- The Sovereign Signal

- Posts

- From Margin Calls to Monetary Collapse: The Great Capital Exodus into Gold & Silver Is Accelerating. Welcome To The Greatest Commodities Super-Cycle In History.

From Margin Calls to Monetary Collapse: The Great Capital Exodus into Gold & Silver Is Accelerating. Welcome To The Greatest Commodities Super-Cycle In History.

A storm of converging crises—from exploding silver deliveries and collapsing Treasury trust, to CME's desperate rule changes and China’s physical metal premiums—signals the breakdown of fiat.

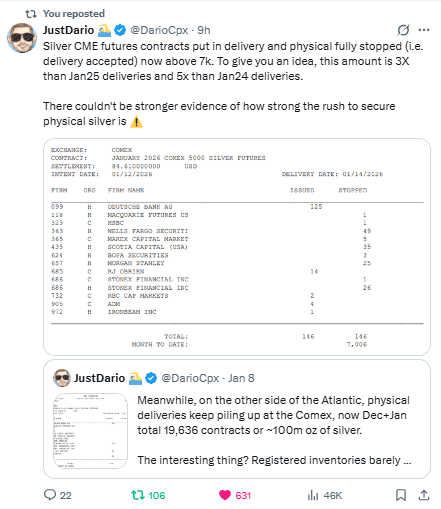

7,000+ silver contracts have been delivered and physically stopped on COMEX.

That's not just a technicality — it's metal in hand, not paper in play. This is 3x January 2025 and 5x January 2024.

Institutions are pulling metal off the table.

Fast. Not rolling. Not arbitraging. They're taking delivery — and disappearing with it.

Why?

Because they know what’s coming.

It’s not just the U.S. — Europe is showing the same signs:

19,636 contracts delivered in just Dec–Jan across the pond.

That’s over 100 million ounces. And yet… registered inventories remain paper-thin. This isn’t a market functioning — it’s a vault being emptied.

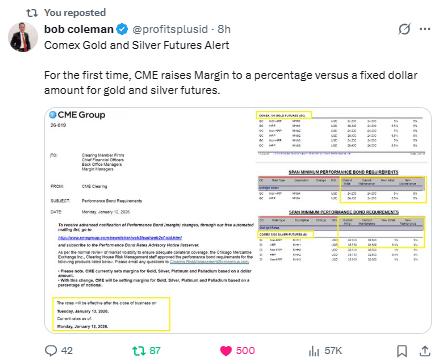

The COMEX just quietly rewrote the rules of the game.

For the first time ever, margin requirements on gold and silver futures are being switched from fixed dollar amounts to percentages.

On the surface, it sounds benign — just a structural tweak.

But in practice, this is a major shift with massive implications.

Here’s what’s really going on:

A fixed dollar margin is stable.

It assumes a certain volatility regime.

But percentage-based margins scale with price — and volatility.

That means the higher these metals run, the more capital is forcibly locked up by participants — especially shorts.

So why change the system now?

Because something has snapped.

The physical market is draining. COMEX deliveries have exploded — 3x last year.

SLV has breached key thresholds. Chinese silver is trading $93+ — and U.S. spot is chasing it hard.

Shorts are under pressure, margin calls are threatening to cascade, and now the CME is bracing for volatility they can no longer contain.

By switching to percentage margins, they're trying to front-run the chaos — controlling liquidity outflows and managing systemic risk before something breaks.

But that preemptive move is its own tell: they’re not in control anymore — they’re reacting.

They’re preparing for something disorderly. You should too.

What the CME just did wasn’t just about raising margins — it was about cornering the weakest hands in the room.

And this text nails what most are missing: this isn't just about traders. It's about producers.

Producers are the ones who must hedge — not because they’re speculating, but because their businesses depend on price stability.

They're the canaries in the derivatives mine. And now, with the new percentage-based margin rules, the deeper the price runs, the more capital they’re forced to post — and many simply don’t have the pockets to keep up.

So what happens?

They get margin-called out of their short hedges, which forces them to cover — triggering more buying pressure...right when physical silver is evaporating off the shelves, China is flashing $93+ pricing, and deliveries are surging across global exchanges.

A feedback loop is forming:

Margin increases →

Hedgers forced to cover →

Price rises →

More margin pressure →

More forced covering.

If physical supply is vanishing, shorts are under siege, and hedgers are being squeezed out of existence, the only thing left is vertical movement.

Not because of speculation — but because the structural scaffolding holding silver down is being yanked away, piece by piece.

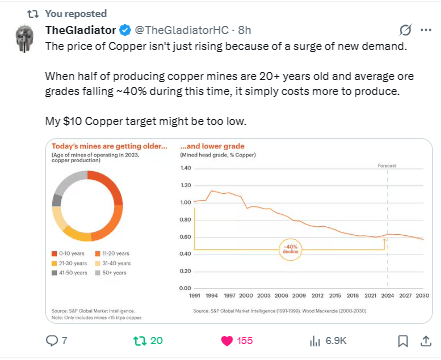

This isn’t just geology catching up — it’s the debt cycle manifesting in the dirt.

We spent the last two decades financing fantasy: tech unicorns with no profits, sovereign debt on zero collateral, and endless printed promises — all while starving the physical world of capital.

Now copper (along with silver) — the bloodstream of modern civilization — is flashing red.

When 50% of copper mines are over 20 years old and average ore grades have collapsed by 40%, that’s not a “cost problem.”

That’s a structural cliff. This isn’t just about dollars per tonne.

It’s about diminishing returns on energy, effort, and capital.

The real cost of copper isn’t what you pay to dig it up. It’s what it now takes to replace it.

Now zoom out: What happens when the most debt-saturated, over-financialized period in human history runs headfirst into the physical reality of supply deficits and exponential electrification?

You get a commodities super-cycle born from neglect — one that won’t be solved by raising rates, printing money, or recycling old narratives.

The $10 copper target may not just be too low — it may be too linear.

This isn’t a trend. It’s a re-pricing of what matters. And we’re still early.

What’s the value of a promise when trust is the currency — and trust is in a bear market?

Voltaire’s observation wasn’t just philosophical. It was mathematical.

Every fiat currency in history has ended the same way: debased, diluted, dead.

What begins as paper backed by gold becomes paper backed by promises… then paper backed by nothing… then nothing.

The truth most can’t stomach: currency isn’t wealth. It’s a claim on wealth.

And when the physical world — copper, silver, oil, grain — starts calling in those claims, the system has to choose: default outright, or default silently through inflation.

Look around: copper at 10-year highs, silver inventories vanishing, $93+ SGE silver in China while U.S. spot chases.

Meanwhile, the cost of everything real is accelerating — not just because of demand, but because fiat supply has gone vertical.

The fiat system wasn’t built to survive resource constraints. But the physical world doesn’t negotiate.

This isn’t just the devaluation of money. It’s the revaluation of reality.

Fiat is approaching its final act - the distortions are reaching their limits.

What happens when the so-called "risk-free asset" becomes radioactive?

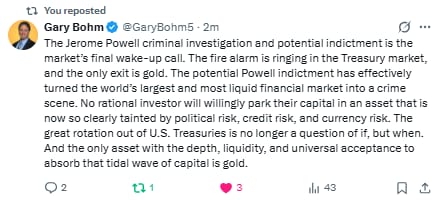

The indictment of Jerome Powell—true or not—is now a narrative accelerant.

The Treasury market was already under pressure from unsustainable deficits, foreign divestment, and growing credit risk.

Now it’s politically contaminated. So where does capital go when the foundation visibly starts eroding?

It can’t go to other sovereign bonds — those are just different flavors of the same poison.

Equities? Too volatile. Cash? Already being melted by policy. Crypto? Still peripheral.

That leaves only one thing with the liquidity, neutrality, and time-tested resilience to absorb a global capital exodus: gold.

This isn’t about gold going up. It’s about everything else falling apart.

The fire alarm isn’t just ringing. The exits are jammed. And gold is the only asset on the other side of the smoke.

The Great Rotation isn’t coming. It’s already started.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply