- The Sovereign Signal

- Posts

- CME & LME “Technical Issues” During Price Surges, Surging SLV Borrow Costs, Shanghai Silver Premium at 15%, SHFE Silver Inventories Are Plunging, SLV Market Cap Doubled Over 100 Days

CME & LME “Technical Issues” During Price Surges, Surging SLV Borrow Costs, Shanghai Silver Premium at 15%, SHFE Silver Inventories Are Plunging, SLV Market Cap Doubled Over 100 Days

We said there would be pain and parabolas ahead. Nothing has fundamentally changed. Expect more big moves in both directions. The world's largest consumer of silver (China) is almost out of physical. What do you think will happen then?

CME & LME “Technical Issues” During Price Surges

When foundational resources (metals) signal regime stress via price, the market’s plumbing conveniently malfunctions.

These “glitches” don’t suppress volatility — they suppress signals of structural breakdown.

The REAL base layer (commodities) is waking up.

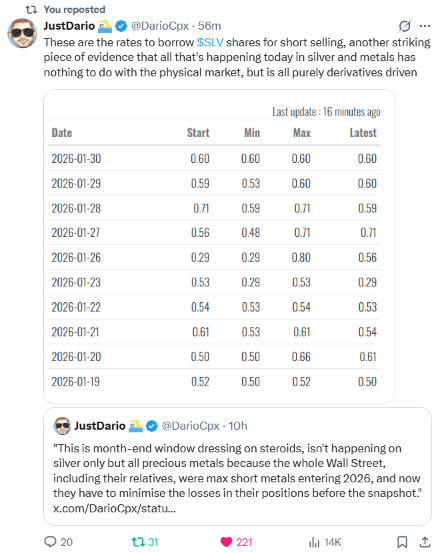

$SLV Borrow Costs Are Re-Surging

Surging short borrow rates expose desperation in the paper market.

This isn’t natural price discovery — it’s defensive suppression to manage optics before the end-of-month snapshot.

Spot silver opened January at $72.42…

The synthetic stack of leverage is fraying.

The world needs much more of the most electrically conductive metal on the planet.

Supply is inelastic and will take years to recover/catch up. Nothing has fundamentally changed.

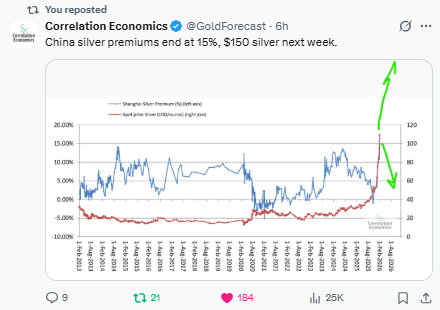

When the East (more physical demand in their market) is willing to pay a double-digit premium for physical silver, it’s not a “technical indicator” — it screams “Hey, this is the real price.”

Physical metal is being repriced — not in futures, but at the margins where trust still matters.

This is a collateral revaluation in motion.

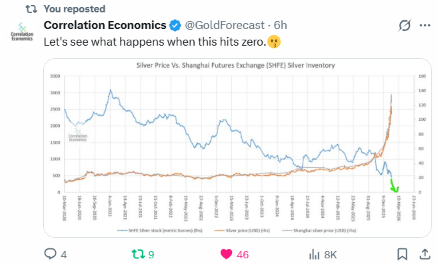

SHFE Inventories Plunging

Chinese inventories approaching zero is not a supply glitch — it’s the physical world rejecting a distorted paper pricing system.

This is base-layer stress. Silver is finally money again when fiat finally starts breaking.

Big players are rushing to secure physical silver before price goes parabolic.

Watching inventories drain is watching belief drain from fiat collateral.

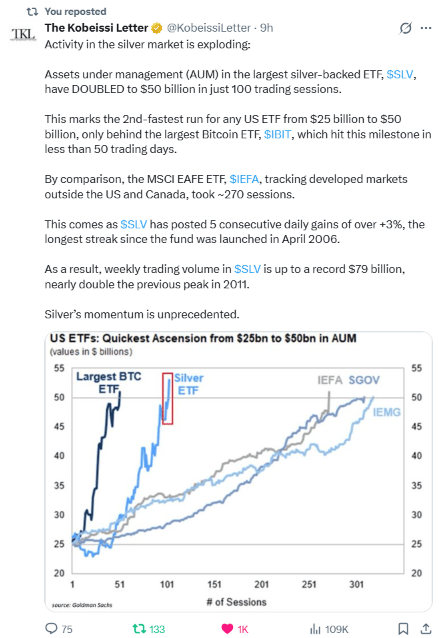

$SLV AUM Explodes

$25B → $50B in 100 days signals more than momentum — it’s a stampede.

Institutions are rotating into hard collateral beneath the surface.

Financial capital is trying to quietly shift before the next wave hits.

It’s not a gold rush. It’s a collateral migration.

Silver Retests $100, Then Recovers

A manipulated flush, quickly reversed, signals paper failure and real demand waiting just beneath the surface.

Price didn’t collapse — the synthetic layer cracked.

Even engineered drawdowns can’t suppress the direction of travel: from infinite paper to finite metal.

That $100 retest wasn’t fear — it was validation.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply