- The Sovereign Signal

- Posts

- Countdown to Zero-Silver LBMA, Oct-2 Backwardation, and 70-of-70 Chinese Cities Down: Commodities at 0.08× as Yellen Warns of “Banana Republic” Risk

Countdown to Zero-Silver LBMA, Oct-2 Backwardation, and 70-of-70 Chinese Cities Down: Commodities at 0.08× as Yellen Warns of “Banana Republic” Risk

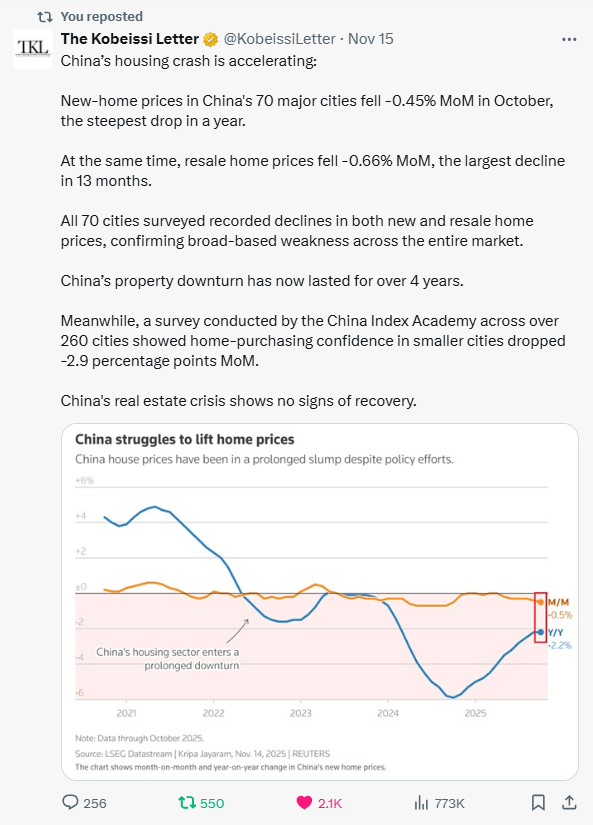

LBMA is practically living hand-to-mouth on COMEX with effectively zero free-float silver while the metal has sat in backwardation since Oct 2; at the same time China’s housing bust has dragged on for 4+ years with new-home prices −0.45% MoM, resales −0.66% MoM across all 70 major cities, global commodities change hands at just 0.08× emerging-market equities, and former U.S. Treasury Secretary Janet Yellen is openly warning the United States is “in danger of becoming a banana republic.”

Picture the global silver market as a warehouse that issues receipts for metal.

The problem?

They’ve issued far more receipts than metal actually sitting on the racks.

LBMA is operating that warehouse.

David Jensen’s points boil down to this:

LBMA contracts are mostly promises stacked on other promises (forwards built on spot).

LBMA has almost no spare physical inventory, even though they keep pulling metal from COMEX just to stay afloat.

Whatever physical they get is already spoken for the moment it arrives.

And large COMEX “naked short” positions mean even more claims waiting in line.

Now bring in China:

Shanghai just drained to a 10-year low — only 577 tons left, down 46 tons in one week.

That’s the world’s biggest industrial consumer aggressively emptying its shelves at the exact moment LBMA is running hand-to-mouth.

When both the West’s warehouse has no spare metal and the East’s warehouse is being drained, the timing stress becomes obvious:

More people will eventually show up holding receipts (contracts), expecting metal.

But the warehouse can’t hand out what it doesn’t have.

That’s the leverage:

Millions of ounces promised, only thousands available.

The deeper the inventories fall, the more violently the price must adjust to sort out who actually gets metal.

This is happening right now because years of cheap silver, artificial suppression, and industrial demand finally collided with tightening global supply.

When the receipts overwhelm the racks, the price won’t rise slowly —

it must reprice instantly to reflect real scarcity.

Think back to the warehouse image:

Too many receipts, not enough silver on the racks.

LBMA is living delivery-to-delivery, while Shanghai’s shelves just dropped to a 10-year low of 577 tons.

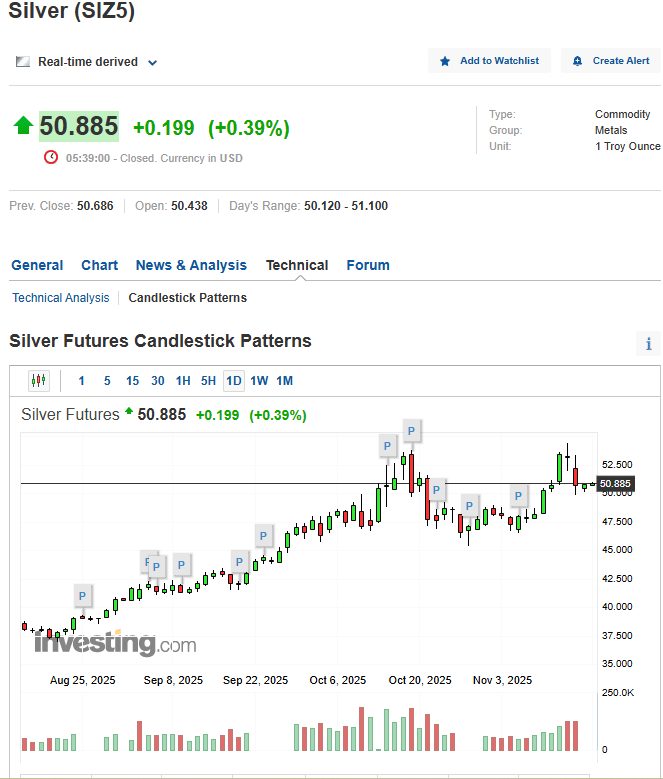

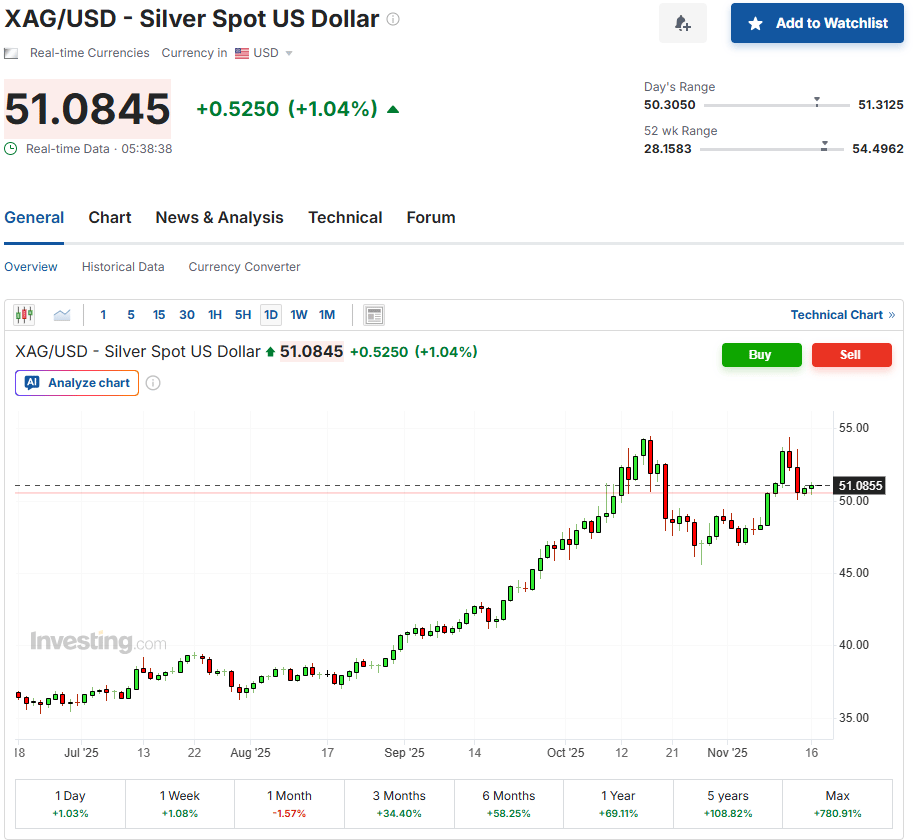

Silver futures are cheaper than spot silver…

This is called backwardation - the market is shouting:

“I want real metal now more than promises later.”

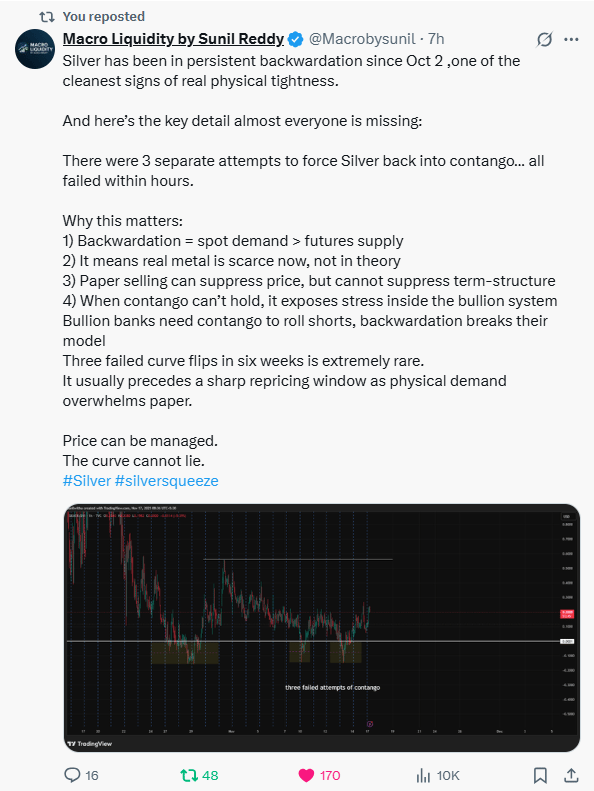

Now Sunil’s post adds the second half of the x-ray:

Since Oct 2, silver has sat in persistent backwardation – the spot price today is higher than futures.

There have been 3 separate instances where it almost went back into contango… all failed within hours.

In plain English:

Banks who are short silver need contango (futures > spot) so they can keep rolling those short bets forward.

If they can’t push the curve back to contango, it means the physical tightness is stronger than their paper games.

Tie this back to the warehouses:

LBMA is nearly out of free-float silver.

China just drained its own vaults to decade-low levels.

Now the time curve itself is breaking – three failed curve flips in six weeks.

That’s leverage in action:

You’ve got a mountain of paper claims stacked on a shrinking pile of metal.

As long as contango holds, the system can juggle those claims.

Once backwardation refuses to go away, the juggling stops. Somebody, somewhere, has to settle in real ounces, not IOUs.

Why this matters right now:

Every day backwardation persists while inventories fall, pressure builds.

When the break comes, price won’t politely “trend higher”; it will lurch upward to decide who actually gets metal and who’s left holding useless paper.

Price can be massaged on a screen.

But when the curve and the warehouses agree – “we’re out” – that’s when silver stops trading like a chart and starts trading like oxygen.

Take everything we just said about paper silver vs real metal…

…now layer the world’s #2 economy on top of it.

China’s housing bust isn’t a local problem:

Home prices in all 70 major cities are falling,

The downturn has lasted 4+ years,

Confidence in 260 smaller cities is still dropping.

For China, housing is not “just another asset class” – it’s the core collateral of their financial system.

When that collateral sinks, three things happen:

Credit strains:

Banks, developers and shadow lenders are stuffed with property-backed loans.Falling prices quietly blow a hole in their balance sheets, so they either:

tighten lending (credit crunch), or

get bailed out with new state-backed money.

More money, less trust:

To keep the machine from stalling, authorities lean on easier credit, guarantees, and de-facto money printing.In the most leveraged, globally connected system in history, that doesn’t stay in China – it bleeds into global dollar and bond markets through capital flows, FX interventions, and demand for safe collateral.

Capital looks for real anchors:

When paper wealth (housing, stocks, bonds) looks shaky, big money hunts for assets that:don’t depend on a developer paying a loan,

don’t vanish when a central bank panics.

That’s gold and silver.

Now connect this to silver specifically:

The paper curve is already screaming tightness (persistent backwardation, failed attempts to push it back into contango).

LBMA and Shanghai inventories are draining, just as the world faces rising systemic stress from China’s property bust and the knock-on effects in credit and global money supply.

So you have:

More credit risk, more money creation, more distrust of paper,

Against a fixed, tiny, industrially critical pile of silver.

That’s LEVERAGE in its purest form:

A mountain of claims, balanced on a shrinking stack of atoms.

The deeper China’s housing crisis cuts into global credit, the more central banks are forced to “paper over” the damage – and the more violently capital will eventually rotate out of overleveraged paper promises and into real, scarce metal.

In that world, silver stops being a “trade” and becomes what it really is:

an emergency exit out of a burning, over-mortgaged system.

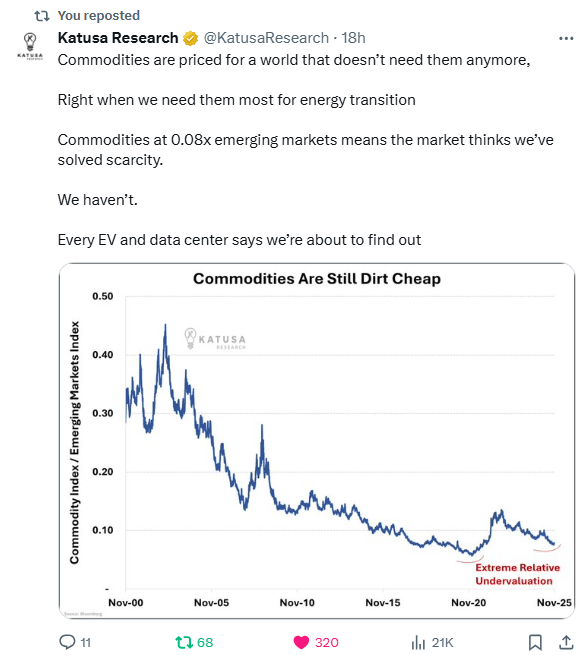

Commodities at 0.08x EM equities is the market saying:

“Scarcity is solved. Don’t worry about the real world.”

That illusion only exists because the most leveraged financial system in history needs cheap inputs to keep its house of cards standing.

But here’s the crack running through the floor:

EVs, data centers, and grids are about to explode demand.

Producers are under-funded and supply is thinning out.

When reality hits, commodity prices don’t drift higher — they detonate upward into an empty cupboard.

And in a max-debt system, rising commodity prices punch the credit markets in the mouth:

Costs jump

Margins collapse

Defaults rise

Central banks panic and spray liquidity

Every rescue means more currency dilution… which drives capital straight into real assets.

And that’s where silver becomes the pressure point.

Silver is the most mispriced asset in the entire system — both an industrial essential and a monetary escape hatch.

So you’ve got a perfect setup:

Paper world priced for infinite abundance…

Real world screaming scarcity…

Silver sitting at the collision point.

When the illusion breaks, capital doesn’t rotate — it rushes.

When Janet Yellen – former Treasury Secretary and Fed Chair – says the U.S. is in danger of becoming a banana republic, that’s not Twitter drama.

That’s an architect warning you the foundation is cracking.

“Banana republic” means:

Government addicted to debt + money printing

Political gridlock

Currency and bond market trust slowly dying

And now this same insider is floating gold-linked Treasuries – basically hinting:

“Plain paper IOUs may not be enough. We might need real collateral to keep getting our debt financed.”

In the most leveraged, interconnected financial system in history, that matters:

U.S. Treasuries are the collateral spine of global credit.

If confidence in that spine wobbles, every leveraged player – banks, hedge funds, sovereigns – has to demand higher yields, more margin, more collateral.

Leverage works both ways: a small loss of faith in government paper becomes a big move in interest rates, credit spreads, and liquidity.

How do authorities usually respond?

More QE, more backstops, more quiet monetization – which means more currency units chasing the same finite pool of real assets.

That’s where gold and especially silver re-enter the story:

They’re nobody’s liability in a world drowning in IOUs.

Silver is both monetary metal and industrial fuel – yet it sits in a tiny, under-owned market compared to the ocean of government and corporate debt.

So when someone like Yellen is publicly allowed to use “banana republic” language and whispers about gold-backed bonds, the message is simple:

The base layer of the global financial system is rotating back to gold.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply