- The Sovereign Signal

- Posts

- China Silver Inventory Continues Depleting at an Alarming Pace (5.2% Out In One Day) While Shanghai Silver Premium ~13.5% Above Western Silver Prices, COMEX Silver Inventories Down 22% From Their Peak

China Silver Inventory Continues Depleting at an Alarming Pace (5.2% Out In One Day) While Shanghai Silver Premium ~13.5% Above Western Silver Prices, COMEX Silver Inventories Down 22% From Their Peak

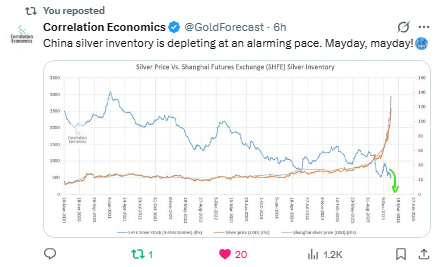

China Silver Inventory Depleting at an Alarming Pace

This is demand signaling real physical scarcity, not paper speculation.

The global debt super-cycle has masked fundamental shortages for years — but as trust in financial collateral erodes, physical supply constraints become the true price driver.

China’s depletion is actual metal leaving vaults, meaning storage + availability are tightening — a direct crack in the supply layer beneath the financial system.

Silver Vanishing — 5.2% Out in One Day in China

Rapid diminution of available metal is physical demand dominating price discovery — exactly what happens when the financial system’s paper claims are losing their anchoring power.

When metal disappears from inventory, paper contracts can no longer be honored easily — and pricing must migrate toward where real settlement happens.

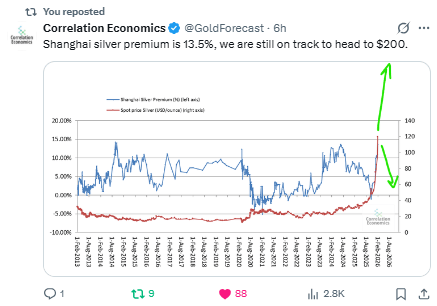

Shanghai Silver Premium ~13.5% and Silver On Track to $200

This is a decentralized price signal.

Eastern markets (China) clearly value silver at a higher real physical price than Western benchmarks like LBMA or COMEX.

A persistent premium means Western paper markets are disconnected — not because they are right, but because they are detached from physical reality.

This is collateral repricing, not cyclical speculation.

Not VAT tax — real premium.

This highlights a core structural weakness:

Western markets still try to dismiss physical pricing discrepancies as “arbitrary” or “technical.”

That’s exactly how suspended dysfunction shows up — denial of real fundamentals.

But the market can only ride on narratives for so long.

Eventually real shortages and real delivery signals are what matter — and Shanghai is the market more driven by physical demand.

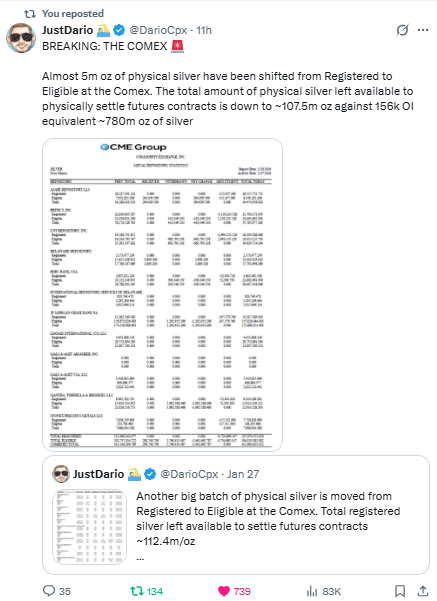

COMEX — Registered to Eligible Movements

This is a classic red flag in the paper market.

Registered inventories are what are actually deliverable against futures contracts at any point in time.

When registered stock is drained, it means:

Sellers are refusing to leave metal in deliverable form.

Physical metal is being hoarded or moved away from settlement pools.

Futures are increasingly unbacked by actual silver.

That is the paper market unravelling — a foundational crack in the base layer of global finance.

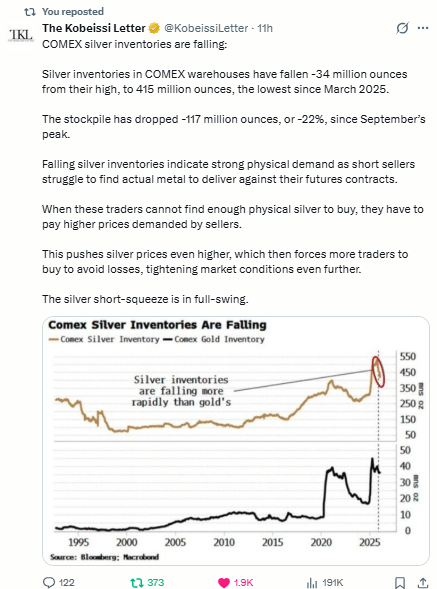

COMEX Silver Inventories Falling Dramatically

This is not a coincidence.

It is systemic feedback — strong physical demand is draining inventories faster than speculation can fill them.

This means:

Backwardation becomes possible.

Arbitrage breaks.

Physical price signals overpower financial signals.

Repricing accelerates.

This is exactly how a collateral swap begins: when physical assets become more credible than sovereign debt claims.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply