- The Sovereign Signal

- Posts

- Expect Asia To Pull Silver Up At Least Another $2.50 Or So In The Short Term, SLV Call Positioning Increasingly Bullish On Short-Term Upside, Mainstream Financial Media Starting To Ditch Bitcoin Pumps For Silver, China's Silver Export Restrictions Begin January 1st

Expect Asia To Pull Silver Up At Least Another $2.50 Or So In The Short Term, SLV Call Positioning Increasingly Bullish On Short-Term Upside, Mainstream Financial Media Starting To Ditch Bitcoin Pumps For Silver, China's Silver Export Restrictions Begin January 1st

Asia premium + options gamma + narrative flip + export clamp = ignition: Shanghai’s bid drags NY higher, SLV calls add upside fuel, media rotation legitimizes the move, and China’s Jan-1 export curb tightens supply right as demand accelerates.

Expect silver futures to jet at least another $2.50 or so higher soon here.

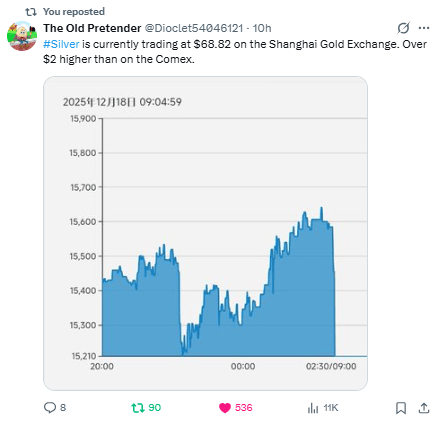

…when Shanghai trades ~$2+ over COMEX, the path of least resistance is “U.S. catches up.”

Here’s why:

Arb pressure:

Refiners, banks, and big traders can EFP/ship bars toward the higher-priced market.

That drains “cheap” Western supply and bids COMEX/OTC up until the gap narrows.

Signal, not noise:

A persistent SGE premium means local, price-insensitive demand (industrial + saver + policy) is outpacing supply.

That’s hard for paper shorts to fade.

Follow-through fuel:

We’ve got high lease rates, heavy ITM calls, and rising delivery claims—so dips are getting vacuumed quickly.

Near term that makes your +$2.50 “catch-up” read very plausible: either Shanghai cools or the U.S. lifts—and right now demand says lift.

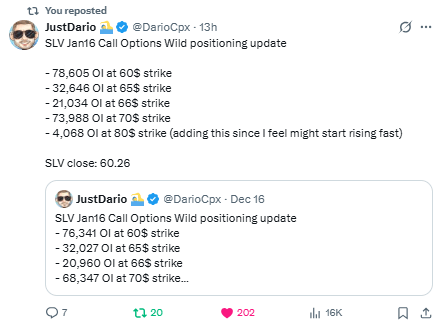

A wall of Jan-16 SLV calls sits right on the price path—~78.6k at $60, 32.6k at $65, 21.0k at $66, 74.0k at $70, and even 4.1k at $80.

That’s ~210k contracts total, or ~21.0 million shares of SLV exposure (each contract = 100 shares) — roughly $1.27B of notional at ~$60.

Why it matters:

As SLV trades up through each strike, dealers who sold those calls must buy more SLV to hedge (delta rises toward 1).

That mechanical hedging creates incremental demand right at $60 → $65 → $66 → $70, often accelerating price—classic gamma fuel.

If spot keeps lifting into Asia/EU sessions, those clusters can become ignition points: every dollar higher pulls in more hedging, which can pull price higher still.

Feedback loop.

Near-dated (Jan 16) options intensify this: less time = faster delta changes = sharper hedging flows.

Knock-on: heavy SLV creation to meet demand can force APs to source more physical, tightening an already stressed silver market—amplifying your “paper → metal” squeeze dynamic.

Flip side: if price fails and retreats below those strikes into expiry, hedges unwind the other way—air-pocket risk and violent pullbacks.

Bottom line: into January OPEX, positioning is set up for asymmetric upside bursts on each strike breach (especially $65–$70), with the caveat that failed breakouts can reverse hard.

When legacy outlets start saying “Bitcoin is risk-on,” they’re admitting what we’ve been getting at: crypto rides easy liquidity.

That frees up the “flight-to-quality” lane for real collateral—gold first, then silver, which is both monetary and industrial.

Here’s the setup if mainstream piles into silver the way they chased Bitcoin:

Narrative flip → flows.

Once “silver = risk-off + growth metal” becomes cocktail-party knowledge, you get ETF creations, structured-product issuance, and dealer hedging that mechanically buys dips.

Thin float, elastic price.

Physical tightness + high lease rates mean a dollar of new demand travels farther in price than it would in Bitcoin (where supply is always on-offer) or mega-caps (deep liquidity).

Feedback loops.

Media coverage → retail/institutional allocation → APs source bars → spot tightens → futures backwardation risk → more coverage.

That loop is far more explosive in a small market like silver.

Macro tailwind.

If policy is easing while deficits balloon, the bid for real collateral strengthens.

Silver adds an industrial kicker (solar/AI power build-out).

Translation: if the mainstream fully rotates from “Bitcoin proxy for risk” to “silver is the collateral/growth hedge,” the flow/float mismatch could do in months what took Bitcoin years.

If China really restricts silver exports Jan 1, it’s a hard supply shock.

Metal gets trapped inside China, the Asia premium widens, and the rest of the world must bid higher to get bars—so lease rates jump, backwardation pops, and price gaps up.

Net: dips get bought, paper markets chase physical, and the squeeze graduates from screen to vault.

Boomerang translation: a dovish Fed chair means lower rates → easier credit → more debt → faster currency dilution.

Real yields sink, financial engineering roars back, and hard money re-prices. Net: structurally bullish for gold and silver.

Headline: Bullish for gold and silver.

Read between the lines on Trump’s speech last night: “I inherited a mess—brace for shock therapy.”

Pair that tone with a $10B Taiwan arms package (and Venezuela situation heating up) and you don’t have diplomacy—you have escalation.

Translation for markets: higher geopolitical risk premia, stickier energy costs, tighter dollar liquidity, and fatter tail risks.

That’s the collateral war—nations scrambling to lock down real collateral before the next leg of the debt crisis. In that scramble, unprintable assets win. Gold and silver are the balance-sheet oxygen.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply