- The Sovereign Signal

- Posts

- A Global Repricing Is Underway. The Largest Commodities Supercycle Is Being Born Out of the Collapse of the Debt Supercycle.

A Global Repricing Is Underway. The Largest Commodities Supercycle Is Being Born Out of the Collapse of the Debt Supercycle.

Shanghai Silver Premium Breaks Records. COMEX Positioning Lacks Longs. Copper will be the Next Silver. Robert Friedland’s Warning. U.S. Race for Resource Sovereignty Begins. Japan’s Financial System Nears Detonation.

Shanghai Silver Premium Breaks Records

Shanghai’s silver premium just exploded higher.

This isn’t retail frenzy—it’s wholesale dislocation.

When China, the largest silver importer and processor, is paying 10–15% more for physical silver than the LBMA benchmark, that’s not a signal—it’s a siren.

Implication: The COMEX/LBMA paper silver system is diverging from physical reality.

The longer this bifurcation persists, the more likely the West gets dragged into a reprice by Eastern physical demand.

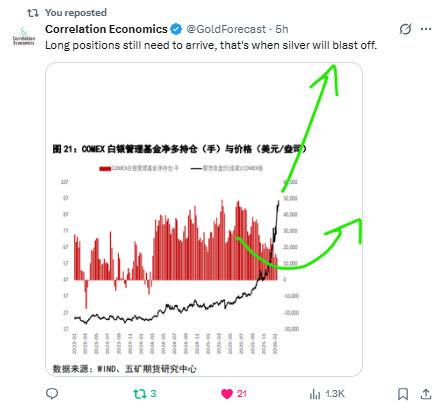

COMEX Positioning Lacks Longs

COMEX positioning is still light on speculative longs.

Translation? The next move higher isn’t a blowoff top—it’s a launchpad.

Once speculative money piles in, it won’t be to arbitrage fundamentals—it’ll be panic chasing scarcity.

This means silver is still in the “smart money accumulation” phase. The “blast off” happens when paper money tries to chase a physical market that’s already gone.

Robert Friedland’s Warning

Friedland isn’t talking his book.

He’s holding up a flare in the fog.

The amount of copper we’ll need to maintain just 3% global GDP growth is staggering.

“You have no idea what we’re facing.”

That’s not hyperbole.

It’s the reality of 10,000 years of copper extraction needing to be repeated in the next 18—without the low-hanging ore.

This means: exponential demand + geological depletion = exponential price response.

U.S. Race for Resource Sovereignty Begins

After decades of offshoring its industrial base and ignoring strategic minerals, the U.S. is now trying to reverse engineer independence.

This won’t be clean or efficient. It means higher input costs, regulatory friction, and geopolitical fragmentation—exactly what fuels commodity bull markets.

Expect two-tier pricing: China/BRICS vs. Western “clean” supply. That pricing divergence will cascade across rare earths, copper, silver, lithium, and uranium.

Japan’s Financial System Nears Detonation

Japan is the fuse on the global debt bomb.

They have the largest debt-to-GDP in the developed world and are the largest foreign holder of U.S. Treasuries.

Now, with their bond market imploding and YCC (yield curve control) on life support, Japan’s currency is unraveling.

This will be a global margin call moment. (Michael Gayed covers this best)

A breakdown in Japanese sovereign debt markets forces global bond repricing, causes mass liquidations, and eventually triggers a reflexive spiral of “safe haven” panic buying in gold, silver, and commodities.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply