- The Sovereign Signal

- Posts

- 44% Of Available COMEX Silver Now Claimed, 81% Chance of Very Dovish New Fed Chair, MBS Repo Just Soared To 2019 Crisis Levels, Japanese Yields Going Through The Roof, And Overnight Funding Rate Elevated For 4th Night In A Row

44% Of Available COMEX Silver Now Claimed, 81% Chance of Very Dovish New Fed Chair, MBS Repo Just Soared To 2019 Crisis Levels, Japanese Yields Going Through The Roof, And Overnight Funding Rate Elevated For 4th Night In A Row

Collateral is failing in plain sight—COMEX silver is being claimed, MBS is in triage, yen carry is snapping, and SOFR is screaming—so capital is sprinting to base-layer money: gold for security, silver for upside. Don't worry, a dovish Fed chair will get all this back on the right track.

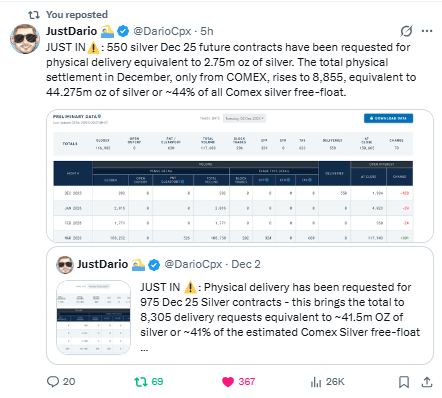

COMEX is being tapped hard.

December physical requests now total ~8,855 contracts (~44.3 Moz) — roughly ~44% of the estimated free-float for the month.

That’s a run rate you don’t see in “normal” markets.

SHFE looks ~8 weeks from empty if current draws persist.

LBMA’s visible stocks are thin and, judging by flows, London is likely leaning on COMEX/SHFE to meet demand.

Put together, the three pillars (LBMA, SHFE, COMEX) are being drained simultaneously.

Why that matters: once deliverable metal thins out across all three venues, the paper price can lose its anchor. You get:

blow-outs in spot–futures basis and EFPs,

soaring borrow/lease rates,

cash-settlement risk/backwardation,

retail/wholesale premiums screaming higher.

In that kind of squeeze, price discovery lurches to the physical market.

We will see triple-digit silver—and even four-digits is on the table ( as a mean reversion of the Dow/Silver ratio suggests).

We’re not saying it must happen in “weeks,” or even months or even the next few years but in a hyper-leveraged fiat system, this pace of draw is unprecedented and the convexity is brutal:

…once the metal is gone, it’s gone—until new supply arrives (slow) or demand is rationed by price (fast).

Trump just tapped Kevin Hassett, here’s the translation:

Faster cuts, easier money, bigger backstops.

Growth first, tighten later (never).

Lower real rates and a looser Fed balance sheet = tailwind for gold.

Silver gets the torque:

tiny float + monetary bid + industrial pull = outsized move.

UST market feels it:

more issuance, softer Fed → steeper curve, choppier dollar.

Bottom line: A Hassett Fed means liquidity on tap in a debt-soaked world.

Gold climbs. Silver flies.

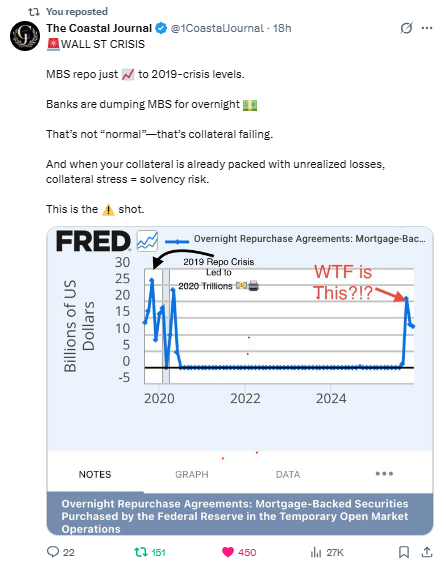

🔍 What This Chart Really Means

Banks are dumping mortgage-backed securities (MBS) into the overnight repo market at levels we haven’t seen since the 2019 liquidity crisis.

That’s not normal—it’s a sign that high-quality collateral is running dry.

MBS are riskier and harder to liquidate than Treasuries. If banks are resorting to using them for overnight funding, it signals deeper cracks:

Collateral quality is deteriorating

Unrealized losses are becoming visible

Funding markets are stressed beneath the surface

In a hyper-leveraged, interconnected financial system, this kind of move can ripple fast.

The last time we saw this setup, it led to trillions in emergency liquidity injections.

What do we think emergency liquidity injections will do to the gold and silver markets?

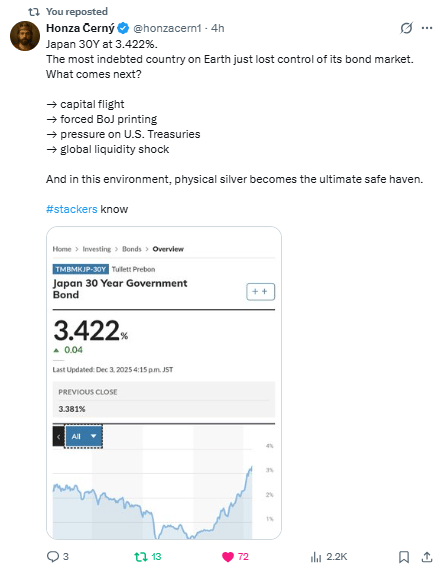

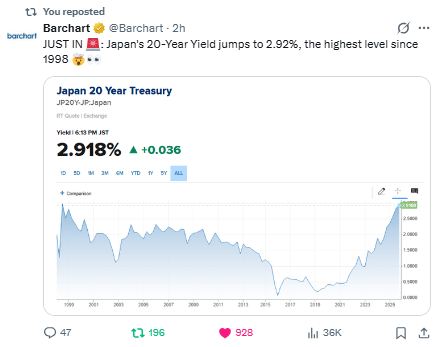

Japan’s 30-year ripping to ~3.4% isn’t a local blip—it kicks the legs out from the yen carry trade and puts the biggest foreign holder of U.S. Treasuries (Japan) at the center of the storm.

How the shock propagates—fast:

Yen carry snaps:

Global funds borrow cheap yen → buy higher-yield assets (including Treasuries).

When JGB yields/yen volatility jump, hedges get expensive, margins rise, and positions are cut.

They sell what’s most liquid first—USTs.

BoJ cornered:

To calm JGBs, BoJ buys bonds (prints).

That tends to weaken the yen, inviting even more reserve use or hedging stress—feedback into UST pressure.

Liquidity thins globally: Rate vol ↑ → haircuts ↑ → margin calls ↑ → de-risking across credit/equities/EM.

Dollar funding tightens; depth vanishes.

Where capital runs: away from leveraged paper toward real collateral.

Japan 20Y at ~2.92% (’98 highs) = the wall just moved.

When long JGBs break out, the yen carry snaps and the world’s biggest foreign UST holder (Japan) becomes a forced actor.

Carry unwind:

Yen vol up → hedges explode → levered funds cut global duration. First out the door: Treasuries.

BoJ cornered:

To cap JGB chaos, BoJ buys more bonds (prints) → weaker yen → more pressure to use reserves.

Liquidity thins:

Rate vol ↑ → margins/haircuts ↑ → depth vanishes across credit, EM, and equities.

Translation: The anchor of global carry is slipping. Money runs from paper to real collateral.

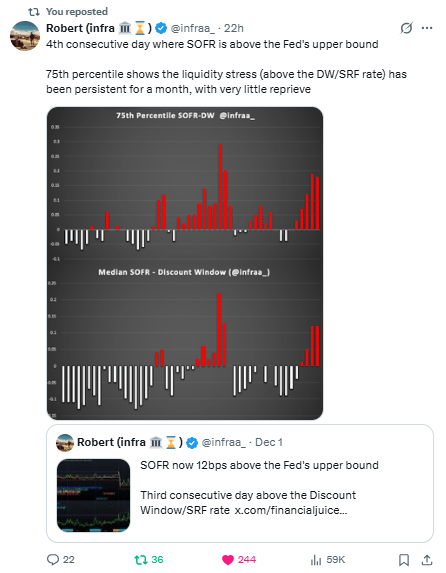

SOFR > Fed upper bound = dollar funding stress.

When overnight rates trade above the policy ceiling (and even above the SRF/Discount Window), it means balance sheets and good collateral are scarce.

Banks would rather pay up in the market than tap the stigma windows.

Why now? Japan.

JGB yields ripping → yen volatility spikes → yen carry trade (borrow yen, buy global duration) starts to unwind.

Funds cut risk and raise dollars to cover hedges/margins → dollar demand jumps → SOFR lifts.

Global leverage feedback loop

Rate vol ↑ → margins and repo haircuts ↑ → forced selling of the most liquid paper (USTs) → dealers hoard balance sheet → market pays above ceiling for cash.

Translation: Rising Japanese yields yank the pin on the yen carry; the unwind tightens dollar funding; SOFR popping above the Fed’s cap is the siren.

In a hyper-leveraged system, that’s how a “local” bond move becomes a global liquidity event.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply