- The Sovereign Signal

- Posts

- Collateral Coup: 4.6T¥ Liquidity Ask, $33B Fed Repos, and a Week of Global Silver Vanishes East

Collateral Coup: 4.6T¥ Liquidity Ask, $33B Fed Repos, and a Week of Global Silver Vanishes East

BOJ’s seven ops couldn’t meet demand (4.6T¥ vs 1.75T¥), the Fed’s window has soaked up $33B since June, central banks hold the most gold this century, and Shanghai just vacuumed nearly a week of mined silver—while put/call sits at 2020 lows and retail leverage is record-high. Translation: leverage is maxed, price discovery is migrating to hard collateral, and gold-linked debt is moving from idea to blueprint.

If the Shanghai Gold Exchange—the East’s biggest metals venue—moves nearly a full week of global silver mine output in one week, that’s not “trading.”

That’s bars leaving the system.

What it really means (plain English):

Float is shrinking.

Metal withdrawn to meet real demand (factories + savers) doesn’t cushion futures sell-offs.

Less available silver ⇒ bigger price moves on smaller buys.

Price power is migrating East.

When Shanghai soaks up supply, London/COMEX inventories matter less and Asia’s premium starts steering global pricing.

Leverage vs. atoms.

Paper shorts can paint the tape for a day; they can’t mint bars.

Each outbound bar tightens the noose on leveraged structures.

Why now: industrial pull (solar/EV), collateral hunger (India making silver bank-eligible), and currency/funding stress are funneling savings into hard collateral.

Net: One venue vacuuming an entire week of mined silver is a structural tell—the world’s second power center for metals is claiming the base layer.

In a system built on LEVERAGE, the side with the atoms writes the rules.

What this really signals:

A senior policy voice is floating a gold-linked U.S. Treasury—a bond whose payoff is tied to the best collateral on earth.

Translation: re-attach part of the debt market to hard collateral so trust doesn’t have to ride purely on promises.

Why now:

Plumbing strain: recurring Fed repo taps, negative swap-spreads, and razor-thin cash buffers say the dollar system is running hot on LEVERAGE and short on pristine collateral.

Credibility gap: $38T debt and rising term premia demand a new trust anchor. A gold-link imports credibility from atoms into paper.

Global signaling: central banks hoarding gold, Asia paying premiums, Shanghai locking bars—price discovery is migrating to where metal lives. Meeting the world halfway with a gold-linked instrument levels the field without a full standard.

Why it’s powerful (and simple):

Collateral upgrade: Treasuries regain a “hard” backstop; funding haircuts compress.

Broader buyer base: savers who want hard money and institutions needing duration can meet in one security.

Stability through cycles: when fiat wobbles, the gold link absorbs stress instead of amplifying it.

Bottom line: this is a bridge product—fiat flexibility with a hard-asset keel. In a max-leverage era, linking debt to the strongest collateral isn’t nostalgia; it’s balance-sheet engineering for a world that needs trust to be measurable again.

Wake up: the conversation has moved from rumor to blueprint.

When the best-funded, best-informed players on earth—central banks—are quietly stacking the most gold this century, they’re not chasing a fad. They’re rebuilding base-layer collateral.

Why now (simple):

Debt & currency strain: High deficits and sticky inflation make paper reserves less reliable. Gold doesn’t depend on anyone’s promise.

Geopolitics: Sanctions risk and a shifting world order push nations to hold value outside another country’s control.

Plumbing stress: Funding wobbles and collateral shortages reward assets that settle on contact—atoms over IOUs.

What it signals:

A rising floor under gold as official demand soaks float.

Price discovery migrating to hard collateral, not narratives.

In a world running on LEVERAGE, the side with the base metal sets the rules.

Bottom line: The smartest balance sheets are upgrading to gold before they have to.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | −14.3 bps | Still negative → swaps > cash Treasuries; funding/credit tension persists (slight easing). | 🟠 Orange |

3-Year SOFR–OIS | 27.53 bps | Elevated; mid-term funding stress remains. | 🔴 Red |

UST–JGB 10-Year | 2.345% | Wide trans-Pacific gap fuels basis/carry distortions. | 🟠 Orange |

Reverse Repos (RRP) | $10.642B | “Safety valve” still near empty despite uptick → very little spare cash buffer. | 🔴 Red |

USD/JPY | 151.87 | Carry trade still supercharging; unwind risk building. | 🔴 Red |

USD/CHF | 0.7937 | Bid for “hardest fiat” persists; safety flows in play. | 🔴 Red |

SOFR Overnight | 4.24% | High carry / tighter overnight funding. | 🟠 Orange |

SLV Borrow (fee / avail / rebate) | 2.26% / 60K / 1.85% | Availability collapsed → borrow tight; squeeze risk higher even with moderate fee. | 🔴 Red |

COMEX Silver Registered | 167.14M oz | Thin deliverable float keeps premia sticky. | 🔴 Red |

COMEX Silver Volume | 106,765 | Activity picked up; tape more responsive. | 🟡 Yellow |

COMEX Silver Open Interest | 162,205 | Lighter positioning; room for expansion/squeezes. | 🟡 Yellow |

GLD Borrow (fee / avail / rebate) | 0.37% / 5.6M / 3.74% | Ample shares; shorting relatively cheap vs recent peaks. | 🟡 Yellow |

COMEX Gold Registered | 19.85M oz | Tight deliverable pool; supports firm basis. | 🟠 Orange |

COMEX Gold Volume | 355,604 | Healthy flow; volatility can gap on news. | 🟡 Yellow |

COMEX Gold Open Interest | 469,656 | Solid participation, slightly lower; susceptible to funding shocks. | 🟠 Orange |

Japan 30-Year JGB | 3.056% | Elevated long end stresses JGB convexity/carry. | 🔴 Red |

US 30-Year UST | 3.978% | Long-end eased, but financial conditions still tight. | 🟡 Yellow |

The Fed’s overnight repo window is getting tapped day after day.

Banks swap Treasuries for cash before the bell because they’re tight on dollars. If funding were easy, this line wouldn’t move.

Why now:

Higher-for-longer rates raised funding costs and marked down bond portfolios.

Deposit flight to money-market funds shrank cheap bank funding.

Thin liquidity across markets means small shocks force more balance-sheet usage.

Why you should care:

Daily repos = stress thermometer. More usage → less spare cash → faster, sharper moves when headlines hit.

Regional banks feel it first; they hold more long bonds and rely more on sticky deposits that aren’t so sticky.

LEVERAGE angle:

When cash is scarce, leveraged players must de-risk. That turns routine dips into air pockets as positions get cut to meet funding.

Positive read-through:

Tight funding pushes capital toward base-layer collateral that doesn’t depend on anyone’s promise—gold and monetary silver—and rewards unlevered balance sheets.

Wake-up summary:

Daily Fed repos are a flare: the system is running hot. Manage risk, trim leverage, and favor real collateral over promises.

Read the tape:

Put/Call at 2020-style lows = crowds chasing upside, little demand for protection.

Margin debt at record highs + retail leverage booming = a market riding borrowed speed.

Why now:

“Soft-landing” narratives and long habit of dip-buying make risk feel cheap.

Zero-day options and off-exchange plumbing create the illusion of constant depth.

What that combo usually breeds:

Crowded longs + high leverage + thin hedges = fragility. Small shocks can trigger outsized moves as margin mechanics bite and liquidity steps back.

Gap risk rises. Prices jump rather than glide; models built on calm data misread the real hazard.

Big-picture translation:

This is a confidence rally powered by leverage, not cushions. When positioning is one-sided and protection light, the path becomes narrow: great while momentum holds, abrupt when it doesn’t.

Wake-up line: everyone’s flying fast in fog—the story is smooth, the surface is calm, but the guardrails are close.

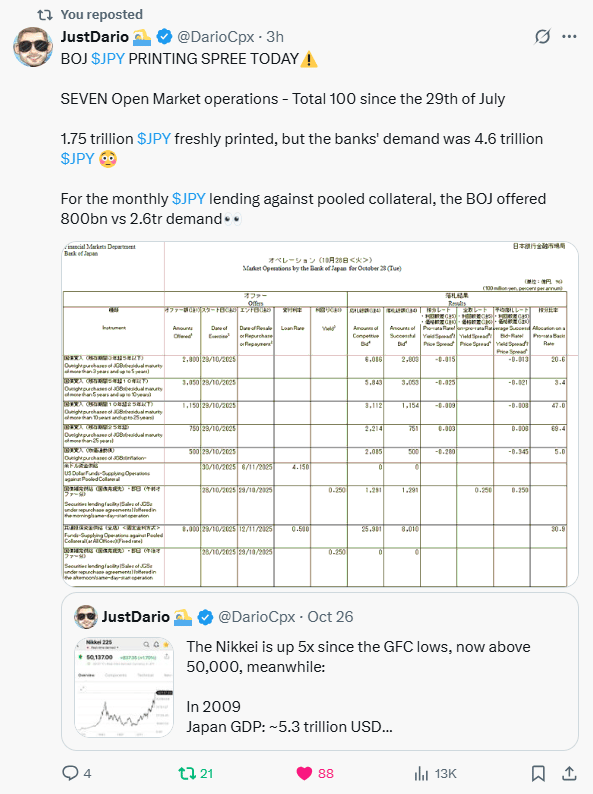

BOJ’s firehose is the tell.

Seven liquidity ops in a day, 1.75T ¥ injected—yet banks wanted 4.6T ¥.

Read that again: demand for cash dwarfs supply.

That’s a funding heartbeat, not a headline.

Why now:

Japan runs the world’s cheapest money.

With debt piled sky-high, the BOJ pins rates → the yen weakens → global funds borrow yen and LEVERAGE into everything (stocks, credit, commodities).

When stress rises, that machine needs more yen to roll. Today’s scramble says the engine is thirsty.

Why it matters to everyone:

Japan is the largest foreign holder of U.S. Treasuries and the #4 economy.

If the yen snaps or JGB yields twitch, Japanese players may sell hedges or Treasuries to plug holes → higher global rates, thinner liquidity.

A supercharged carry trade works—until it doesn’t.

Then flows reverse together, turning small shocks into big ones.

The holistic read:

This isn’t doom; it’s diagnosis. The most interconnected market ever is riding one funding source.

When the BOJ must spray liquidity daily and it’s still not enough, the message is simple: the world is over its skis on LEVERAGE.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply