- The Sovereign Signal

- Posts

- 🇨🇳📈 China’s Russian Gold & Silver Surge – A Quiet Shift Beneath the Surface

🇨🇳📈 China’s Russian Gold & Silver Surge – A Quiet Shift Beneath the Surface

Russia—the world’s #2 gold producer—is launching a domestic physical gold contract on the St. Petersburg International Mercantile Exchange by year‐end.

This has huge long term implications on price discovery in the metals markets.

Source: BullionStar (via X/Twitter, Jul 21, 2025) — data from China’s General Administration of Customs.

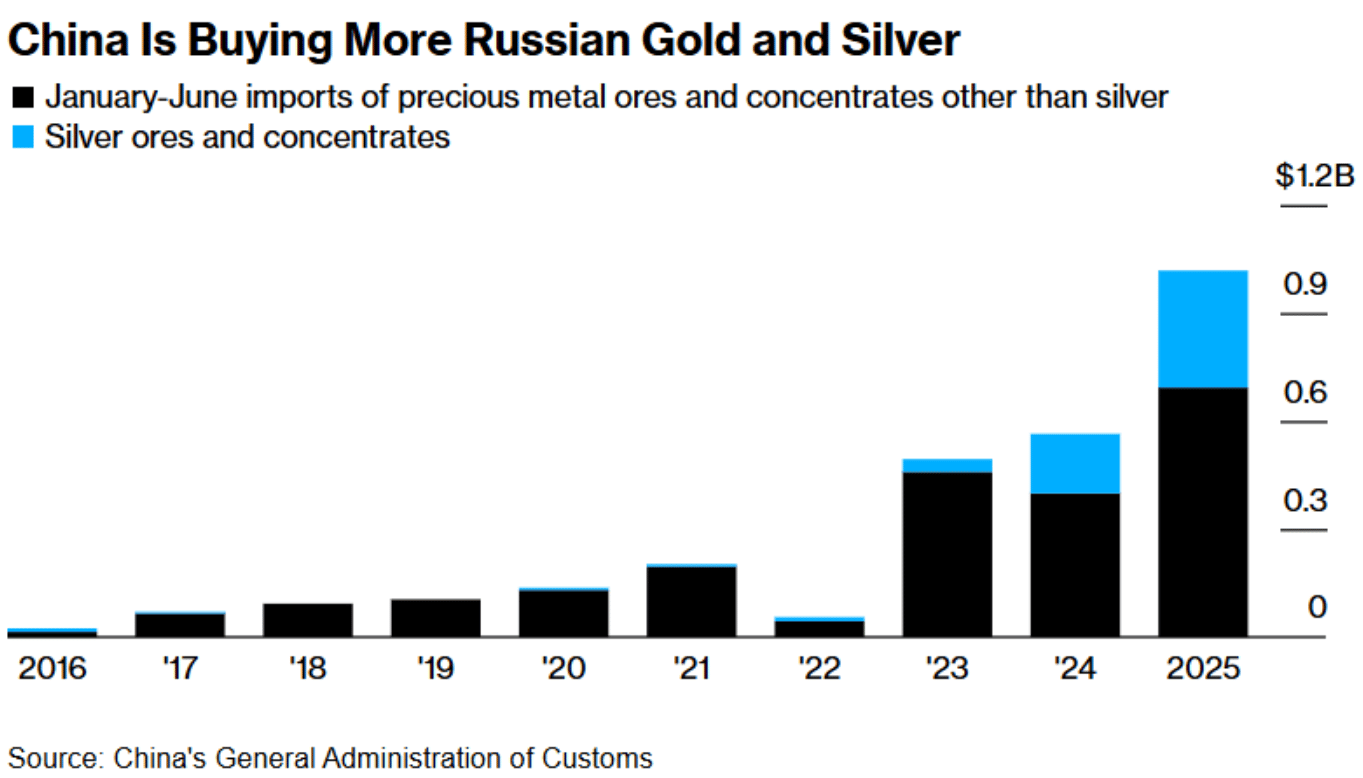

🔹 From 2016 through 2021, China’s imports of Russian gold and silver ores were a rounding error.

🔹 But starting in 2022, the bars explode higher—2024 and 2025 alone show well over $1B in combined gold and silver ore imports, with silver’s slice (blue) sharply growing.

👉 Read between the lines:

While most eyes are glued to Western benchmarks like the LBMA, a deeper restructuring of the global metals market is underway:

✅ Russia’s New Exchange

As Vince Lanci highlighted in conjunction with Arcadia Economics, Russia—the world’s #2 gold producer—is launching a domestic physical gold contract on the St. Petersburg International Mercantile Exchange by year‑end.

This is not a gimmick.

It’s a strategic move to set local price benchmarks and reduce reliance on the LBMA, which for decades has been the West’s pricing choke point.

✅ A Parallel Ecosystem Emerging

China is buying aggressively from Russia because they know where this is going.

They’re not thinking about sending those bars to London to be recast into “London Good Delivery” bars—they’re creating their own ecosystem of standards, refineries, and clearinghouses.

✅ Why This Matters for the Bigger Picture

When the second‑largest gold producer builds its own benchmark, and its largest trade partner is stockpiling metal directly under those terms, you’re watching the quiet formation of a parallel monetary network—one where gold and silver flow outside the LBMA’s shadow.

And the timing?

– LBMA inventories are thinning

– SLV borrow rates spiked have jumped from .68% on July 10th with 4.1M shares available to ~2.63% with only 1.5M shares available.

– COMEX silver registered remains <25% of open interest, meaning one in four claims standing for delivery would drain inventories.

That’s not just supply and demand.

That’s two systems diverging:

🧭 The West’s synthetic benchmarks vs.

🌏 The East’s sovereign price setting and real metal accumulation.

✨ The Takeaway

When you see charts like this alongside Russia’s exchange launch, you’re watching the old monetary plumbing being rewritten in real time.

Gold and silver aren’t just commodities—they’re re‑emerging as tools of sovereignty and settlement.

Signal | Latest Level | What It Means | Zone |

|---|---|---|---|

10‑Year Swap Spread | –27.7 bps | Still deeply negative → market still preferring synthetic exposure (derivatives) over cash Treasuries → ongoing collateral distrust. | 🔴 Red |

Reverse Repos (RRP) | $213.666 B | Liquidity buffer slightly improved from prior lows, but still far below historic norms; watch for any sustained move back toward $100 B. | 🟠 Orange |

USD/JPY | 147.51 | Yen still under pressure as BoJ prioritizes defending bonds → carry trade remains stretched. | 🟠 Orange |

USD/CHF | 0.7973 | Back under 0.80, CHF bid despite low yields → ongoing rotation into alternate safe havens. | 🔴 Red |

3‑Year SOFR‑OIS Spread | 27.1 bps | Elevated → forward funding stress remains baked in. | 🟠 Orange |

SOFR Overnight Rate | 4.30 % | Headline stable, but underlying repo dynamics show strain in collateral circulation. | 🟢 Green |

SLV Borrow Rate (CTB) | 2.63 % (with 1.5 M shares available) | 🔥 Borrow squeeze persists, though slightly eased with more shares than last week. Shorts remain under heavy pressure. | 🔴 Red |

COMEX Silver Registered | ~195.9 M oz | Registered ounces still far below open interest → <25 % standing for delivery would drain inventory. | 🔴 Red |

COMEX Silver Open Interest | 173,600 contracts | ≈ 868 M paper oz vs ≈ 195.9 M registered → thin physical cover remains. | 🔴 Red |

COMEX Silver Total Volume | 54,553 | Elevated churn in a market with tight borrow. | 🟠 Orange |

GLD Borrow Rate | 0.54 % (with 3.2 M shares available) | Slightly higher than prior, but still calm relative to silver; gold lending remains stable. | 🟢 Green |

COMEX Gold Registered | ~20.24 M oz | Registered gold steady despite rising OI → slow underlying tightening. | 🟡 Yellow |

COMEX Gold Open Interest | 477,796 contracts | ≈ 47.8 M paper oz vs ≈ 20.24 M registered → ~42 % standing for delivery would drain registered reserves. | 🟡 Yellow |

COMEX Gold Total Volume | 243,554 | Very elevated turnover alongside rising open interest → heightened activity. | 🟡 Yellow |

10Y UST–JGB Spread | 2.882 % | Spread still wide → U.S./Japan yield correlation highlighting systemic stress. | 🟠 Orange |

Japan 30‑Year Yield | 3.085 % | Near record highs → BoJ forced to defend bonds, increasing fragility. | 🔴 Red |

U.S. 30‑Year Yield | 4.964 % | Rising in tandem with JGBs → bedrock collateral wobbling. | 🟠 Orange |

SOFRVOL (Repo Usage) | $2.775 T | Overnight funding usage climbing → system leaning ever harder on short‑term liquidity. | 🟠 Orange |

🇷🇺 Russia’s Silver Signal — and the BRICS Ripple Effect

Credit to Tim Treadgold, Forbes, July 15, 2025 — “Silver Might Be Benefiting From Russian Central Bank Buying.”

Sometimes the most important market moves are hiding in plain sight.

According to Forbes, Russia’s central bank — already one of the most aggressive sovereign gold buyers in the world — may now be quietly accumulating silver as well.

Late last year, Russian officials publicly confirmed plans to add silver to state reserves, a step that very few modern central banks have taken.

Russia is not just another player.

It is one of the two strongest power centers in the emerging BRICS alliance — alongside China — an alliance openly exploring alternatives to the Western‑dominated financial architecture.

🔎 Read between the lines

Russia’s move is not happening in a vacuum.

It’s part of a broader shift we’ve been tracking:

✅ By adding silver to state reserves, Russia signals that silver is not merely an industrial input — it’s regaining recognition as a monetary metal, a strategic asset in a gradually emerging, new multipolar order.

✅ BRICS members are watching.

When the #2 economy in that alliance (and the world’s #2 gold producer) formalizes silver as part of its sovereign reserves, it is highly likely others will follow suit in the short to mid term.

Think of nations like Brazil or India looking to diversify reserves and insulate from Western sanctions; silver is liquid, globally recognized, and historically proven.

✅ Timing is everything.

Russia’s accumulation coincides with silver’s explosive move this year despite near‑record short positions on COMEX (and record at one point).

How do you get a price surge when paper shorts are so heavy?

👉 Because a sovereign bid underneath the market can overwhelm paper games.

👉 Because supply is genuinely tightening — as seen in SLV borrow stress and sub‑25% COMEX registered cover.

⚡ A quiet driver of silver’s rally

Forbes frames it as “silver might be benefiting,” but the on‑chain of central banks is rarely direct.

They accumulate discreetly, through intermediaries and off‑market agreements — but the impact leaks through:

Less metal available to shorts.

A tightening physical market.

A psychological shift: silver is being treated as monetary again.

Combine that with Russia’s broader agenda — launching its own gold benchmark, building alternative clearing houses — and you can see how silver fits into a parallel settlement system gradually taking shape within the BRICS sphere of influence.

💡 Translation

Russia’s signal isn’t just about a few million ounces.

Officially announcing plans to add silver to its state reserves — that is literally expanding its definition of strategic monetary holdings beyond gold and foreign currency.

It’s about one of the two most powerful BRICS member redefining what counts as sovereign money — and setting the tone for a bloc that represents over 40% of the world’s population.

👉 Silver’s surge this year might not just be a squeeze… it might be the first ripple of a monetary revaluation from East to West.

🌐 And here’s why that matters even more right now

The momentum behind moves like Russia adding silver to its reserves and BRICS building alternative settlement rails doesn’t happen in a vacuum.

It accelerates when the existing foundation of the Western system begins to wobble.

The more fragile U.S. Treasuries and Japanese Government Bonds become—the very collateral layer that underpins global leverage—the more urgent it becomes for rising powers to anchor themselves to something outside that system.

Which brings us to the other side of the story…

🇯🇵 Japan’s Bond Market Isn’t Just “Volatile.”

It’s the Second Pillar of the Global Collateral System… and It’s Cracking in Tandem with the First.

When the Kobeissi Letter points out:

JGB volatility just hit a record 4.02%, 30‑yr yields have climbed ~75 bps to 3.08%, 10‑yr near 1.60%, and downgrade whispers grow louder…

…it’s not just a local story.

It’s a clear warning light flashing from the core layer of collateral that the entire global funding system is built on.

🔎 Read between the lines

As we’ve been hammering home in these reports:

✅ United States (USTs): world’s largest sovereign bond market.

✅ Japan (JGBs): the world’s second‑largest sovereign bond market.

✅ Together: they are the load‑bearing beams of global liquidity—supporting repos, swaps, and the entire overnight funding machine.

When JGB yields surge while U.S. 30‑year yields hover near 5%, you’re not just watching two bond markets trade — you’re watching the anchors of global leverage strain against their moorings.

🧩 The structural linkage

10 Year Swap spread deeply negative for months (‑27 to ‑30 bps) → market preferring synthetic hedges over “pristine” Treasuries.

3‑Year SOFR‑OIS in the mid‑20s bps → funding markets still pricing in structural stress.

Reverse repo balances stuck near $200 B → liquidity buffers eroding.

These have been flashing for months — before this JGB volatility spike.

⚡ Why Japan matters so much

Japan isn’t just another creditor. It is the largest foreign holder of U.S. Treasuries.

The more the BOJ has to defend their bond market, the less it can defend it’s currency…

…which supercharges the yen carry trade — cheap yen borrowed to fund risk everywhere.

But every strand of that leverage web ultimately winds its way back into Treasuries, swaps, and the core collateral markets that hold it all together.

The higher JGB yields go, the more aggressively the BoJ must intervene, and the more fragile both pillars become.

Two anchors rising in yield together = collateral repricing = systemic tremor.

🥈 And why metals are whispering louder

As that foundation wobbles:

Broker‑dealer banks have quietly hoarded $1.17 T in “pristine” collateral.

SLV borrow rates have screamed from 0.68% (4.1 M shares) on July 10th to ~2.63% (~1.5 M shares) as of 2:20:23 AM EDT July 22nd.

COMEX silver registered still stands at only ~195.9 M oz vs ~860 M oz in paper claims.

Silver’s rally through this stress isn’t random.

It’s the pressure valve hissing before the rest of the system hears it.

💡 Translation:

The JGB spike is not isolated — it’s a live example of the cracks we’ve been tracking between JGBs and U.S. Treasuries.

When the base layer fractures, the scramble for real collateral begins.

👉 That’s why silver is waking up from its slumber.

👉 That’s why gold is quietly resetting the sovereign balance sheet.

🛠️ Where Insight Meets Action — Your Access to Gold & Silver

All of this isn’t just fascinating market theory.

It’s the kind of structural shift that quietly rewards those positioned before everyone else sees it.

We’ve just covered how:

✅ Russia is rewriting the rules by adding silver to reserves and launching its own gold benchmark.

✅ China is stockpiling Russian gold and silver outside Western pricing channels.

✅ BRICS is openly laying rails for a parallel settlement system.

✅ And stress is showing in the Western collateral base—USTs and JGBs—right as physical metal markets tighten.

💡 Translation

We’re not talking about headlines.

We’re talking about positioning in assets that sit outside the fragile layers of synthetic collateral—hard assets that can’t be printed, rehypothecated endlessly, or frozen at a clearinghouse.

That’s where our referral access comes in.

🥇🥈 Gold & Silver Referral Access — Built for This Moment

Through my partnerships with major bullion dealers, you can:

✔️ Acquire allocated physical gold and silver at competitive spreads.

✔️ Choose fully insured delivery straight to your door, or opt for secure storage in world‑class vaults with metals audited daily for your peace of mind.

✔️ Diversify into a layer of wealth that sits beyond the reach of systemic shocks—tangible, verifiable, and under your control.

📩 Let’s Talk

If you’ve been watching these reports and thinking, “But what do I do about this?”—reach out.

I’ll walk you through current opportunities, dealer connections, and the structures that fit your goals.

👉 Reply to this report or message me directly to start the conversation.

Your timing could not be better.

The system is changing.

Gold and silver are reawakening.

And you don’t have to just watch it happen.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply