- The Sovereign Signal

- Posts

- COT Silver Report (Sept 17–23, 2025)

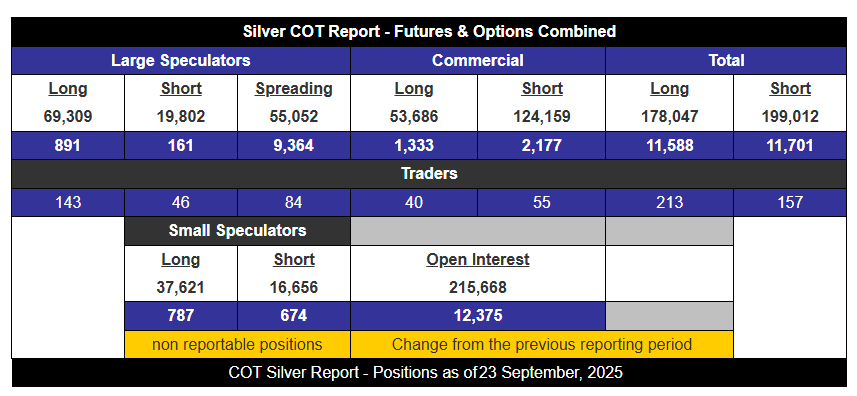

COT Silver Report (Sept 17–23, 2025)

📈 Price opened $42.875, closed $44.437, and as of this morning is already $47.11 — meaning this COT snapshot captured the front end of liftoff.

Futures Only (COMEX)

Who’s who:

Small Specs = retail/prop desks

Large Specs = hedge funds, CTAs, macro momentum funds

Commercials = bullion banks/swap dealers warehousing flow

Source for the above image is silverseek.com

Position Shifts (vs prior week):

Large Specs (funds):

Longs: 72,318 (+0.97%)

Shorts: 20,042 (–0.21%)

Spreads: 18,048 (+14.2%) 🔥 big jump in basis/calendar trades

Net Long = +52,276 (up +738, +1.4%)

Commercials (banks):

Longs: 42,281 (–1.9%)

Shorts: 115,036 (+0.46%)

Net Short = –72,755 (grew by –1,366, +1.9%)

Small Specs (retail):

Longs: 33,158 (+2.3%)

Shorts: 12,679 (+1.0%)

Net Long = +20,479 (up +628)

Open Interest: 165,805 (+1.75%)

👉 Read: Price up +$1.56 and OI up → new money entered.

Funds are dipping in net long, commercials leaned further short (warehousing demand), and spreads exploded higher → signaling serious positioning shifts beneath the surface.

🔹 Liquidity & Funding Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –17.17 bps | Still negative but less extreme → collateral scarcity persists, some easing at the margin. | 🟡 Yellow |

Reverse Repos (RRP) | $48.073B | Bouncing slightly off the floor → tiny uptick could be early warning of volatility rotation (watch VIX). | 🔴 Red |

USD/JPY | 148.63 | Backing off 150 → pressure still intense on yen carry trades. | 🟠 Orange |

USD/CHF | 0.7968 | Slipping further under 0.80 → safe-haven demand confirming systemic stress. | 🔴 Red |

3-Year SOFR–OIS Spread | 29.7 bps | Anxiety premium entrenched; credit plumbing remains stressed. | 🔴 Red |

SOFR Overnight Rate | 4.18% | Steady at policy → surface calm masking fragility. | 🟡 Yellow |

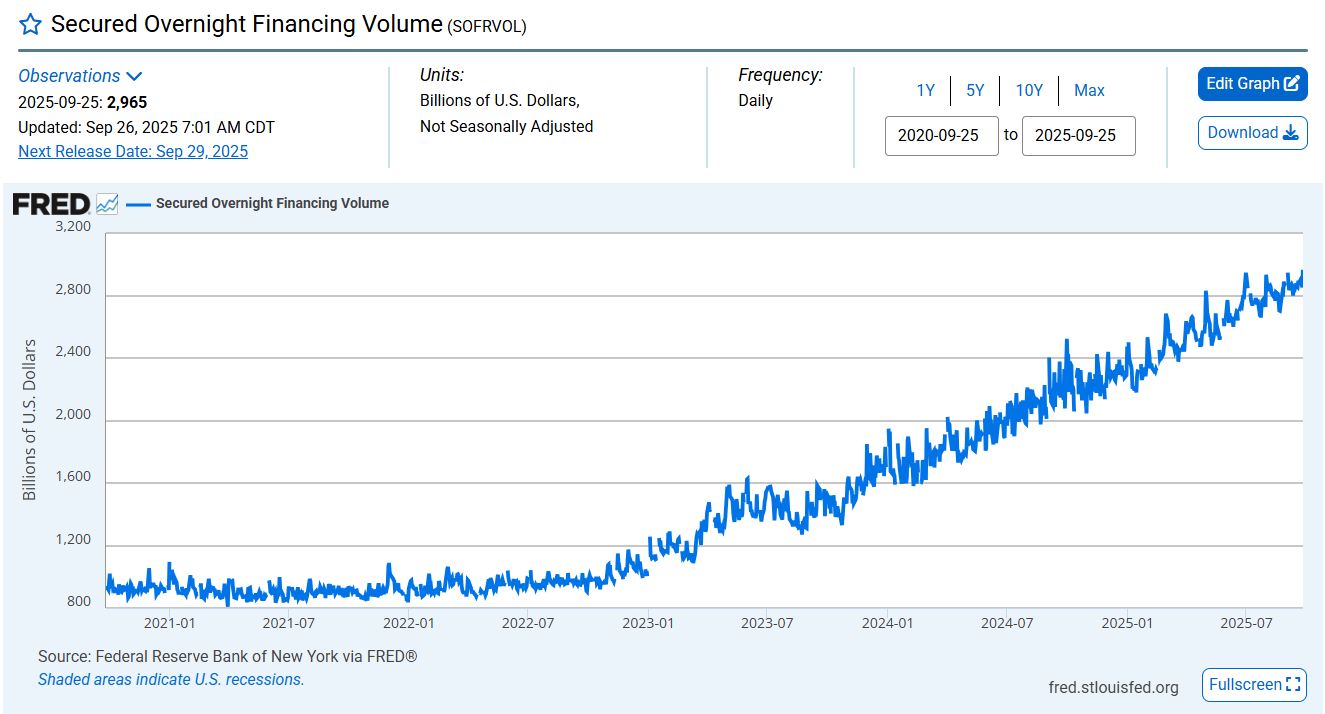

SOFR Vol | $2.965T (record) | 🚨 New record high → collateral churn exploding, another sign the plumbing is rattling. | 🔴 Red |

🔹 Silver & Gold Market Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

SLV Borrow Rate | 2.16% (600K shares avail.) | Borrow stress still elevated, supply razor-thin. | 🟠 Orange |

COMEX Silver Registered | 195.699M oz | Thin registered vs. leverage—delivery risk acute. | 🟠 Orange |

COMEX Silver Volume | 109,648 | Heavy turnover, especially coming right as we saw that massive Globex green candle → momentum accelerating. | 🔴 Red |

COMEX Silver Open Interest | 170,025 | Rising with price + volume → conviction inflows, not just short covering. | 🟠 Orange |

COMEX Gold Registered | 21.81M oz | Marginally higher, but still lean relative to open interest. | 🟡 Yellow |

COMEX Gold Volume | 245,529 | Strong flows confirming gold joining the silver surge. | 🟡 Yellow |

COMEX Gold Open Interest | 529,692 | Elevated; leverage still taut. | 🟠 Orange |

🔹 Global Yield Stress

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

UST–JGB 10Y Spread | 2.495% | Hedged return compression persists. | 🟠 Orange |

Japan 30Y Yield | 3.119% | Elevated; BoJ pinned in a corner defending stability. | 🔴 Red |

US 30Y Yield | 4.714% | Heavy long end → debt-service strain compounding. | 🟠 Orange |

Source for the above image is silverseek.com

Futures + Options Combined (the bigger picture)

Position Shifts (vs prior week):

Large Specs (funds):

Longs: 69,309 (+1.3%)

Shorts: 19,802 (+0.8%)

Spreads: 55,052 (+20.4%) 🚨

Net Long = +49,507 (down –7,468, –13%)

Commercials (banks):

Longs: 53,686 (+2.5%)

Shorts: 124,159 (+1.8%)

Net Short = –70,473 (up –844, +1.2%)

Small Specs (retail):

Longs: 37,621 (+2.1%)

Shorts: 16,656 (+4.2%)

Net Long = +20,965 (down –113)

Open Interest (combined): 215,668 (+6.1%)

👉 Read: The real story is in spreads: +9,364 (20% jump).

This is swap dealers and funds repositioning hard — volatility hedges, roll structures, and basis trades are surging. Meanwhile, commercials nudged short again, but not aggressively.

Connecting the Dots

Funds: Hedge funds & CTAs are cautiously pressing long, but the massive spread ramp shows they’re also preparing for volatility to explode.

Commercials (bullion banks): Added to shorts modestly → this is risk warehousing, not an “attack.” They’re matching client flow.

Retail/small specs: Staying long, trickling in more size.

Big Picture:

Open interest surged +12,375 contracts combined (+6.1%) while price ripped from $42.87 → $44.44.

That means this rally isn’t just shorts puking — it’s fresh capital flowing in.

And now? Price at $47.11 confirms those positions are already deep in profit, which pressures shorts even more.

💡 Translation: We’ve entered the classic setup where:

Funds are long + spreading volatility bets

Banks are warehousing risk but leaning short

Retail is chasing higher

Price is detonating upwards in real time

This is the anatomy of a market breaking free from its paper shackles. The shorts aren’t “managing” anymore — they’re being overrun.

SOFR vol (overnight funding volume) just ripped to another record high at $2.965T, which screams one thing: the system is leaning on more leverage than ever to keep liquidity flowing.

That fragility isn’t doom—it’s the setup for explosive asymmetry, because when the plumbing rattles this hard, gold and silver are the natural release valves.

Reverse repos finally bounced off the floor at quarter-end, hinting at rotation into volatility (watch the VIX), while SLV borrow stress at 2.16% with only 600K shares left shows sourcing physical silver remains a knife fight.

And what’s silver doing in the middle of all this? Absolutely ripping higher with conviction—volume, open interest, and price all surging in tandem, a signature of fresh inflows rather than just shorts covering.

Gold is being pulled into the slipstream too, with heavy volumes confirming it’s joining silver’s momentum. The lesson is simple: we can’t control systemic fragility, but we can position where that pressure has to escape. Right now, that escape valve is precious metals—and silver is leading the charge.

168 rate cuts in a single year isn’t stimulus — it’s desperation.

Every cut makes debt cheaper, which means more borrowing, more leverage, and an even bigger avalanche of obligations that can never be repaid in real terms.

That debt spiral forces central banks to print, expand money supply, and quietly dilute every dollar, euro, and yen in circulation. This is a global race to the bottom — currencies competing to devalue faster just to keep their economies afloat.

And when fiat melts down like this, there’s only one way capital can preserve itself: by flooding into real money. Gold and silver aren’t going higher because of hype — they must go higher, mechanically, as the denominator (currency) gets debased. This isn’t a trade — it’s the safety valve for the entire system.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply