- The Sovereign Signal

- Posts

- ⚔️From Derivatives to Deliverables

⚔️From Derivatives to Deliverables

The Silver Squeeze Is Not a Meme — It’s the Pressure Valve Repricing the Base Layer of Global Finance

“First slowly, then all at once.” — Hemingway, and the Market's Last Warning

For thousands of years, silver wasn’t just a metal — it was money itself.

Long before central banks, credit systems, or synthetic assets, silver was the standard.

It was the first metal used as currency in ancient Mesopotamia, and the foundation of East–West trade across the Silk Road.

The Spanish silver dollar became the world’s first truly international reserve currency — circulating from Asia to the Americas, bridging civilizations.

It’s only in the last 54 years — a blink in the timeline of human commerce — that silver has been relegated from this monetary role.

The past five decades have been an anomaly — a pause, not a conclusion.

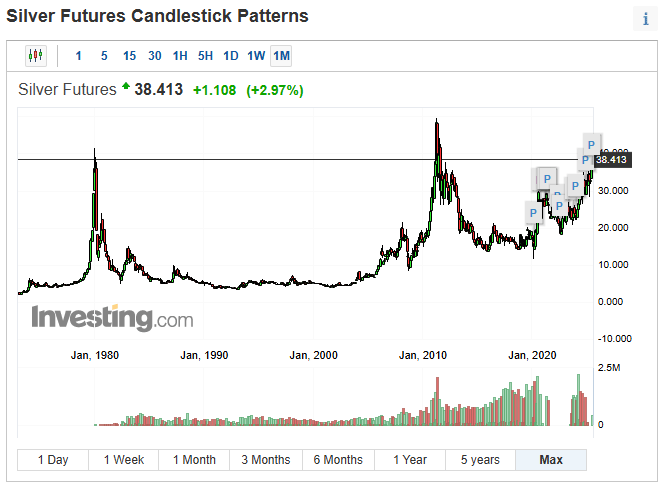

And silver’s price reflects that pause:

👉 Still nearly 30% below its 1980 all-time high — over 44 years ago.

👉 Name another essential industrial commodity with that kind of lag.

You can’t. Because there isn’t one.

We are in our 5th straight year of structural deficit in silver

Silver is used in nearly every modern technology — medicine, energy, military, phones, EVs

Silver isn’t just moving —

It’s detonating.

Signal | Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –29.07 bps | Still deeply negative. Reflects a synthetic hedging regime where derivatives are favored over Treasuries—implying structural distrust in U.S. credit. | 🔴 Red |

Reverse Repos (RRP) | $183.339B | Collateral pool near extinction. RRP drainage = Fed’s liquidity buffer gone. Watch out if this goes under $100B and stays there. | 🔴 Red |

USD/JPY | 146.90 | Yen weakening slightly. Still below the 150 panic zone, but volatility risk is brewing. FX interventions may be approaching. | 🟠 Orange |

USD/CHF | 0.7974 | Swiss Franc nearing post-Bretton Woods extremes. Global capital is screaming for safety. Sign of hidden systemic fear. | 🔴 Red |

3-Year SOFR OIS | 27.4 bps | Long-dated OIS remains disconnected. Market sees future rate dislocation. Points to hidden fragility in funding stack. | 🟠 Orange |

SOFR Overnight Rate | 4.32% | Stable on surface, but stability is artificial. Divergence from OIS and swap rates is the real signal. | 🟢 Green |

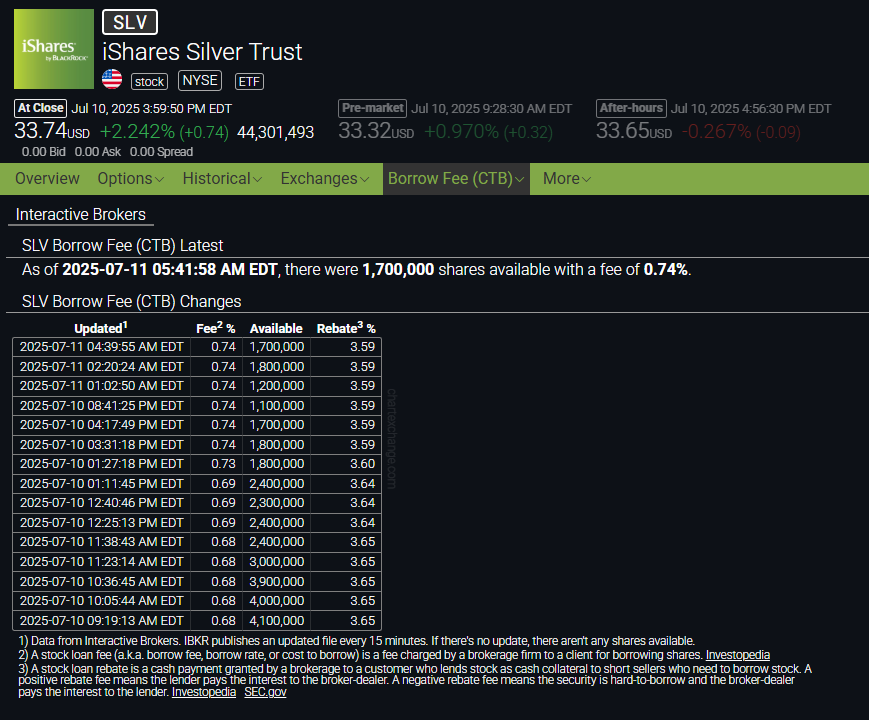

SLV Borrow Rate | 0.74% | Creeping higher again. Implies rising pressure in synthetic shorting. Watching for spikes above 1% as a squeeze signal. | 🟡 Yellow |

GLD Borrow Rate | 0.64% | Subdued for now. | 🟡 Yellow |

COMEX Gold Inventory | 36,876,794.00 (20.2M Registered) | Implies steady physical demand. More traded than available for delivery. | 🟡 Yellow |

10Y UST – JGB Spread | 2.854% | Slight uptick. Still elevated. Implies Japan remains fault line for long-end volatility. Watching BoJ actions closely. | 🟠 Orange |

🧨 The Largest Short Squeeze in Commodity History Has Just Begun

The most overlooked fact in global markets right now is this:

As of last week, banks held the largest net short position in silver ever recorded on COMEX: 54,388 contracts.

At 5,000 ounces per contract, that’s over 271,940,000 ounces net short.

Now compare that to reality:

🔐 Only 191,962,500.612 ounces are registered and available for delivery on COMEX right now.

That means there are 80 million more ounces shorted than physically available to deliver.

Let that sink in.

This isn’t just historic — it’s unprecedented.

Never before have the most systemically connected institutions placed such a massive leveraged bet against a physical asset…

that is already in chronic structural deficit.

And silver didn’t collapse.

It rallied even higher.

Last week alone:

Opened at $36.60

Closed at $37.305

Now sits at $38.413 as of 5:33 AM ET

That’s not normal.

When a record short is placed, price should fall — violently.

Instead, silver rose despite the pressure.

That’s not just bullish — that’s catastrophic for the shorts.

📉 Shorts are getting squeezed.

💥 The coil is unwinding.

🚀 Repricing has begun.

This isn’t a chart setup.

This is a multi-decade pressure breach.

And silver is the release valve for every distortion created by a financial system drunk on leverage, derivatives, and illusion.

The system bet against silver — and silver is calling in the debt.

🧠 The Mechanics of a Silver Short Squeeze (And Why This One’s Different)

When banks or institutions hold a short position, they’ve essentially sold silver they don’t own, betting they can buy it back at a lower price in the future.

If silver’s price drops, they profit.

If silver’s price rises, they bleed — and they bleed fast.

But unlike a typical asset, silver has unique constraints that make a squeeze far more volatile, and far more likely to cascade:

🔄 1. Mark-to-Market Losses Begin Immediately

For every $1 silver rises:

The 54,388 net short contracts lose $1 × 5,000 ounces per contract =

→ $271.94 million in paper losses per dollar.

At today’s price of $38.413, and assuming they shorted around $36.50–$37.00…

many banks are already underwater — by hundreds of millions of dollars.

🧨 2. Margin Calls and Capital Stress

These paper losses aren’t theoretical — they hit in real time.

Brokerage firms and clearinghouses demand more capital (margin) to maintain the position.

If losses deepen, the shorts must:

Post more cash

Post more collateral (Treasuries, etc.)

Or close the position (buy back silver)

And this is where it starts to spiral.

🔁 3. Buying Back Silver Fuels the Price Higher

When a short closes or hedges, it buys silver to do so.

Buying pushes the price higher, which worsens the losses on the remaining shorts…

And those shorts must then either:

Post more margin

Or buy back silver too

This is the reflexive feedback loop of a short squeeze:

🩸 Losses → 💰 Forced Buying → 🚀 Higher Price → 🩸 More Losses → 💰 More Buying

In silver, where:

Deliverable COMEX inventory is already lower than the net short position

Futures open interest is leveraged many times actual supply

There’s a multi-year structural deficit

…the exit door gets very small, very fast.

🧬 4. The Silver Factor: Physical Constraint Meets Derivative Leverage

This isn’t just a financial short.

It’s a short against:

A scarce, indispensable industrial metal

A commodity that’s also a historical monetary reserve

And one that is traded probably at least 100x more on paper (than actually exists in vaults)

So as the price rises:

More traders demand physical

Market makers scramble to source bars

Vaults drain, and premiums explode

A normal short squeeze stops when supply increases.

Silver’s supply can’t increase fast.

The mine cycle is too slow.

And recycling lags industrial demand.

This means a successful squeeze won’t just hurt financially —

It will destroy the entire illusion of sufficient deliverability in the derivatives market.

🔓 5. The Loop That Breaks the Machine

The system depends on paper silver being trusted as equivalent to physical.

But if:

Banks can’t deliver

Vaults can’t meet requests

Price keeps rising

And traders demand metal…

You get a crisis of confidence.

That’s when the loop metastasizes:

🌀 Price rises → Shorts panic → Buy physical → Inventory collapses → Confidence breaks → Everyone rushes to buy physical → Price goes vertical

This is how a squeeze becomes a monetary rupture.

⚖️ COMEX Silver Open Interest vs. Annual Supply

Open interest is the heartbeat of the silver battlefield—it tells you how many futures contracts are still open, how many players are still in the fight.

Right now, with 167,643 contracts live, that’s 838 million ounces of paper silver—nearly 80% of total annual mine supply—still circling the system like dry powder.

When this kind of exposure stacks up as silver rises, it means one thing: the pressure is building, and the fuel for a short squeeze is already in the chamber.

🧾 Current Open Interest (as of now)

167,643 contracts

Each contract = 5,000 oz

→ That’s 838,215,000 ounces of paper silver exposure

🌍 Global Annual Mined Supply

Per the Silver Institute and other sources, global annual silver mine supply is approx:

1.036 billion ounces

📊 Ratio of Paper to Physical

838,215,000 oz (paper claims) ÷ 1,036,000,000 oz (annual mine supply) = ~81%

That means:

Nearly an entire year’s worth of global mine supply is already claimed—on paper—through COMEX futures alone.

And that doesn’t even include:

OTC derivatives

SLV-related leasing & rehypothecation

Unallocated accounts at bullion banks

Industrial demand, which now exceeds 600Moz/year

🧠 What This Really Means

Leverage is extreme

– COMEX silver is not backed 1:1 with physical metal

– The system relies on most contracts being settled in cash, not deliveryIf too many stand for delivery or hedge via physical, it’s game over

– With only ~191M oz registered in COMEX warehouses, the price will go vertical if a meaningful % demanded actual metal.Open interest is a pressure gauge

– As price rises, shorts take mark-to-market losses

– Some may cover, which pushes price up further

– That can trigger more buying, in a reflexive loop → the classic short squeeze dynamic

There are 4.38 paper ounces per registered physical ounce on COMEX right now.

One bad month could create a chain reaction — and we may already be in it.

SLV Borrow Rate: Where the Short Squeeze Will Erupt

When silver's short squeeze goes full Game Stop mode, this is exactly where we’ll see it show up first.

The SLV borrow rate—what short sellers pay to borrow shares—is one of the most real-time, reflexive pressure gauges in the market.

As of this morning, the borrow fee sits at 0.74% with only 1.7 million shares available.

That’s tight—but what matters more is the direction.

On February 7th, this fee hit an insane all time high of 16.24%, signaling panic-level demand to short or hedge silver.

The connection between the SLV borrow rate hitting 16.24% on February 7th, the reverse repo balance collapsing below $100B on February 3rd, and the massive gold exodus from London into COMEX at that time is not a coincidence — it's a multi-signal reflection of acute collateral stress and a systemic scramble for real assets.

💥 1. RRP Drain = Collateral Scarcity Spike

When reverse repos (RRP) drop and stay below $100B — as they did starting Feb 3 — it signals that dealer liquidity is gone, and the system is starving for safe collateral.

RRPs are the Fed’s main “liquidity reservoir,” and once that tank hits “E,” the scramble begins.

This was what really front-ran the global market sell off in March and April.

🏃♂️ 2. Gold Exodus from London to COMEX

At that same time, tens of tonnes of gold left London and entered COMEX warehouses.

Why?

Because U.S.-based demand was exploding for physical settlement — not paper, not derivatives.

This was real capital repositioning away from rehypothecation risk in London.

It’s a signal that trust in paper gold and foreign custodians was cracking.

🔥 3. SLV Borrow Rate Spiked to 16.24%

That’s a stunning number.

It means there was an extreme shortage of available shares to short SLV.

That only happens when two things converge:

Demand to short is sky-high (likely banks trying to cap rising prices)

Supply to short is drying up (holders refusing to lend, institutions hoarding)

This is classic short squeeze anatomy — especially when it aligns with surging physical demand and collateral stress.

It tells us: SLV (and by extension silver) was the release valve.

💡 The Big Picture

This trifecta in early February was the first loud heartbeat of a system under pressure:

A sovereign-level rotation out of fiat collateral and into physical metals

The beginning of the end of suppressed silver prices

And a signal that monetary tightening had broken the internal plumbing

The market was screaming: “We don’t want your IOUs. We want metal.”

Now in July, silver is breaking out — and that moment in February may go down as the first rupture in the dam.

🔮 1. Collateral Stress Happens Before Price Stress

Markets don’t sell off just because prices are “too high.”

They sell off when the funding underneath the market becomes unstable — and the first crack always appears in collateral plumbing.

When RRPs collapsed below $100B on Feb 3 and stayed there, it told us:

🔻 Primary dealers were no longer parking safe collateral.

🔥 They needed it to cover margin, fund positions, or survive volatility.

This kind of move always happens before margin calls and forced liquidations hit broader markets.

🪙 2. Physical Metals Demand = Hedge Fund Fear Index

The gold exodus into COMEX wasn’t retail — it was institutional.

Big money was shifting reserves into physical custody.

That’s a red flag.

At the same time, SLV borrow rates spiked to 16.24%, showing:

🔒 A refusal to lend shares — institutions were hoarding silver

😨 Short sellers were desperate to cap the price and couldn’t find inventory

🧨 Conditions for a volatility-driven squeeze were locked and loaded

These signals showed invisible panic under the surface while equities still floated on narrative.

📉 3. Markets Follow Liquidity — and Liquidity Died in Feb

By the time S&P 500, bonds, and global equities began correcting in mid-March and April:

The true cause — a fracture in liquidity and collateral trust — had already been underway

The real smart money had already repositioned into silver and gold

And RRPs staying sub-$100B was the market screaming “DANGER AHEAD”

It wasn’t about tariffs.

This was about the foundation of trust in leverage — and silver’s squeeze signaled it first.

While the world watched stock charts, the real market — the monetary core — already snapped in February.

Silver was the canary, the release valve, and the front-runner of what was coming next.

🥈 The Repricing Has Begun 🥈

The collateral layer is cracking—and silver just issued the loudest warning shot yet.

As of last week, banks held their largest collective short position in history on COMEX silver…

🔻 54,388 contracts — that’s 271.94 million ounces

🔻 While only 191.96 million ounces are registered for delivery

And silver still rose.

This week? It’s up again—now over $38.40 and accelerating.

Meanwhile:

10Y swap spreads remain deeply negative (–29.07 bps)

SLV borrow rates are climbing (and hit 16.24% earlier this year)

Reverse repos are scraping the barrel ($183B)

This isn’t just price action.

It’s a pressure release.

A short squeeze unfolding on the most undervalued asset on earth.

And it’s happening before the world wakes up to what silver really is:

🌐 History’s first true global currency

⚔️ Industrial lifeblood

📉 The most mispriced asset in all of recorded history

This is where the real collateral rush begins.

I can personally connect you with my trusted referral partners—major U.S. precious metals dealers—to secure preferred pricing and fully insured delivery or storage on the most practical forms of gold and silver, including bars, rounds, and sovereign coins.

Whether you're looking to store in a vault or hold real metal in hand, I’ll make sure you're set up with the same reliable channels I use myself.

📩 DM or email [email protected] to position yourself now—before silver rewrites the rules of real money.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply