- The Sovereign Signal

- Posts

- Bloomberg Admits Central Banks Are Buying Silver, China Silver Export Restrictions Begin In 2 Days, There's Almost 4 Times Less Silver Available To Trade Than Gold Available In Vaults, Silver Is Still Less Than Half Of It's All-Time High When Adjusted For CPI, Chinese Silver Price Remains Elevated And Somewhat Decoupled From Western Silver Prices

Bloomberg Admits Central Banks Are Buying Silver, China Silver Export Restrictions Begin In 2 Days, There's Almost 4 Times Less Silver Available To Trade Than Gold Available In Vaults, Silver Is Still Less Than Half Of It's All-Time High When Adjusted For CPI, Chinese Silver Price Remains Elevated And Somewhat Decoupled From Western Silver Prices

Silver has begun retracing part of it's meteoric rise on Friday. How long until the next leg up? An elevated spread in China (a market driven more by physical demand) suggests the short-term outlook remains bullish.

Bloomberg is admitting central banks are in the silver aisle - that’s a big deal.

These are price-insensitive, multi-decade hoarders—buyers who don’t flip, they remove float.

When the referee starts buying the ball, the game changes: scarcity tightens, industrial users get crowded out, and paper benchmarks eventually chase physical reality higher.

This isn’t a meme squeeze; it’s a regime shift signaled by sovereign balance sheets.

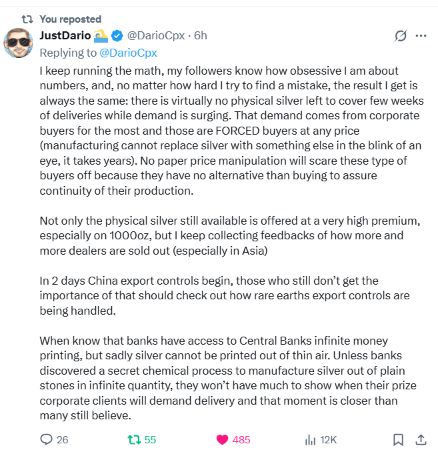

Manufacturers are price-insensitive, forced buyers and there isn’t enough metal to cover even a few weeks of deliveries—while Asia’s shelves empty and China clamps exports.

When sovereign hoarders meet non-negotiable industrial demand into shrinking float, paper benchmarks don’t “guide” the market—they chase it.

The repricing won’t be polite; it will be a scramble to secure supply.

The tradable float is inverted.

There’s more gold sitting idle than silver ready to move.

So line it up—sovereigns accumulating, manufacturers as forced buyers, China choking exports, vault inventories thinning—and all of it is crashing into a smaller, tighter silver float than gold.

That’s why screens jerk and premiums stick: price isn’t “running hot,” the market is discovering scarcity in real time.

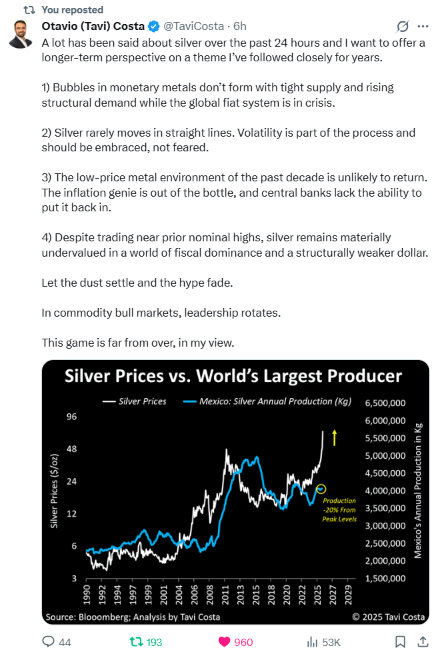

Stack this on top of the tiny-float insight: you’ve got structural demand rising into a shrinking production base (Mexico still ~30% below peak), while the fiat system wobbles and the dollar’s structural tailwind fades.

That cocktail doesn’t produce neat lines; it produces violent stair-steps—volatility as the mechanism for repricing scarcity.

The “cheap metal decade” is gone because central banks can’t stuff inflation back in the bottle without breaking things that matter more.

Leadership rotates in commodity bull markets; with less tradable silver than gold and tighter mine supply, silver’s turn is mathematically loaded.

Let the noise shake out—this game isn’t close to finished.

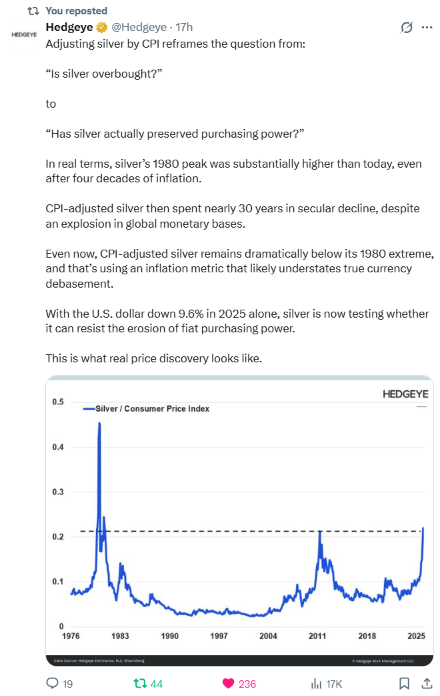

If supply is tight and leadership is rotating to hard commodities, then real pricing matters—and CPI-adjusted silver is still miles below its 1980 purchasing-power peak even after a historic fiat binge.

That means the “blow-off” we just lived through wasn’t excess; it was catch-up.

And because CPI likely understates currency debasement, the true gap is larger.

Translation: scarcity + underpriced real value = asymmetric upside.

Volatility is just the toll on the highway to fair value.

If silver is still undervalued in real terms and Shanghai trades 12% over London, that’s not noise—that’s the physical market refusing the Western paper mark.

Export frictions + drained inventories = broken arbitrage, so spreads don’t close; they force upward convergence.

The long game is simple: scarcity sets the price, and the center of gravity just shifted to where the metal actually moves.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply