- The Sovereign Signal

- Posts

- Bank Reserves Crash to 5-Year Lows — as Central Banks Buy 634 Tons of Gold and Silver Backwardation Returns

Bank Reserves Crash to 5-Year Lows — as Central Banks Buy 634 Tons of Gold and Silver Backwardation Returns

Bank cash cushions are evaporating while repo usage tops $40 B since June and vault withdrawals hit 45 M oz. QT and Treasury issuance are tightening funding, leverage is peaking, and policy reflexes are growing louder. The tape is clear: trust is migrating from leveraged paper to physical collateral.

Banks’ gas tank is flashing red.

What the chart screams: Reserves parked at the Fed are sliding to 5-year lows.

That’s the banking system’s cash cushion—its shock absorber. Thin cushion = small bumps feel like potholes.

Why now (the plumbing):

QT drains reserves, Treasury issuance/TGA refills vacuum cash, deposit flight to money-market funds keeps pulling dollars out, and higher rates make funding pricier.Same assets, more leverage pressure.

Why it matters:

Banks are one of the market’s engines.

Low reserves = less room to make markets, extend credit, or absorb hits.

When stress pops (headline, swap spread wobble, yen-carry sneeze), hedges get yanked and moves go from dip to air-pocket.

Tell to watch:

Rising repo usage, negative swap-spread drifts, and RRP still light = the system is running hot on leverage with a thinner cash buffer.

Positive, holistic read:

This is an early warning, not a fate.

De-levering and rebuilding cash steadies the machine.

In a world wired tight, liquidity is oxygen—respect the gauge.

Wake up: Stocks can fly high, but if the fuel light’s on, every cloud matters.

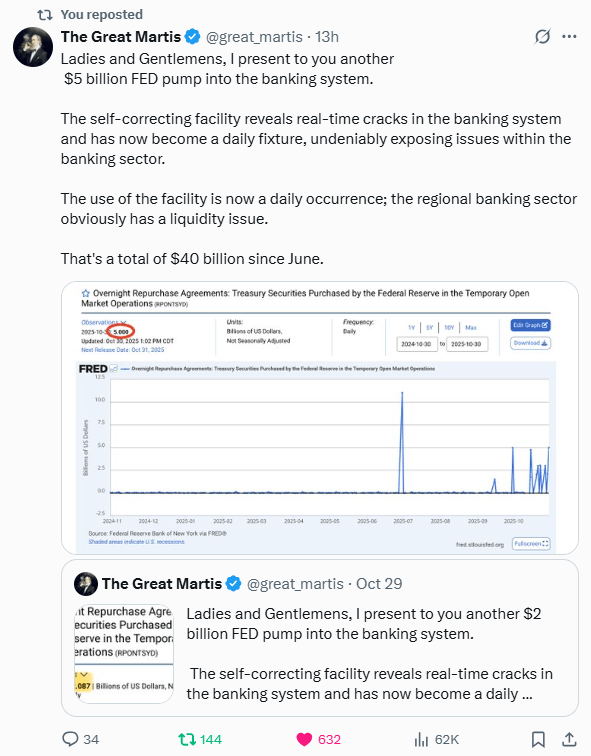

The tell: Daily Fed overnight repo prints ($5B today; ~$40B since June) mean banks are swapping Treasuries for cash before the bell.

That’s the system using its inhaler.

Why now (the plumbing, not a headline):

QT + heavy Treasury issuance pull cash out of banks.

Deposits → money-market funds keep draining reserves.

Higher rates dent bond values, lifting margin and haircuts.

Global carry strains (yen, swaps) raise dollar funding needs.

What it means (LEVERAGE):

Thin cash cushions + long-duration assets = tight funding.

When volatility flickers, forced de-risking can turn dips into air pockets because everyone reaches for the same dollar at once.

Holistic read:

This facility is the pressure valve—it keeps pipes from bursting, but it also signals stress.

Rebuilding reserves and de-levering balance sheets cools yields and steadies markets far better than wishful narratives.

Wake up: Stocks can sprint, but the fuel light is on. In a max-leverage system, liquidity is oxygen—watch the gauge.

Signal, not slogan: Central banks just bought 220 tons of gold in Q3 (up 28% vs. Q2), 634 tons YTD, tracking 750–900 tons for the year. They’re buying into high prices—not waiting for sales.

Why now (LEVERAGE 101):

Debt & deficits:

More government borrowing lifts duration risk; balance sheets want collateral that doesn’t default.

Funding stress:

Repo taps, thin cash buffers, and swap-spread wobble reward assets that settle on contact.

Geopolitics:

Sanctions and custody risk push nations toward value outside another country’s control.

FX fragility:

A weak or volatile currency books cleaner against a neutral reserve.

What it really says:

Gold is the base layer in a leveraged system—no counterparty, no plug to pull.

When the most informed, best-funded players keep stacking at record highs, they’re not chasing a story; they’re upgrading collateral.

Plain English: Watch what they do, not what they say.

The scoreboard says trust is migrating from IOUs to atoms.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −15.83 bps | Still negative → swaps richer than cash Treasuries; funding/credit tension persists. | 🟠 Orange |

3-Year SOFR–OIS | 29.5 bps | Elevated mid-tenor funding stress; risk appetite fragile. | 🔴 Red |

UST–JGB 10-Year | 2.455% | Wide trans-Pacific gap → basis/carry distortions linger. | 🟠 Orange |

Reverse Repos (RRP) | $19.166B | Safety valve still near empty → very thin spare cash buffer. | 🔴 Red |

USD/JPY | 154.12 | Carry trade supercharged; unwind risk building. | 🔴 Red |

USD/CHF | 0.8023 | Bid for “hardest fiat” persists; safety flows in play. | 🟠 Orange |

SOFR Overnight | 4.27% | High carry / tighter overnight funding. | 🟠 Orange |

SOFR Transaction Volume | $3.061T | Heavy plumbing usage; system running hot. | 🟠 Orange |

SLV Borrow (fee / avail / rebate) | 1.71% / 2.3M / 2.41% | Availability improved vs. lows but still tight if demand jumps. | 🟡 Yellow |

COMEX Silver Registered | 163.42M oz | Deliverable pool thinning quickly; supports firm premia/basis. | 🔴 Red |

COMEX Silver Volume | 68,613 | Quieter tape; moves can gap on headlines. | 🟡 Yellow |

COMEX Silver Open Interest | 159,731 | Moderate positioning; room for expansion/squeezes. | 🟡 Yellow |

GLD Borrow (fee / avail / rebate) | 0.48% / 5.6M / 3.64% | Ample shares; shorting cost moderate. | 🟡 Yellow |

COMEX Gold Registered | 19.85M oz | Tight deliverable pool keeps basis firm. | 🟠 Orange |

COMEX Gold Volume | 269,052 | Healthy flow; volatility can gap on stress. | 🟡 Yellow |

COMEX Gold Open Interest | 469,018 | Solid participation; susceptible to funding shocks. | 🟠 Orange |

Japan 30-Year JGB | 3.039% | Elevated long end stresses JGB convexity/carry. | 🔴 Red |

US 30-Year UST | 4.666% | Long end tightening financial conditions; de-risking sensitive. | 🟠 Orange |

Read the tape: silver is tight now, not someday.

Backwardation = scarcity.

When near-term prices > future prices (LBMA spot > forwards/EFP flipping +5–10¢ to –23/–14¢; 2-mo OTC from –0.5%/flat to ~–2%), the market is shouting: I’ll pay more for metal today than promises tomorrow.

Bars are leaving the system.

Another 2.5M oz withdrawn; ~45M oz in three weeks.

Shipments from NY/Shanghai to London only briefly eased the squeeze—free float refilled, then drained again.

Leverage vs. atoms.

Falling lease rates didn’t loosen supply because paper carry ≠ new bars.

With inventories thin, each ounce leased or sold short must be found and returned into a shrinking pool.

Why now:

Asia/India premiums, solar/EV pull, and dollar-funding stress push savers toward settlement-grade collateral.

That funnels demand to immediate delivery venues (LBMA/SGE), not just futures screens.

Bottom line: When spreads invert and stockpiles bleed, availability—not quotes—sets the rules.

Backwardation is the market’s siren: the bid is for metal in hand.

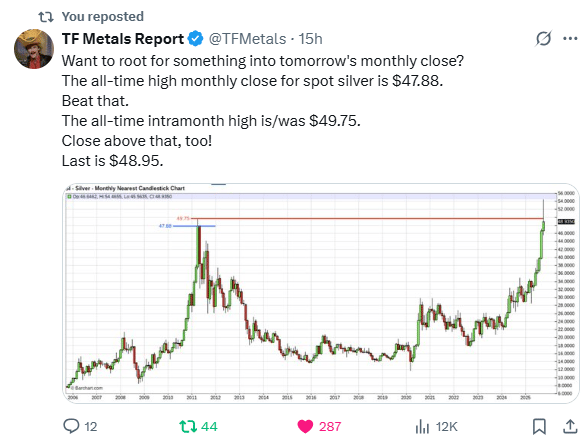

What this line in the sand means

Two doors:

Close above $47.88 (all-time monthly close) and you confirm a new regime.

Push/close above $49.75 (all-time intramonth high) and the old ceiling becomes the floor.

Why it’s happening now (in plain English)

Atoms > paper:

Backwardation, vault draws, and Asia/India premiums say the bid is for metal now, not promises later.

Thin float + big use:

A decade of under-mine + solar/EV demand = fewer spare bars; each real bid moves price more.

Funding stress:

Tight dollar plumbing squeezes leveraged shorts; carry trades wobble; forced buys meet scarce stock.

Under-ownership:

Western allocations to metals are still tiny—small reweighting = outsized impact.

Leverage angle

In a market stacked with paper claims but short of bars, price inflects at the edges—new highs force shorts to cover into a shallow pool.

That’s how levels become events.

Translation

A close through these highs isn’t just a chart win; it’s the market admitting silver’s denominator changed: less float, more need, tighter money.

Hindenburg Omen fired — here’s the deeper cycle it’s pointing at:

Divergence alarm:

New highs and new lows together = the market’s engine is misfiring.

Indexes look fine; internals don’t.

Breadth → fragility:

A few mega-caps pull the wagon; when they wobble, there’s no net under the market.

Leverage flywheel:

We’re in a regime of exponentially more leverage (record margin debt, rock-bottom hedging).

That pushes prices farther from real valuations, so when something breaks, forced de-risking turns dips into air pockets.

Policy reflex:

Bigger cracks invite bigger liquidity waves.

Each rescue means more currency debasement than the last.

That cycle—more leverage → bigger busts → bigger money floods—accelerates.

Why this matters now: Funding costs are up, cash cushions are thin, and global carry is twitchy—so the system is primed for vicious volatility bursts followed by outsized liquidity responses.

Translation: This isn’t fate; it’s mechanics.

A leverage-soaked market produces sharper drawdowns and louder “rescues.”

In that world, physical gold and physical silver—base-layer collateral that doesn’t rely on anyone’s promise—tend to gain structural bid as each round erodes currency value.

Bottom line: The omen is a symptom of an accelerating cycle: prices stretched by leverage, corrections amplified by margin, and policy replies that debase faster each time.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply