- The Sovereign Signal

- Posts

- China Accelerates' Commodities Imports', Physical Silver Supply Crisis Intensifies, Global Assets' Are Melting Up As Fiat Currencies Depreciate, US Electricity Prices Are Soaring

China Accelerates' Commodities Imports', Physical Silver Supply Crisis Intensifies, Global Assets' Are Melting Up As Fiat Currencies Depreciate, US Electricity Prices Are Soaring

Silver is the most electrically conductive metal on the planet.

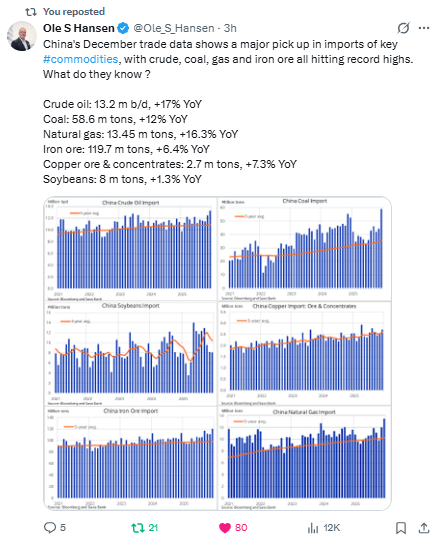

China isn’t just stockpiling commodities — it’s front-running the next phase of global instability.

Crude, coal, gas, iron, copper — all up double digits YoY.

This isn’t trade — it’s strategic accumulation.

China’s preparing for scarcity, conflict, or both.

The world’s factory is hoarding the raw materials of control. Something big is coming.

The silver “price rally” is a distraction.

This is a physical failure at the heart of the global settlement system.

London is running on fumes — 62,000 tonnes of phantom silver backed by a mere 1,400 tonnes of deliverable metal.

This isn’t market volatility, it’s systemic paralysis. When trust in paper silver evaporates, the real game begins: a scramble for physical that vaporizes supply and sends silver into a “new price reality” as Michael Oliver likes to say.

When every asset class — from commodities to credit to equities — breaks records in sync, it's not a bull market.

It’s a melt-up. Fiat is quietly imploding under the weight of decades of artificial suppression and debt bingeing.

What comes next isn’t just inflation — it’s repricing. Commodities aren't rising; currencies are failing. We are in the early innings of this super-cycle.

Powell is signaling the U.S. will default slowly through inflation and repression, not explicitly.

Bondholders are being promised guaranteed losses, while gold offers neutrality, sovereignty, and zero counterparty risk.

Layer that atop weaponized reserves, collapsing trust in institutions, and record-high everything — and you’re not looking at a bull case for gold.

We’re looking at its re-monetization. The end of “risk-free” assets is the beginning of gold as the new anchor. This isn't policy — it's inevitability.

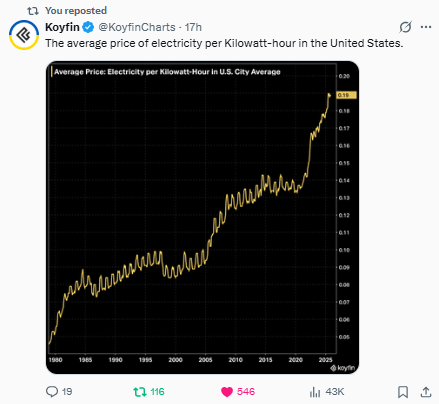

Electricity costs are going vertical — and this is just the price signal.

The real story is structural: aging grids, chronic underinvestment, electrification mandates, and commodity scarcity all colliding at once.

This isn’t inflation. It’s transformation.

Silver is the most electrically conductive metal on the planet. Indispensable.

As electricity melts up, the industrial silver demand curve doesn’t bend — it snaps upward.

No reset, no relief — just relentless consumption of a finite resource.

Welcome to the commodities super-cycle born from a debt supernova.

The silver burn has barely begun.

This isn't diplomacy — it's a prelude to commodity chaos.

Qatar doesn’t bluff. It knows any spark between the U.S. and Iran torches the Strait of Hormuz — choke point for ~20% of global oil.

In a world already teetering under soaring electricity costs and industrial metal demand, war risk isn’t just geopolitical — it’s a fuse under the entire commodities complex.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply