- The Sovereign Signal

- Posts

- Commodities Are Being Revalued, Greenland Likely Soon To Be Acquired By The US, Copper Is Being Hoarded Prior To Scarcity, Silver's Eastern Price Divergence Amidst Critically Low Inventory Is A Huge Warning Sign

Commodities Are Being Revalued, Greenland Likely Soon To Be Acquired By The US, Copper Is Being Hoarded Prior To Scarcity, Silver's Eastern Price Divergence Amidst Critically Low Inventory Is A Huge Warning Sign

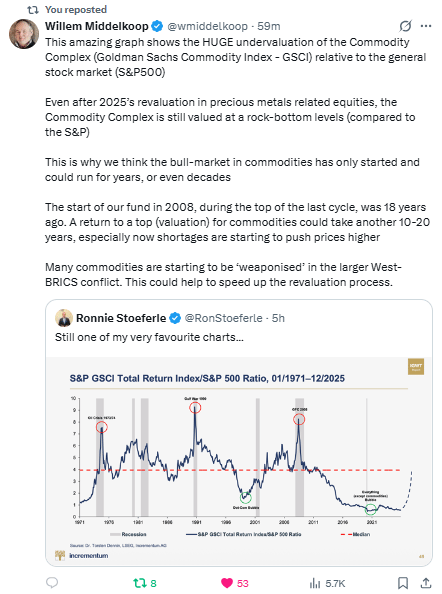

🌍 Commodities are being revalued — not just traded

The Willem Middelkoop and Ronnie Stoeferle posts show that commodities are historically undervalued relative to the S&P 500, and that a multi-decade bull cycle could just be starting.

That’s not about short-term price action — it’s about a structural rotation: the world’s wealth is slowly moving from financial assets (stocks, tech) back into tangible resources (energy, metals, agriculture).

This typically happens when:

Inflation and debt erode faith in fiat assets,

Nations begin hoarding “real” value (gold, silver, copper, oil), and

Geopolitical fractures push countries to secure their own supply chains.

🧭 Greenland — the resource frontier

The “U.S. & Denmark to create working group to discuss Greenland acquisition” headline ties into all of this.

Greenland holds massive untapped reserves of:

Rare earth elements,

Uranium,

Nickel, and

Possibly lithium and precious metals.

Bringing Greenland under greater Western influence would be a strategic move to secure resource sovereignty before supply chains tighten further.

It’s part of the new “resource cold war” — the West vs. BRICS+ competition over energy, metals, and strategic geography.

If the U.S. can cement control or deep cooperation with Greenland, it blocks both Russia and China from a key northern foothold and ensures Western dominance over Arctic access points and undersea cables.

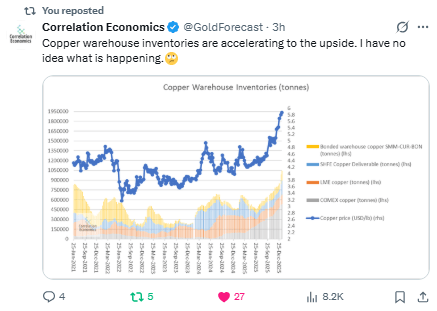

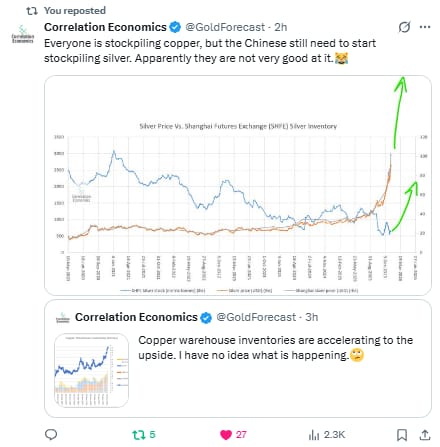

🧱 Copper is still abundant — but not indefinitely

Unlike silver, where above-ground inventories are already razor-thin, copper is still available to be hoarded.

That’s why you’re seeing inventories rise — it’s accumulation, not oversupply.

Participants who understand that global electrification, defense manufacturing, and green-energy build-outs will consume immense amounts of copper are getting ahead of the curve.

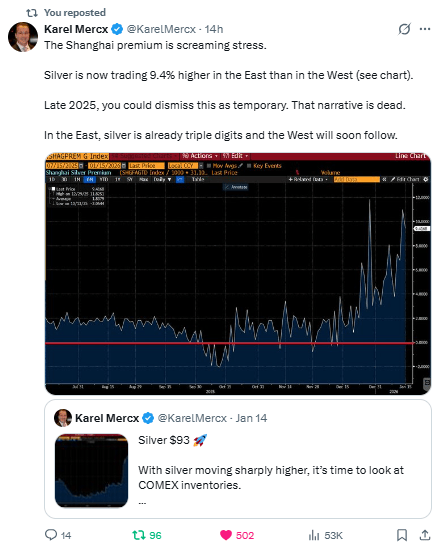

🪙 Silver’s divergence is a warning sign

The Shanghai silver premium and SLV withdrawals show something serious:

Physical silver in the East is commanding much higher prices than paper or ETF silver in the West.

This divergence usually means supply is drying up and paper markets are losing credibility — a classic prelude to a monetary repricing event.

Silver is unique — it’s both an industrial metal and once again, soon to be a monetary metal (like it was for essentially all of history prior to 1971).

When both demand sides (industry + investors) rise simultaneously, you often see explosive repricing.

It’s not that China or other industrial powers are ignoring silver — it’s that they simply can’t get enough, no matter how aggressively they try.

China’s silver market — the most physically driven in the world — is showing unmistakable signs of structural exhaustion.

Shanghai inventories have collapsed, and the spread between Chinese and Western prices has blown out, with sustained premiums far above U.S. and COMEX levels.

That’s not poor logistics or mismanagement — it’s proof that physical supply has broken away from paper pricing.

China has been draining every available source — domestic mines, imports, and recycled flow — and still can’t meet industrial and investment demand.

The blown-out spread isn’t a quirk; it’s the market screaming scarcity.

The world’s largest industrial consumer of silver is now competing at any price for metal that simply isn’t available — marking the shift from tightness to true structural shortage.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply