- The Sovereign Signal

- Posts

- 🚨Broker‐Dealer Banks Are Suddenly Stockpiling Over $1.17 Trillion Of Pristine Collateral

🚨Broker‐Dealer Banks Are Suddenly Stockpiling Over $1.17 Trillion Of Pristine Collateral

We Haven't Seen This Since Q1 2008

In his YouTube breakdown yesterday, George Gammon highlights something Wall Street hasn’t done since 2008:

Broker‑dealer banks are suddenly stockpiling over $1.17 trillion of pristine collateral — Treasuries and mortgage‑backed securities — on their balance sheets.

Why does that matter?

When they hoard, it’s because they see what’s coming: a period when collateral becomes scarce, liquidity tightens, and they can cash in on larger spreads.

In other words, insiders are quietly bracing for stress, and they’re preparing to profit from it.

Signal | Latest Level | What It Means | Zone |

|---|---|---|---|

10‑Year Swap Spread | –28.9 bps | Still deeply negative → market prefers derivatives over cash Treasuries → base layer collateral distrust flashing. | 🔴 Red |

Reverse Repos (RRP) | $193.66 B | Watch out for a sustained break below $100B. | 🟠 Orange |

USD/JPY | 148.55 | Yen likely to continue weakening as BoJ defends bonds → carry trade likely to stretch further. | 🟠 Orange |

USD/CHF | 0.8021 | Global CHF reserves increased from $20 billion to $88 billion recently despite low yields → rotation to alternate safe havens. | 🟠 Orange |

3‑Year SOFR‑OIS Spread | 25 bps | Slightly lower → short‑term funding tension slightly eased, but still historically elevated at over 20bps. | 🟠 Orange |

SOFR Overnight Rate | 4.34% | Stable headline rate but masking deeper collateral mispricing underneath. | 🟡 Neutral |

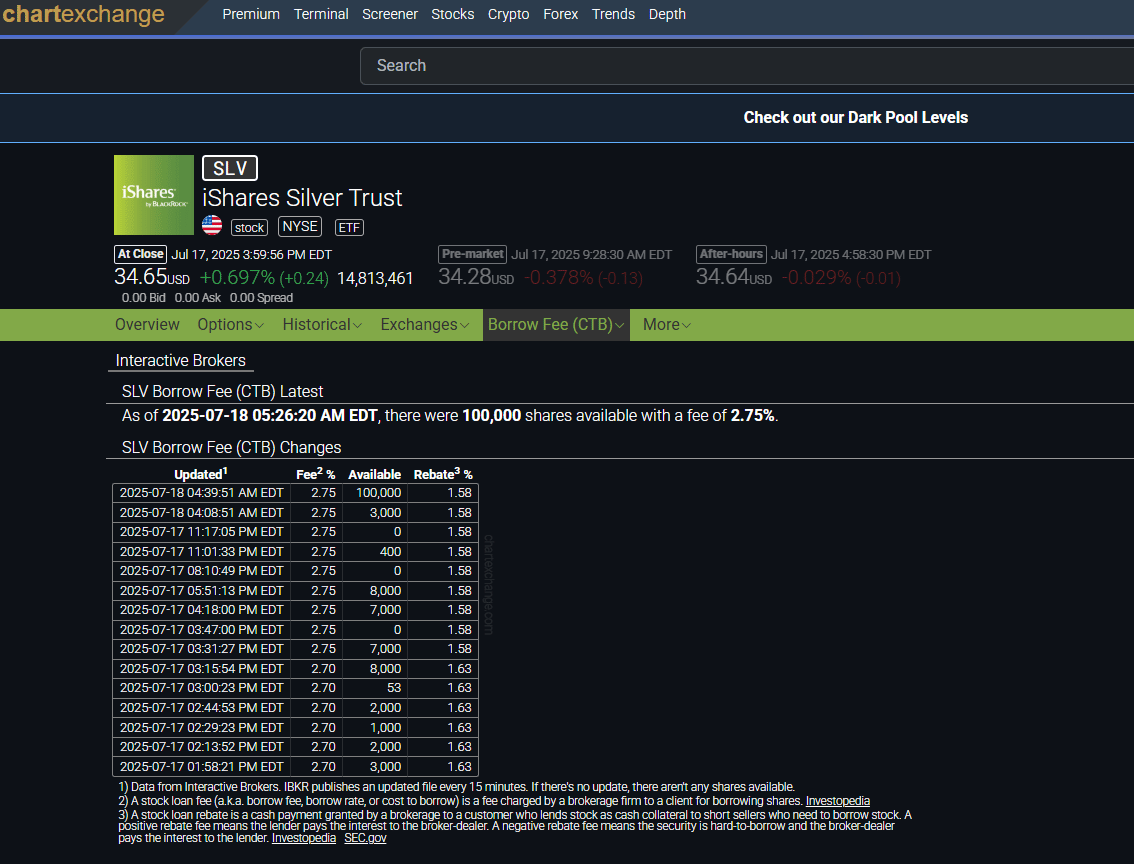

SLV Borrow Rate (CTB) | 2.75% | 🚨 Surge from 0.68% (July 10, 4.1M shares) → 1.82% → now 2.75% with only 100,000 shares available → shorts under growing pressure. | 🔴 Red |

COMEX Silver Registered | 195,913,275.19 oz | Registered ounces remain far below total open interest → physical tightness persists. | 🟠 Orange |

COMEX Silver Open Interest | 173,006 contracts | ≈865 M oz paper vs ≈196 M registered → <25% would drain registered. | 🟠 Orange |

COMEX Silver Total Volume (Yesterday) | 47,017 | Healthy churn, but in a market with vanishing borrow availability. | 🟠 Orange |

GLD Borrow Rate | 0.50% | Stabilized, but elevated relative to historic norms. 4,500,000 shares available. | 🟢 Green |

COMEX Gold Registered | 20,190,185.97 oz | Registered metal holding steady while open interest rises → slow tightening continues. | 🟡 Yellow |

COMEX Gold Open Interest | 452,473 contracts | ≈45 M oz paper vs ≈20 M registered → <45% would drain registered. | 🟡 Yellow |

COMEX Gold Total Volume (Yesterday) | 186,824 | Elevated turnover alongside rising OI. | 🟡 Yellow |

10Y UST–JGB Spread | 2.912% | Spread still wide → US/Japan yield correlation signaling systemic stress. | 🟠 Orange |

Japan 30‑Year Yield | 3.09% | Near record highs → BoJ forced to defend bonds, adding deep systemic fragility. | 🔴 Red |

US 30‑Year Yield | 4.995% | Rising in lockstep with JGBs → bedrock collateral wobbling. | 🟠 Orange |

SOFRVOL (Repo Usage) | $2.771 T | Overnight funding usage climbing cyclically → system leaning ever harder on short‑term liquidity. | 🟠 Orange |

⚠️ The Bedrock Is Shifting — And the Signals Are Converging

Wall Street’s $1.17 trillion collateral hoard isn’t happening in a vacuum.

It’s unfolding while the two largest pillars of global finance — U.S. Treasuries and Japanese Government Bonds — are wobbling under rising yields and policy traps.

Japan’s bind: exports declined .5% in June (2nd consecutive month), GDP contracted .7% in Q1 2025, 30‑year JGB yields pressing 3.08%–3.2% as the BOJ is forced to defend bonds more aggressively at the cost of a weaker currency, fueling the global yen carry trade (and global leverage) that much more.

U.S. echo: 30‑year Treasury yields climbing in lockstep to ~5%, tightening the noose on the collateral base the entire system relies on.

📌 These aren’t just bonds.

They are the foundation of every repo, swap, and leveraged position worldwide. When their yields rise and trust thins, the entire structure above them begins to tremble.

🔧 Forward Signals Have Been Screaming

The forward‑looking stress signals we’ve been tracking match Gammon’s warning:

10‑Year Swap Spread: –28.9 bps (dealers preferring synthetic hedges over real Treasuries → collateral distrust).

3‑Year SOFR–OIS: 25 bps (overnight funding strain priced in years ahead).

SOFRVOL: ~$2.8T and cyclically climbing (the system leaning harder and harder on overnight funding).

These aren’t background noise.

They’re organic early warnings of base layer collateral stress and mid term stress in overnight liquidity for the global financial system — same pattern on a larger scale that we saw before 2008 and before the 2020 liquidity seizure.

💥 The Fuse Lit in Silver — And It’s Popping Off

If you’ve been following these reports, you know we’ve been calling out these moves in silver for weeks — pointing out that this is the pressure release valve for distortions across all asset classes, under the surface, where almost nobody is watching.

Sure enough, it’s popping off.

As of July 18, 2025 at 05:26:20 AM EDT, only 100,000 SLV shares available (down from 4.1 million on July 10th) to borrow with the fee spiking to 2.75%.

Just 2 days ago there were zero shares available for almost 24 hours, after the borrow fee had jumped from .68% to 1.82% within a week as shorts scrambled to source metal in a tightening market.

SLV is the largest silver ETF in the world.

We can see yesterday at multiple times there were zero shares available with the number staying very low throughout the day.

👉 This is not normal.

It’s a flashing signal that the move in silver is just getting started.

Silver is acting as the pressure‑release valve for distortions across all asset classes — distortions driven ever higher from real values by cheap debt and the perpetual belief that another liquidity backstop will always be there to save the markets from the next major liquidity event.

And of course the pressure release valve for the distortions would be:

✅ The first metal used as currency in ancient Mesopotamia.

✅ The first truly international reserve currency — the Spanish silver dollar.

✅ The currency that connected the East and West in commerce along the Silk Road.

When the modern financial superstructure starts creaking under its own weight, capital instinctively remembers that history.

🌏 China’s Liquidity Surge: Fuel on Dry Tinder

Layer onto this backdrop the spark igniting beneath the surface:

China’s M1 money supply — the most pro‑cyclical measure of liquidity — is now accelerating sharply.

Fresh data show annual growth surging to 4.6%, up from 2.3% last month and only 0.4% at the start of the year.

This isn’t just another data point.

👉 China’s M1 is larger than U.S. M1 ex‑savings deposits and accounts for roughly a third of the entire G10’s M1.

👉 As such it is the single most important driver of global liquidity swings, and historically it leads global growth and inflation by 3–6 months.

Simon White at Bloomberg put it bluntly: money drives markets, and China is the biggest player.

When M1 growth in China accelerates, it’s not just a domestic story — it feeds into global funding conditions, credit creation, and ultimately asset prices.

💡 What does that mean in this distorted system?

✅ More liquidity → more inflation pressure just as price growth is re‑intensifying.

✅ More inflation → upward pressure on sovereign yields.

✅ Higher yields → stress on the very collateral (Treasuries, JGBs) that underpins the financial system.

✅ More stress → more reliance on repo markets, more interventions, more stealth debasement.

And while China is stoking liquidity, the Federal Reserve’s independence is coming under political fire.

The world’s most important central bank may soon be forced to choose between price stability and market stability — and history says they will always choose liquidity.

💡 We’re not waiting for a single “Minsky moment.” We’re living inside a Minsky era.

Each major liquidity flare‑up is a mini Minsky moment—a tremor that forces new interventions—yet every intervention leaves the foundation weaker.

Each tremor demands a bigger patch than the last, until the patches themselves become the system.

Since 2020, we’ve effectively been in perpetual QE:

✔️ The Fed buys Treasuries (distorting supply and demand at the very base layer),

✔️ Then “rents” them back into the market through reverse repos just to keep collateral circulating.

That isn’t a healthy, organic foundation.

That is a loop—a patch to the patch—keeping the sovereign debt layer alive by artificial means.

And here’s the thing:

None of this reverses the trajectory.

It only means each future liquidity event will require:

🔹 even larger balance‑sheet expansions,

🔹 even more aggressive yield caps and facilities,

🔹 and therefore exponentially more currency debasement.

🛠️ The toolbox is not empty — but every tool distorts the foundation further

✅ More Yield Curve Control (YCC)

They can double‑down on capping long‑end yields by buying even more sovereign debt (QE in a new costume). That pushes more duration risk onto central bank balance sheets… but it postpones the stress for a time.

✅ Balance‑sheet acrobatics (repo/reverse repo gymnastics)

We’re already seeing this — the Fed “renting” Treasuries back into the system through reverse repos, or creating new liquidity facilities. These are patches on patches — they buy time but deepen fragility.

✅ Massive bill issuance / collateral reshuffling

Treasury and MoF (Japan) can shift issuance into short‑term bills to appease money markets, while buying back off‑the‑run debt to manufacture “pristine” collateral. Again, it works short‑term but compounds structural imbalance.

✅ Currency interventions

For example Japan…they can step into FX markets to slow the yen’s decline while trying to defend its bond market—but here’s the catch: they cannot defend both at the same time.

These two fronts—yen stability and JGB yields—are structurally intertwined with the very foundation of the global system: U.S. Treasuries, the base layer of collateral worldwide.

Every time Japan sells reserves (like Treasuries) to prop up the yen, or prints yen to cap JGB yields, stress reverberates straight into that base layer.

And in today’s hyper‑interconnected system, if Japan truly becomes a problem, it won’t stay contained.

The risk isn’t just Japan—it’s what happens when one of the largest sovereign bond markets in the world begins to wobble alongside other major economies already weighed down by debt and intervention.

In a world this tightly coupled, a fracture in one pillar shakes the entire foundation.

✅ “Financial repression” policies

Mandates for domestic institutions to hold more sovereign debt, capital controls, even stealth regulatory pressure to keep yields in check. These aren’t new… but they push more risk into the shadow system.

⚠️ The Cost

Each of these buys time, but they all worsen the underlying issues: the base layer (sovereign debt) is over‑leveraged and now structurally wobbling.

That’s why the signals we track are at the heart of base layer collateral and global liquidity:

🔹 10‑year swap spreads stuck deeply negative for months and months on end,

🔹 3‑year SOFR‑OIS also blowing out for months and months on end

🔹 Cyclically greater and greater dependency on overnight funding for markets to stay liquid as measured by SOFR repo volumes

These are forward looking stress signals that the market expects base layer collateral and heartbeat of global liquidity to malfunction more and more over the next few years.

🌐 Patching the Cracks: What Can They Really Do?

So, what could they do?

👉 A lot… but every patch leads to more leverage and more fragility.

It just postpones, distorts, and makes each eventual re‑pricing sharper.

And I don’t think anyone can fully grasp just how sharp these re‑pricings might be.

Whether this plays out over years or decades, the trend is unmistakable from 30,000 feet:

👉 We are watching the modern fiat experiment (54 years young) erode the base layer of the largest and most interconnected global financial system in recorded history.

👉 Capital inevitably seeks the old base layer—the one that worked for millennia.

🥇 Gold quietly rotates back to the center as the ultimate collateral.

🥈 Silver, the lagging release valve, is positioned to go parabolic—because it’s been sidelined and undervalued ever since it stopped being base money.

You don’t need to time a single Minsky “moment.”

You need to see the cycle—and position for what every patch implies:

✅ More debasement ahead,

✅ More fractures in sovereign debt,

✅ And a return to what has always held value when the system strains beyond repair.

🌌 Why gold & silver matter

When interventions stretch the rubber band further, the eventual snaps are more violent… and capital historically rotates to what cannot be printed:

🥇 Gold (already quietly becoming the new base layer on central bank balance sheets),

🥈 Silver (the lagging pressure release valve for distortions across asset classes fueled by cheap debt and the perception that another liquidity backstop will always be there— we’re seeing the early mechanics of that now in SLV borrow markets).

💡 Want to position yourself before the next snap?

I can personally connect you with my trusted referral partners at major U.S. precious metals dealers—fully insured, secure vaulting or delivery, and only the most practical, liquid forms of gold and silver (no numismatics, no gimmicks).

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply