- The Sovereign Signal

- Posts

- America Re-Establishes Superpower Status As Metals'/Resource War Heats Up, Silver Trading Over 10% Higher In China, Silver Breaking Out Against Equities As A Monetary Hedge, Silver Demand Set To Increase

America Re-Establishes Superpower Status As Metals'/Resource War Heats Up, Silver Trading Over 10% Higher In China, Silver Breaking Out Against Equities As A Monetary Hedge, Silver Demand Set To Increase

Silver is absolutely crucial to the AI race and military spending around the globe.

Markets smelled a hemispheric resource war the moment Venezuela lit up.

When great powers start muscling for metal supply lines, traders price three things fast: future scarcity, fatter risk premia, and the policy response to fund it all.

That cocktail = higher term-structure stress, backwardation, and a monetary bid—so gold rips as neutral collateral and silver rips as the dual-use choke point for energy + AI hardware.

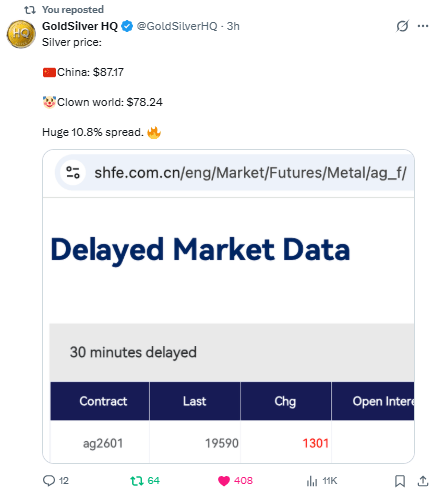

China’s $87 vs. West’s $78 is the risk premium for a world splitting its metal supply lanes: capital controls, licenses, refinery bottlenecks, and war logistics jam the arbitrage, so the East pays up and the West lives in paper nostalgia.

That spread is the canary—when pipes reconnect, it won’t be China coming down; it’ll be our price ripping up to meet theirs.

Capital is tip-toeing from “growth stories” to store-of-value convexity, repricing silver from input → money.

When trust in financial assets wobbles, gold moves first; silver follows with beta and violence.

That spread won’t close by China coming down—it closes with Western paper chasing physical and SILVER outrunning equities like a currency catching fire.

The game is changing from credit-backed money to metal-backed credibility.

Central banks (the most well funded and well informed traders in the world as Andy Schectman points out) aren’t “hedging”—they’re changing the unit of account for risk.

When the base layer re-hardens, capital reprices everything above it: fiat premium melts, real rates get politically capped, and silver—gold’s high-beta twin—moves from industrial input to monetary accelerant.

Buckle up.

The war budgets above are a vacuum hose on silver.

Drones, guidance systems, radars, satellites, secure comms, even hypersonic heat shields all chew through Ag; every extra billion in defense is more sensors, more solder, more mirrors, less inventory.

As geopolitics heats, monetary metal meets munitions metal: central banks hoard, militaries drain the barrel, civilians get what’s left at a rising clearing price.

Gold bankrolls, copper carries, but silver makes it think.

AI is a power-hungry, photon-soaked, heat-spitting machine—and the metal with the highest electrical/thermal conductivity and mirror-grade reflectivity is the bottleneck.

Data centers, chips, interconnects, sensors, solar backstops—strip out the silver and the “AI boom” flatlines.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply