- The Sovereign Signal

- Posts

- 🛢️ Crude Awakening - Surface Tensions, Subsurface Fractures

🛢️ Crude Awakening - Surface Tensions, Subsurface Fractures

📉 As airstrikes ripple through Tehran and crude races higher, the U.S. dollar is convulsing. Don’t just watch Tehran—watch the plumbing. Risk assets are whispering the same message: liquidity stress is back.

⚠️ Signal Dashboard

Category | Signal | Current Reading | Interpretation |

|---|---|---|---|

🛢 Crude Oil (Brent/WTI) | Brent $73.94 (+6.65%) / WTI $72.65 (+6.82%) | Spiking | Pricing in Iran/Israel escalation & Strait of Hormuz risk |

🟩 VIX Index | 21.18 (+17.54%) | Surging | Fear index flashing red; systemic fragility rising |

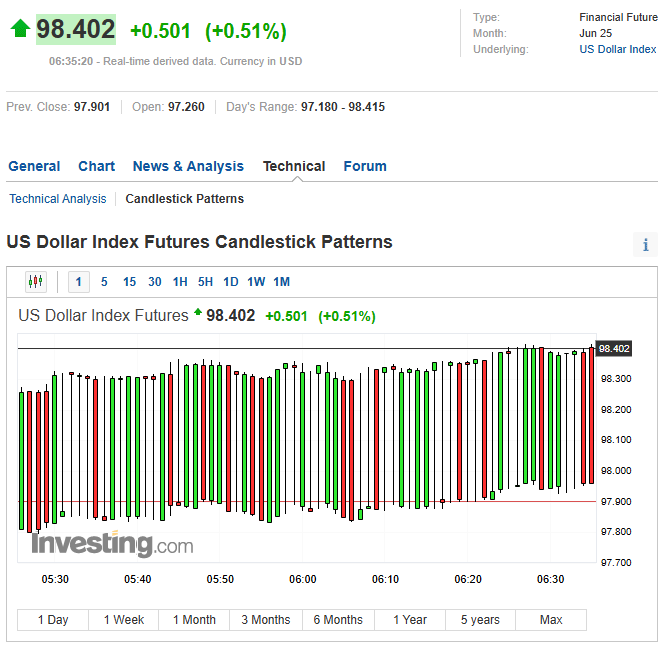

💵 DXY (Dollar Index) | 98.402 — violently whipsawing | Unstable | No trend, no confidence—only tension in the pipes |

🪙 Gold | $3,445.50+ | Bidding Higher | Safe haven demand building rapidly |

🥈 Silver | $36.505 | Holding Gains | Re-accummulation underway; poised for next impulse leg |

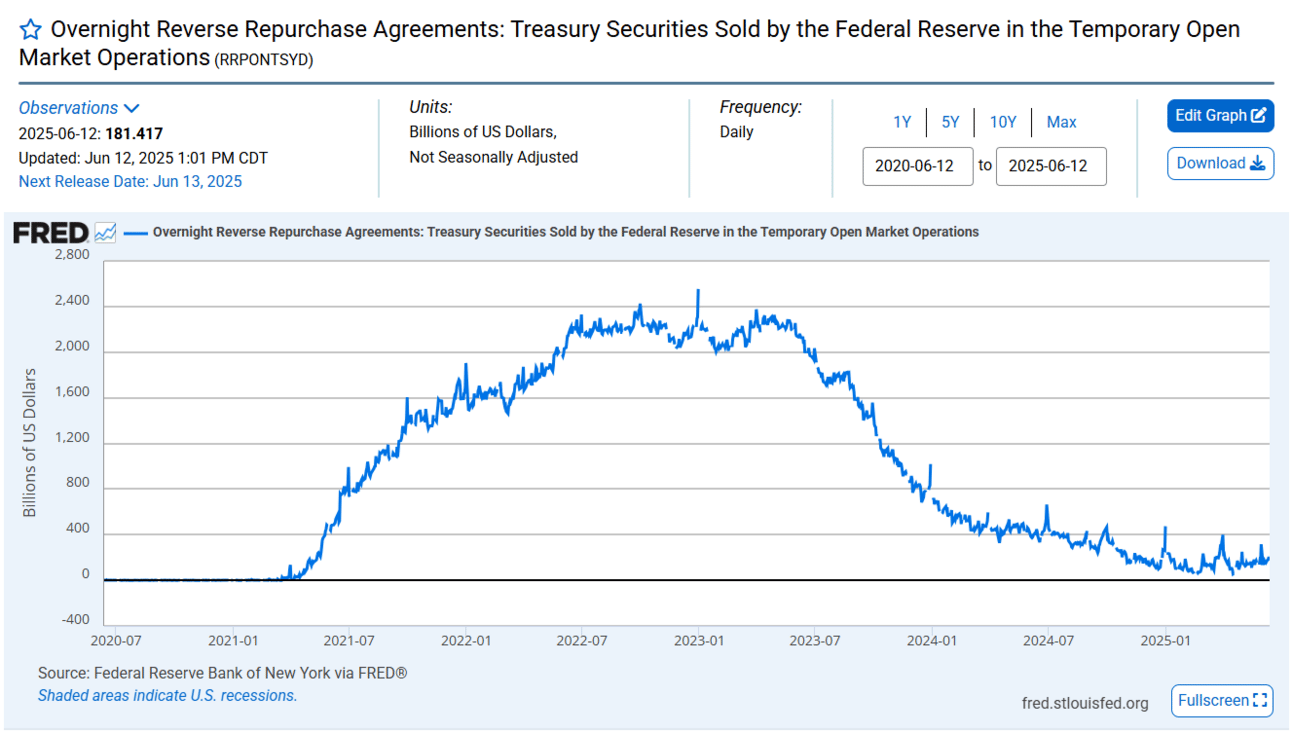

🔁 Repo Market Stress | 181.417 Billion | 🚨If this dips and stays below $100 Billion for consecutive days | VIX spike + DXY thrash = rising stress in collateral plumbing |

📊 1-Min Chart Behavior: Chaotic bid-ask dislocations, algorithmic panic

💥 Interpretation: Not strength—symptom of fracture

As Israeli airstrikes on Tehran ignite a powder keg long in the making, the U.S. dollar has spent the early hours of June 13th violently oscillating—slipping, surging, slipping again.

This 1-minute chart doesn’t reflect conviction—it reflects confusion.

🧠 VIX Spike + DXY Whipsaw = Rising Stress in Collateral Plumbing

DXY Whipsaw = FX Market Dislocation

The U.S. dollar is the lubricant of global finance.

Whipsaws in the dollar — especially during illiquid hours — often mirror dysfunction or divergent monetary/fiscal policy expectations, especially in FX basis markets.

Combine this with geopolitics (Iran, Strait of Hormuz risk), and you're seeing supply chain shock meets capital flow disorder.

Together, They Signal Repo Market Risk

The repo market — where institutions swap collateral (like Treasuries) for short-term funding — is hypersensitive to:

Collateral quality

Dollar availability

Volatility in funding instruments (e.g., bills, swaps)

When VIX spikes, counterparties want better collateral.

When DXY thrashes, it signals confusion in dollar demand vs. supply.

🩻 The Invisible Pulse Beneath the Surface: Repo Market Watch

In a financial system built on confidence and collateral, the overnight reverse repo (RRP) market is the bloodstream.

📉 The key level to watch

If RRP balances fall below $100 billion and remain there for multiple consecutive days, the odds of a global equity market selloff rise significantly.

💥 Conceptually, Why It Matters

The repo market is the heartbeat of short-term funding—a silent yet massive plumbing system.

When it clogs, credit velocity halts.

And when credit halts, everything else—equities, derivatives, commodities—follow.

In March 2023, Feb 2025, and Sept 2019, and 2008 - the repo freeze was the signal before the explosion.

In each case, the mechanical stress in the repo plumbing preceded broader cracks in risk assets.

Watch the level.

Sub-$100B and persistent = red alert.

⚠️ Strait of Hormuz: The 21-Mile Fuse That Could Detonate $130 Oil

It’s just 21 miles wide—but it might as well be a fault line running through the global economy.

The Strait of Hormuz, through which 30% of the world’s seaborne oil and 20% of its LNG passes daily, is now quietly glowing like a geopolitical tripwire.

🛢️ JPMorgan has warned

If this narrow passage were closed or severely disrupted, oil wouldn’t just jump—it would detonate.

Their worst-case projection?

$120–$130 oil.

Not from gradual supply issues, but from an exponential repricing triggered by a single spark.

The probability?

Just 7%, says JPM.

The impact?

Violent and nonlinear.

Global inflation would roar back with a vengeance, igniting CPI metrics, destroying soft-landing narratives, and crushing rate-cut expectations.

Shipping lanes would be rerouted or halted, wreaking havoc on global trade and container freight markets.

Collateral stress would spike across energy-exposed credit markets, forcing sudden repricing in funding, hedging, and risk models.

💥 This is not just about oil.

It’s about the systemic vulnerability of a hyper-leveraged, over-financialized global economy resting on narrow geopolitical choke points.

And while headlines chase the “what if”, the gold and silver markets have been silently screaming “when.”

🎯 Probability Zones

Scenario | Probability | Impact on Markets |

|---|---|---|

🧯 Tensions Rise, No Strike | 60% | Oil hovers $75–85; Gold steady; Silver grinds up |

💣 Israel or U.S. Strike on Iran | 30% | Gold $3,600+ |

🧊 Strait of Hormuz Closure | 7% | Oil $115–130 |

✌️ Truce or Deal | 3% | Risk-on bounce; gold pullback below $3,300 short term |

🔚 Closing Reflection: The Clock is Ticking

This is no longer a game of rate hikes or CPI prints.

This is about capital structure re-evaluation in real time—across energy, security, money, and sovereignty.

When oil spikes, the VIX jumps, the dollar thrashes, and gold climbs simultaneously…

It’s not a rotation.

It’s a recalibration.

One more blow to confidence—monetary or geopolitical—and the cracks become fractures.

This is why real assets are rising.

This is why gold isn’t waiting.

This is why the repo market is the next signal to watch.

Stay sharp. Stay sovereign.

🛡️ Stack Reality. Exit the Illusion.

When pixels pulse, narratives churn, and headlines scream for attention — the wise step back and anchor in the tangible.

Not numismatic novelties.

Not paper promises.

But weight. Form. Substance.

Gold and silver.

Unyielding. Unmistakably real.

As a Sovereign Signal reader, you’re not just stacking metal — you’re staking sovereignty.

You’ll get dealer-direct pricing, fully insured delivery, and access to the kind of trust you can’t download.

📦 Delivered to your vault or doorstep.

⚖️ No fluff. Just real weight at a fair rate.

📩 Reply to this report or email [email protected] and I’ll get you connected.

This isn’t fear.

This is foresight.

And when the system starts shaking, only weight holds ground.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply