- The Sovereign Signal

- Posts

- China Silver Vault Drains 2.8% in a Day, Shanghai SGE Silver Stock Drops to 494 Tons, Shanghai Silver Price Trades at 16.71% Premium Above Western Silver Price, COMEX Silver Vault: 104m Oz Registered vs 740m Oz Open Futures Positions, Gold Positioning Indicates Not Near Bull Market Top, U.S. Declares Metals ‘Strategic’ + $12B Stockpile

China Silver Vault Drains 2.8% in a Day, Shanghai SGE Silver Stock Drops to 494 Tons, Shanghai Silver Price Trades at 16.71% Premium Above Western Silver Price, COMEX Silver Vault: 104m Oz Registered vs 740m Oz Open Futures Positions, Gold Positioning Indicates Not Near Bull Market Top, U.S. Declares Metals ‘Strategic’ + $12B Stockpile

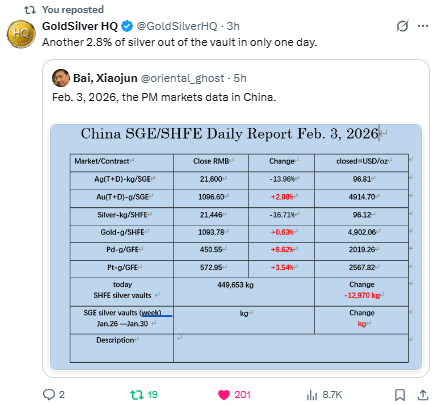

China Vault Drain – 2.8% in a Day

Physical silver continues to be ripped from the Shanghai vaults.

This isn’t just trading noise — it’s the collateral layer beneath the financial system being removed.

The East is stacking atoms while the West suppresses pixels. A slow run on real metal has begun.

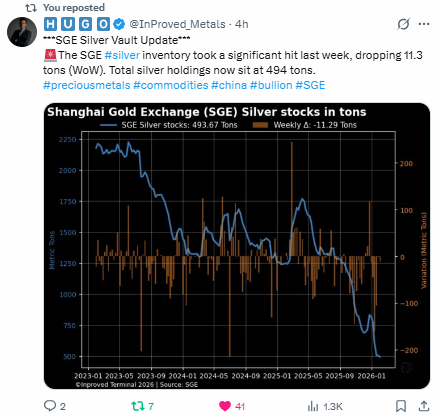

Shanghai SGE Silver Stock Drops to 494 Tons

Chinese silver continues to plumb new lows.

In a debt-saturated system, the flight to real collateral isn’t theoretical — it’s visible.

When trust in fiat evaporates, tonnage matters more than tonality. China is shifting its foundation.

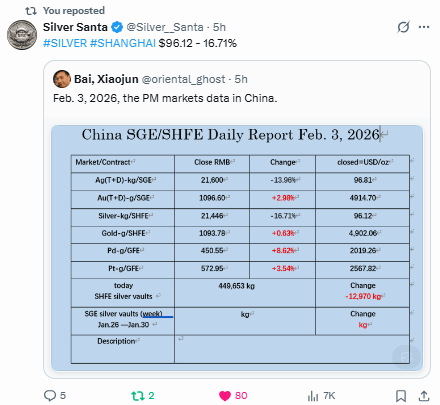

Shanghai Silver Price $96.12 | -16.71%

The paper price dropped, but physical flows continue to scream scarcity.

In a highly leveraged market, price action can mislead — but vault withdrawals do not.

The dislocation between synthetic pricing and physical reality remains blown out.

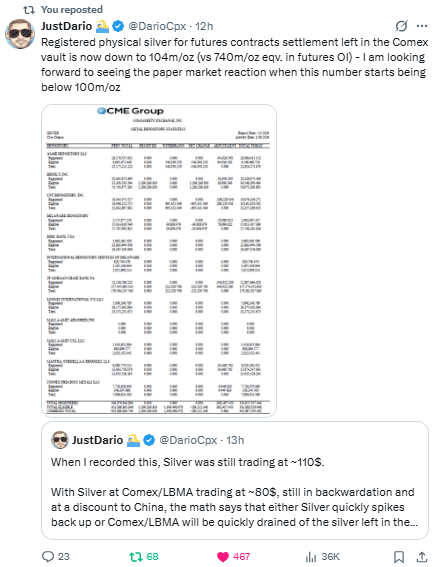

COMEX Vault: 104m Oz Registered vs 740m Oz Futures

The leverage ratio is 7:1 on COMEX.

That’s the primary Western exchange for physical metal with the most transparency.

That leverage ratio doesn’t take into account the far more extreme leverage in LBMA, SLV, or other silver funds.

Bottom line, this is a game of musical chairs - there is nowhere near enough silver to go around.

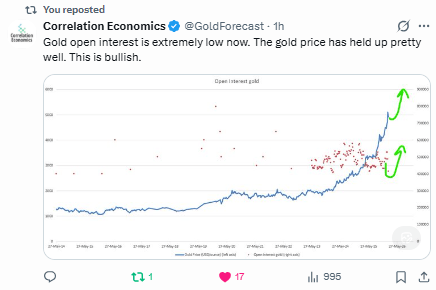

Gold Open Interest Is Low, Price Holding Up

A quiet shift.

Open interest draining while price resists drawdown suggests tightening in supply — or accumulation in stealth.

Low open interest IS NOT something we see at the top of a bull market.

Another signal that markets are continuing to reprioritize scarcity over sentiment.

U.S. Declares Metals ‘Strategic’ + $12B Stockpile

This is the sovereign admission that commodities are no longer just inputs — they’re now leverage in a geopolitical resource war.

The base layer is moving from debt instruments to tangible assets. This is the start of a collateral swap.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply