- The Sovereign Signal

- Posts

- A Supernova in Slow Motion: The Japan-Silver-Dollar Triangulation

A Supernova in Slow Motion: The Japan-Silver-Dollar Triangulation

What no one’s pricing in: Silver isn’t just money — it’s the material foundation of the next era.

Read between the lines of Shanghai pricing, COMEX drainage, ETF outflows, and industrial silence — silver isn’t trading like a precious metal anymore.

It’s trading like a bottleneck.

The paper price is still shackled by old narratives: “monetary hedge,” “second-tier gold,” “too volatile.”

But on the ground?

It's a critical mineral — rapidly vanishing from accessible inventories while demand accelerates from defense, AI, solar, EVs, and grid resilience.

This isn’t just about inflation anymore — it’s about functionality.

No silver, no AI data centers. No advanced weapon systems.

And the market has barely begun to price this reality in.

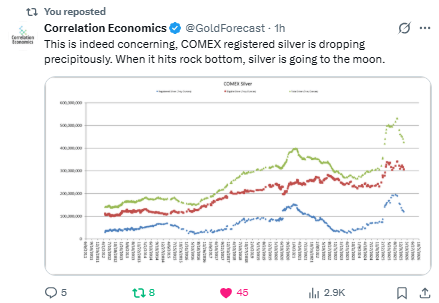

Meanwhile, the COMEX behaves more like a betting parlor than a commodity exchange — offering a price for a ghost of a supply that may not exist when demanded.

So what’s the real risk? Not volatility. Illiquidity. Breakage. Repricing.

When silver finally reflects its role in this high-tech, energy-constrained, geo-strategically bifurcated world — it won’t “rise.” It will rebase.

And the rebase won’t be gentle.

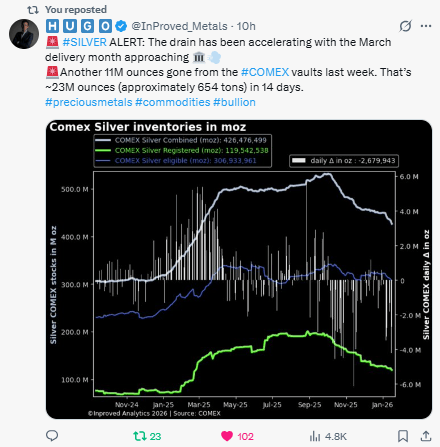

COMEX is bleeding out.

Registered silver is being withdrawn at a pace that’s becoming geometric.

With March delivery approaching, the vaults have shed 23 million ounces in 14 days.

These aren’t random movements.

They are telegraphed signs of a run on paper silver by insiders and industrial users who don’t trust the system to deliver when the music stops.

When registered hits zero — the world gets its first “margin call” in silver.

Shanghai is the real price discovery now.

While the COMEX spins like a Vegas wheel, the physical price in Shanghai has pierced $100 and holds — day after day.

This is not a blow-off. This is a repricing of reality — and China, the largest importer of silver, has zero interest in playing Wall Street’s derivative shell game.

The East is now telling the West: “We’ll pay more for the real thing.”

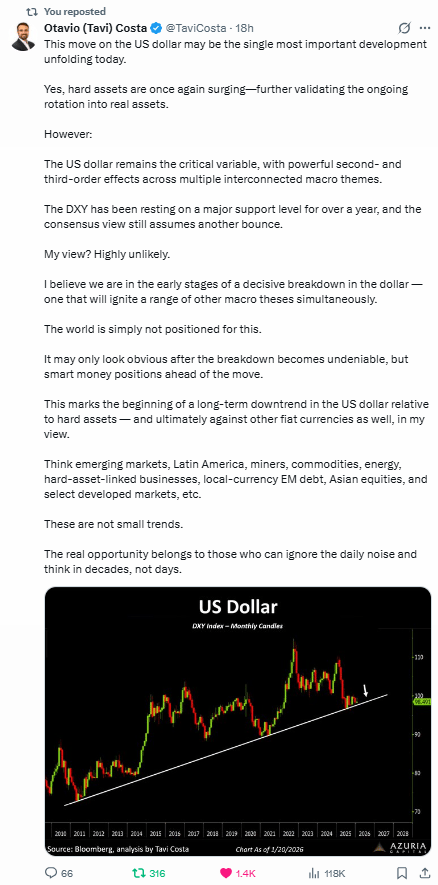

The dollar is next.

While the dollar has held up — propped by global dysfunction — even that floor is splintering.

Tavi Costa sees it clearly: a decade-long uptrend is now breaking.

Once the DXY rolls over decisively, we’re entering a hard asset super-cycle, whether Wall Street is ready or not.

It’s not just gold. It’s not just copper. Silver is the laggard and the leverage.

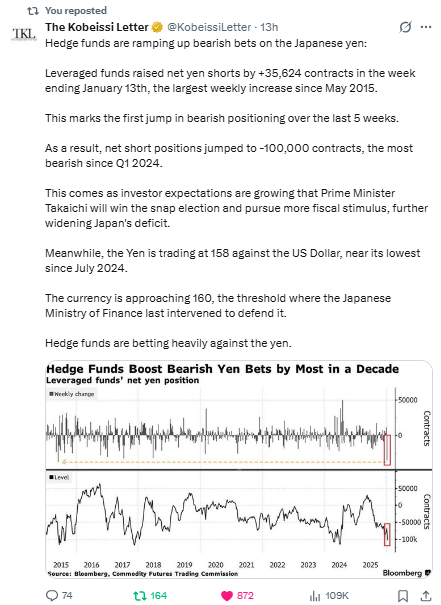

The yen is disintegrating, and hedge funds are betting it collapses further.

Bearish positioning is at decade-highs. The BOJ’s illusion of control is cracking.

When this breaks, the capital flight will be disorderly — and a strong yen hasn’t been the safe haven this time.

Instead, capital is hunting a deeper form of safety: hard assets, not just paper FX pairs.

Japan is the fuse.

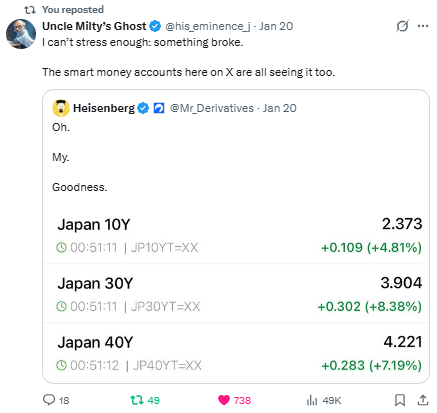

The Japanese bond market is no longer functioning like the world's third-largest economy’s cornerstone — it’s behaving like an emerging market in crisis.

Yields across the curve are exploding, with the 30-year blowing out like a meme stock (+8.4% in one session).

This is not a normal correction — it’s a disorderly repricing of sovereign risk in the most indebted developed nation on earth, a country holding over $1 trillion in U.S. Treasuries.

When a developed nation’s sovereign debt starts trading like junk, the system is screaming.

Japan has nowhere left to go but monetary debasement.

And when they panic-print again — which they will — they don’t just set off a local fire. They pour gas on global fiat dilution.

This isn’t about speculation anymore. It’s about survival of capital.

Japan is the first domino in a failing fiat regime.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply