stocks, EM, credit, even crypto — hence Bitcoin puking and Nikkei rolling over.

Put it together with what we just walked through:

Silver ripping and Asia standing for delivery.

COMEX inventories getting spoken for.

banks suddenly yanking tens of billions from the Fed via repos.

As Japan — the most indebted, most levered, most Treasury-entangled major economy on earth — continues to reprice rates higher.

Read between the lines:

📉 The global carry trade leverage machine is starting to unwind from its weakest link: Japan.

🥈 Gold and silver aren’t just going up; they’re front-running the realization that leverage and debt have their limits.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply