- The Sovereign Signal

- Posts

- China Suspends 6 Groups of Accounts Amidst Abnormally Large Silver Liquidations, Silver Lease Rates Back Above 6% in London, Over 1 Billion Ounces of Silver Traded Daily In Last 7/9 Days, SHFE Vault Bleeds 15% In One Day

China Suspends 6 Groups of Accounts Amidst Abnormally Large Silver Liquidations, Silver Lease Rates Back Above 6% in London, Over 1 Billion Ounces of Silver Traded Daily In Last 7/9 Days, SHFE Vault Bleeds 15% In One Day

Silver's fundamentals are screaming "HIGHER NOW." We'll see how long it takes for price action to follow.

In a normal, functioning market:

If commodities are being liquidated hard, it’s usually deflationary → yields drop, bonds rise, Fed cuts more likely → equities rally (especially growth/tech).

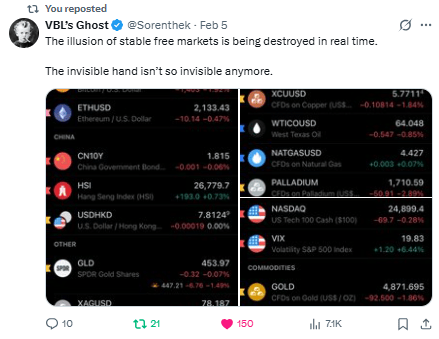

But what we’ve been seeing instead is:

Commodities tanking

Precious metals nuked

Bonds flat or dysfunctional

Equities not rallying

VIX up

That’s not rotation — that’s disorder.

It points to forced liquidations, collateral stress, or margin calls — a “sell everything that’s liquid” scenario.

We would generally expect equities to hold up in a standard commodity dump.

The fact that they’re not (or only holding weakly while volatility rises) suggests something deeper is snapping beneath the surface — not economic slowdown, but structural dysfunction.

And when precious metals and real collateral assets are getting smoked while inventories collapse, it’s likely not organic selling — it’s synthetic price action masking underlying stress.

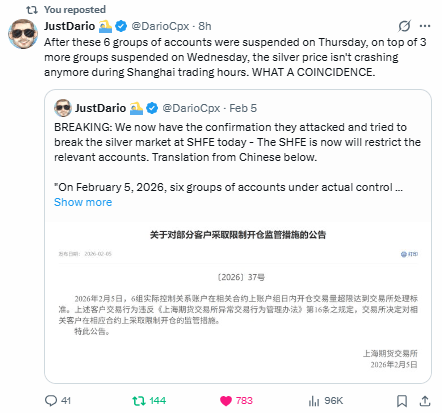

SHFE Account Suspensions

This is China actively intervening to stop the synthetic collapse of silver via paper leverage.

Six groups of accounts suspended — and like clockwork, the silver price stops crashing during Shanghai hours.

This is not organic market action; it’s coordinated damage control.

It shows that when physical demand asserts itself (China being the key physical buyer), paper price suppression gets exposed.

Collateral distress is being masked through force.

Silver Lease Rates Spike to 6.1%

This is a screaming signal of physical tightness.

Lease rates rising like this means real metal is scarce.

Institutions wouldn’t pay this premium unless they needed actual silver.

It's the exact opposite of what you'd expect during a crash if supply were loose — again, pointing to paper liquidation in the face of hard collateral stress.

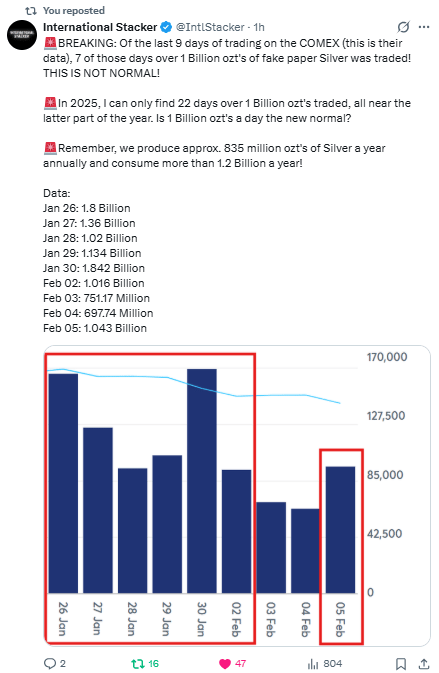

Over 1 Billion oz of Paper Silver Traded 7 of 9 Days

This is sheer derivative distortion — insane leverage on a collapsing physical base.

You don’t trade 1.8 billion oz of paper silver in a day when global annual production is ~835 million oz unless something is deeply wrong.

This is a sign of synthetic volumes masking lack of physical deliverability, driven by collateral stress and forced rebalancing.

It’s not demand-based pricing.

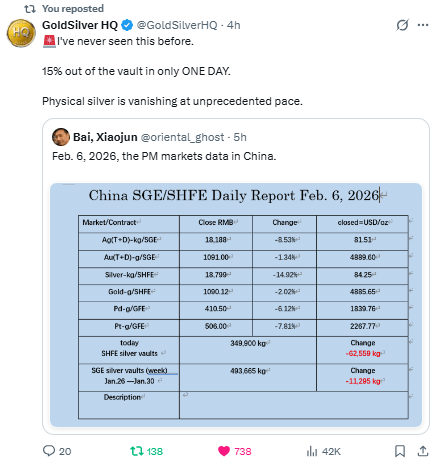

SHFE Vault Loses 15% in One Day

Confirmed run on real metal.

On February 6, 11,285 kg (~362,800 oz) of silver physically left SHFE.

That’s not theory — that’s actual exit of collateral.

This means smart capital is front-running the breakdown and moving to secure metal before trust evaporates.

It's the canary in the coal mine for COMEX.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply