- The Sovereign Signal

- Posts

- 6th Largest Liquidity Injection Since 2020, Massive Out Of The Money Call Options In SLV Suggest Big Money Is Betting On Another Big Move In Silver In The Next Few Weeks, Asahi's Online Japanese Store Sells Out Of Silver, and Bank of Japan Set To Hike Rates Next Week

6th Largest Liquidity Injection Since 2020, Massive Out Of The Money Call Options In SLV Suggest Big Money Is Betting On Another Big Move In Silver In The Next Few Weeks, Asahi's Online Japanese Store Sells Out Of Silver, and Bank of Japan Set To Hike Rates Next Week

Is Japan's rate hike already completely priced into the markets or will we start to see some leverage unwind?

…the plumbing is groaning.

We just cut rates and started $40B/month in Treasury buybacks, yet the Fed still had to pump $5.2B in overnight repos.

That means dealers were short cash or usable collateral—funding pressure is rising even as policy eases.

When easing collides with stress this fast, it screams latent liquidity fragility: higher volatility in long rates, a tighter collateral race, and a reflex bid for real hedges (gold/silver) while the system quietly leans back on the Fed.

This is a powder-keg of convexity.

Huge call open interest in SLV stacked at $60 / $65 / $70 means a ton of upside exposure expires soon.

If many of those calls were sold by dealers, every uptick toward those strikes forces dealers to buy SLV (and silver proxies) to hedge.

That hedging ramps non-linearly as price gets closer—classic gamma squeeze fuel.

The clustering at round numbers creates price magnets into expiry.

A clean break above one strike can cascade hedging into the next (60 → 65 → 70), pulling futures along for the ride.

Flip side: fail to hold levels and those calls decay fast; hedges get unwound and you can get an air-pocket down.

Big firepower cuts both ways near expiration.

Net: this OI setup says momentum up can accelerate violently, and pullbacks can be sharp—the definition of a market shifting from slow grind to jet-engine moves.

When Asahi Japan—a major refiner/mint—shows sold out across products, it means the squeeze isn’t just at coin shops; it’s upstream at the source.

That signals a real physical tightness: wholesale inventory is being pulled faster than it can be replenished, premiums are set to climb, and refiners will start allocating supply.

In that setup, futures/ETFs have to bid up or risk breaking the paper–physical link.

Translation: the market is telling you scarcity is real, not narrative—expect higher premiums, delayed delivery, and price volatility skewed up until fresh supply appears (which will take years).

…because flows, physics, and policy are all leaning the same direction—up—right now.

Physical pinch:

LBMA lease rates spiking, SHFE vault draws, Asia paying higher prices, and heavy COMEX delivery claims = real-world scarcity.

When the cash market is tight, paper gets dragged higher.

Policy tailwind:

The Fed just restarted balance-sheet support (bill buybacks/overnight liquidity) while talking cuts.

That pulls real rates down even if long yields wobble—rocket fuel for gold/silver.

Technical ignition:

Gold is pressing blue-sky breakout levels; silver just cleared/held key thresholds and flipped back into backwardation at times—classic squeeze anatomy.

Positioning & optionality:

Massive upside call OI in SLV/Si and under-ownership in metals = gamma/CTA chase on strength.

Small moves can snowball into big ones.

Narrative regime change:

Japan’s yield shock, crowded AI megacap trade, and record global debt keep volatility bid.

In stress, capital reaches for collateral (gold) and scarce industrial money (silver).

Does it have to hit $4.7k/$75 in 2–3 weeks? Not “have to.”

But the setup supports a fast overshoot: tight physical + easing bias + breakout tech + options fuel.

Biggest caveat: exchange margin hikes can create violent shakeouts before the next leg.

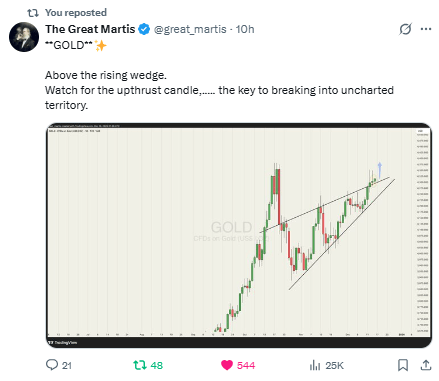

Here’s what he’s saying—plain and tight:

Structure:

Gold had been climbing inside a rising wedge (two rising, converging trendlines).

Price has now popped above the top rail—that’s your first signal the lid might be off.

Confirmation:

He’s watching for an “upthrust candle”—a long, decisive up day that closes above the wedge and recent highs.

That’s the ignition print that says the breakout is real, not a tease.

Implication:

A confirmed upthrust = price discovery in “uncharted territory” (new all-time highs).

In that mode, momentum/trend followers, options gamma, and FOMO flows can cascade.

Risk check:

If price fails back inside the wedge quickly, that’s a throwback/fakeout and the breakout case cools until buyers defend the top rail on a retest.

Net: hold above the wedge with a strong close → gold’s next leg likely accelerates; slip back inside → patience until the market proves it.

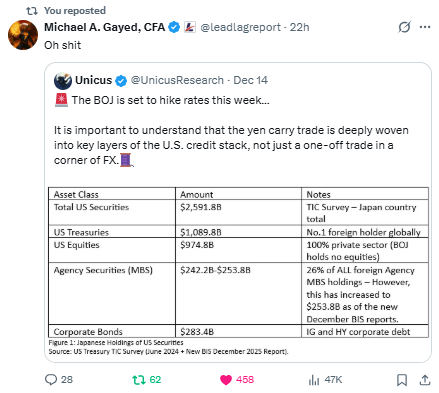

When the BOJ hikes, it pulls a thread that runs through the whole U.S. credit sweater.

Japan is the #1 foreign holder of Treasuries and owns a big chunk of agency MBS and corporates.

For decades, ultralow JGB yields made the yen-carry trade a no-brainer: borrow in yen ~0%, buy higher-yielding USD assets, hedge the FX.

Hikes + rising JGB yields flip that math.

Hedging costs jump, VaR models scream, and Japanese banks/insurers/funds are pushed to reduce U.S. duration risk or repatriate back into JGBs.

What that means stateside: less marginal demand for Treasuries/MBS, wider credit spreads, more equity multiple pressure, and intermittent liquidity air-pockets as carry positions unwind.

If the move is fast, you don’t just get FX volatility—you get forced selling and margin calls across rates, credit, and stocks.

A BOJ hike isn’t a local story; it’s a global tightening impulse that hits at the heart of U.S. (and thus global) funding markets.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply