- The Sovereign Signal

- Posts

- Commodities as National Security, What's Coming In Silver Remains The Most Asymmetric Repricing in Markets, Gold To Silver Ratio Will Eventually Revert Towards Its Mean, Copper Is The Next Silver, Risk On Assets Are More Mispriced Than Ever

Commodities as National Security, What's Coming In Silver Remains The Most Asymmetric Repricing in Markets, Gold To Silver Ratio Will Eventually Revert Towards Its Mean, Copper Is The Next Silver, Risk On Assets Are More Mispriced Than Ever

Commodities as National Security

From lithium to rare earths, governments are waking up: you can’t have sovereignty, energy independence, or even a modern military without controlling your mineral inputs.

China dominates rare earths and is locking down silver.

The U.S. is scrambling to rebuild domestic supply chains, with officials now openly discussing stockpiling and 100s of billions in long-term investment.

The age of "just-in-time" is dead.

"Just-in-case" is the new global standard.

And when governments start hoarding, price discovery breaks.

This is what we're seeing in gold and silver now.

Most "available" metal is not for sale. It’s pre-positioned, pre-leased, or already earmarked for strategic reserves.

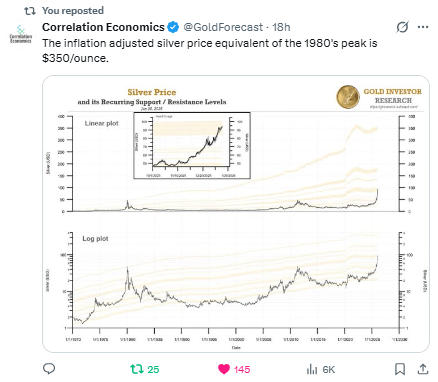

Silver: The Most Asymmetric Repricing in Markets

In 1980, silver spiked to $50 per ounce.

Adjusted for today’s monetary debasement and CPI distortion, that price is $350 per ounce in real terms.

That’s where price would be if silver had kept pace with inflation — let alone the hyper-financialized world we now live in, where debt has gone vertical and trust in fiat is evaporating.

The Golden Ratio Will Revert To Its Mean

The gold-silver ratio sits at 49:1.

But 19:1 is what you dig out of the ground.

And since the beginning of recorded history, it has hovered closer to 15:1.

Every tick higher in that ratio signals the magnitude of silver’s coming repricing.

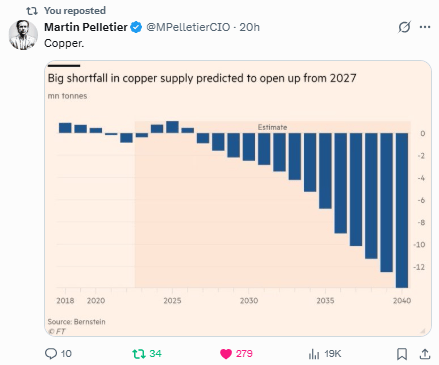

Record Structural Shortages Ahead

Copper is the next silver.

We consume 30 million tonnes a year, with demand only growing from electrification, AI infrastructure, and defense.

Less than 15% of that comes from recycling. The supply cliff begins in 2027 and only gets steeper.

We will need to mine more copper in the next 18 years than we’ve mined in the past 10,000 combined.

Markets Are Mispricing Everything

The illusion of control is breaking.

Political systems are diverging from economic realities.

Trump wants a weak dollar and low rates.

He may get neither — or just one.

But markets are priced as if the Fed can rescue everything without consequences.

That dislocation is the breeding ground for violent repricing.

Precious metals will be the greatest benefactor.

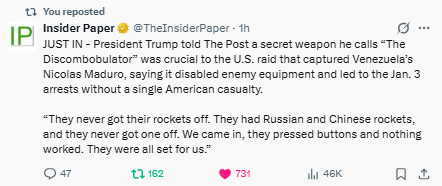

The Unknown Unknowns: A Modern Day, All Out Hot War

We have no real idea what an all out modern hot war would look like.

Not because we lack imagination, but because the world has advanced so radically since World War II that historical analogies break down.

WWII was fought with steel, oil, and manpower.

Today’s conflicts sit on top of layers of black-box technologies—AI-driven targeting systems, electronic warfare, hyper-sonics, space assets, quantum sensing, directed energy, cyber-physical sabotage, and weapons that may never be publicly disclosed until they are used.

The moment those systems surface, markets will scramble to understand what materials they require—after the fact.

…silver and copper are overwhelmingly the most likely metals to be required in larger quantities by whatever advanced (possibly classified) technologies emerge in a true hot war scenario…

…unlike rare earths or specialty metals that are used in trace amounts in specialized systems, silver and copper are volumetric.

They are needed not in grams, but in kilos and tonnes.

And they scale directly with technological expansion.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply