- The Sovereign Signal

- Posts

- 50% Dark Trading, $8K Gold Call, 3.75M oz Silver Buy: The Collateral Pivot

50% Dark Trading, $8K Gold Call, 3.75M oz Silver Buy: The Collateral Pivot

Fiat is structurally melting, U.S. stocks trade mostly off-exchange, mega-banks are openly modeling a much higher gold price, and Turkey just vacuumed 3.75 million oz of silver...

When the leader of close U.S. security partner and major economic friend says “post-American order” now, he’s reading the dashboard the way traders do:

Plumbing is creaking: negative swap spreads, SOFR spikes, pre-open Fed repo taps—classic signs of a dollar system running hot on LEVERAGE and short on easy collateral.

Allies are hedging: central-bank gold buying at records, Asia premiums over LBMA, Shanghai locking bars with warrants—price discovery is migrating to where the metal (and trade) lives.

Fiscal/FX strain is visible: $38T debt, rising term premiums, Japan’s carry pump—global funding increasingly depends on policy muscle, not organic demand.

Market mood is brittle: VIX pops on small dips, bank/credit wobble, housing liquidity gaps—thin cushions everywhere because balance sheets are maxed.

Put simply: the dollar system still dominates, but the margins—reserves, commodities pricing, settlement preference—are shifting. Leaders who run trade hubs must plan for more than one center of gravity.

Positive read-through: multipolar competition pushes real-asset collateral (gold/monetary silver), local-currency rails, and redundancy in payments. In a world built on LEVERAGE, the side holding the base layer sets the rules. The speech is the diplomatic version of what markets are already whispering.

What this really says about silver right now

Silver didn’t “fail” at the 1980 high—it retested and held it. In charts, that turns old ceilings into new floors, i.e., a launchpad.

Under the hood, the tape is primed for LEVERAGE to work in both directions:

Tiny tradable float (vault drawdowns, Asia premiums/backwardation) + rising physical pull (China/India/solar) = every incremental dollar moves price more.

Crowded short/derivative flows can still smack futures for a day, but they can’t mint bars—so air-pocket dumps → violent snap-backs.

Once price clears a major high, momentum/CTA/option gamma tends to pile on, converting a squeeze into a runaway.

Technical breakout + structural scarcity + mechanical flows = parabolic risk to the upside. Whether “$100 by Christmas” happens is a timing call, but the asymmetry is real: limited supply, reflexive demand, and a market built on paper trying to price a metal.

Turkey just hoovered up ~3.75 million ounces of silver in a single month.

That’s a giant vacuum turned on in a tight market.

Why it matters (plain English):

Real cash > paper.

Turks are swapping a melting lira for atoms.

When households and refiners do that, bars leave the system, not “trade around” it.

Eastward pull strengthens.

China, India…now Turkey.

The more buyers pay up outside London/NY, the more metal flows East, shrinking Western float.

Tighter float = bigger moves.

Each bar in Istanbul is one less to cushion futures smacks; fewer deliverable ounces means faster snap-backs when shorts cover.

Industrial + monetary demand rhymes.

Turkey’s jewelry/refining hub and booming PV demand mean the bid isn’t just speculative—it’s use + savings.

Leverage meets scarcity.

Paper can push quotes for a day; it can’t refill emptied vaults.

That mismatch is the fuel for air-pocket drops and rocket rebounds.

Another mid-sized economy just joined the “buy real collateral” crowd. In a max-leverage world, that’s bullish—small incremental buying now moves silver a lot.

When the house admits the house is on fire, believe it.

JPMorgan floating gold at $8,000 by 2028 isn’t a wild guess—it’s Wall Street saying, softly, “fiat’s grip is slipping.”

In a max-leverage world, that has three explosive read-throughs:

Repricing the ruler:

If the yardstick (currency) is weakening, the base layer (gold) must be marked way higher to balance all the IOUs stacked on top.

That’s how sovereign math and bank collateral get patched—by gold, not by press releases.

Silver’s coiled spring:

When gold re-rates, monetary silver historically outruns it—smaller market, tighter float, and new collateral use cases (India, BRICS) turn small bids into big moves.

Margin call on “paper wealth”

Higher real collateral values + rising funding costs = pressure on levered assets.

Money migrates to what settles on contact—gold first, silver next.

Bottom line: a megabank just green-lit the narrative the crowd has mocked for years.

If they’re publicly admitting a doubling, they’ve already modeled the path—and it runs through scarcity, delivery, and leverage unwinds.

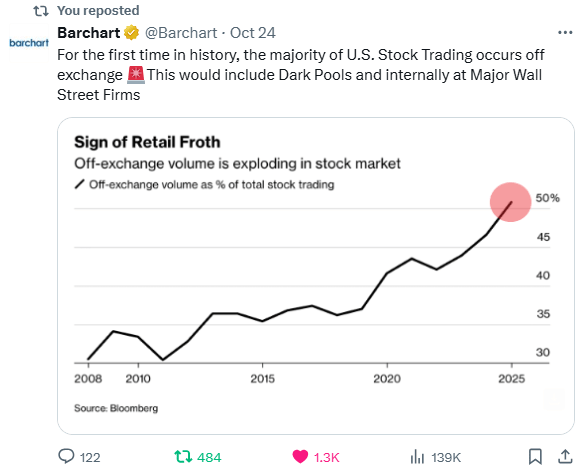

When most trading goes dark, price becomes a suggestion, not a signal.

What this means:

Over half of U.S. stock trades now happen off-exchange (dark pools/internalization).

That hides real supply/demand, so the quote you see can be a hall of mirrors—great in calm, dangerous in stress.

Why it’s happening:

Brokers route orders internally to skim pennies (payment-for-order-flow, internalization).

It feels cheaper for retail, but it starves exchanges of volume, weakening true price discovery.

Hidden risk:

In a leveraged market, liquidity is performative until it’s needed.

When volatility spikes, dark venues can step back, spreads explode, and everyone rushes to the same lit exit—air-pocket drops.

Knock-ons:

More gap moves (prices jump, not glide).

Models trained on tidy exchange data misread risk.

Regulators eye this—rule shocks can hit business models suddenly.

Holistic take:

Less transparency + more leverage = fragile optics.

In regimes like this, capital migrates to things that don’t rely on perfect plumbing or hidden quotes—cash flows you control and base-layer collateral (gold/monetary silver).

Off-exchange dominance is a late-cycle tell. Enjoy the calm fills, but plan for the day the lights matter again.

Why now? Because the system needs collateral that can rise when debt can’t.

Debt math broke.

With $trillion deficits and sticky inflation, the U.S. can’t slash rates to make Treasuries surge in price.

If your main collateral (USTs) can’t appreciate much, margin buffers vanish in a leveraged system.

Plumbing is creaking.

Repo taps, negative swap spreads, SOFR wiggles—funding is tight. Banks want collateral that expands balance-sheet cushion as stress builds.

Regime shift in assets.

Central banks hoard gold; BTC spot ETFs/custody made crypto institutional-grade.

If you’re a dealer, saying “we accept BTC collateral” turns client assets into new lending capacity + fee streams—and keeps flows inside your pipes.

Geopolitics & optics.

With reserve fragmentation and “post-American order” chatter, firms hedge currency/fiscal risk by adding non-sovereign collateral.

It’s a flexible valve against sovereign stress.

They’re not blessing a fad; they’re patching a collateral shortage. When your core IOU can’t rally, you reach for things that can—gold… and silver.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply