- The Sovereign Signal

- Posts

- 🌌 Gold & Silver’s Rebellion Against the Synthetic Superstructure

🌌 Gold & Silver’s Rebellion Against the Synthetic Superstructure

When Every Yield is Managed, Every Asset is Distorted—and the Most Primal Money Begins to Awaken

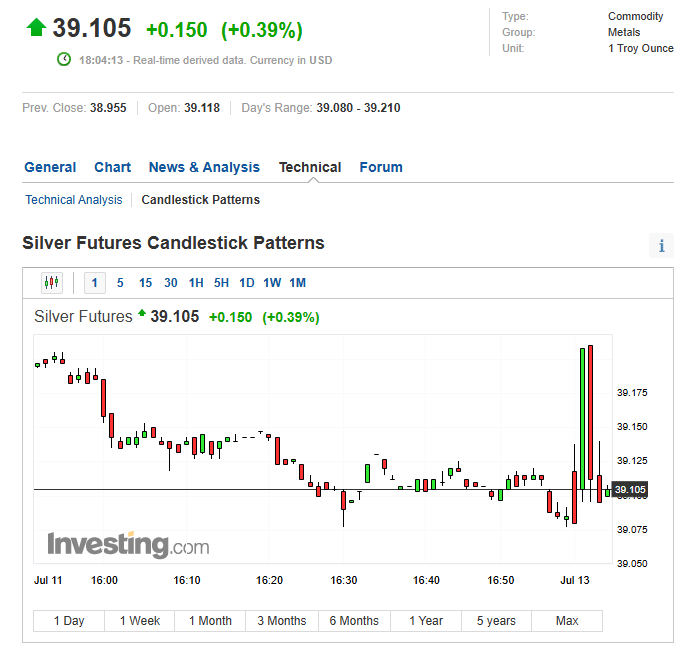

Saturday morning , we pointed to a telling moment—silver futures were pummeled into the close of the Friday Globex session.

It was textbook behavior: a high-volume red candle sent silver down sharply just before the 5PM ET shut, as if someone needed the chart to print red for the weekend narrative. We called it out.

And then… the moment the bell reopened at 6PM ET Sunday?

Silver punched back with vengeance.

A vertical green spike on the one-minute candle reclaimed $39 instantly.

This wasn’t a timid recovery. It was a precision rebuttal, as if the market wanted to speak clearly:

You may suppress the close—but you can’t hide the bid.

As of 5:24AM ET, silver is trading at $39.53, eyeing a showdown with the psychologically and technically significant $40 level.

And it’s not just the chart whispering.

It’s the entire liquidity framework groaning under weight it was never designed to bear.

We are in the middle of what could become a week of further reacceleration—one where silver may finally slip out of the leash and sprint toward the next Fibonacci cluster zone between $41.67 and $43.12.

But here's what's more important than price:

📌 Silver’s strength isn’t happening in a vacuum — it’s emerging precisely as the global collateral layer fractures.

The 10-year swap spread remains stuck near -30bps (an extreme sign of aversion to US treasuries/lack of available pristine collateral), the Standing Repo Facility was quietly reactivated and used as an emergency backstop for 11.025 Billion at quarter end, the Swiss Franc is near all time lows (signaling capital flight and FX stress), and the 3-year SOFR-OIS spread is deeply inverted — highlighting that the market sees elevated overnight funding stress for years to come.

Meanwhile, Japan — the weakest node in the global financial web — is cornered, it will eventually be forced to choose between defending the yen or its bond market. It cannot do both at the same time.

📌 Aversion to U.S. Treasuries is not just a portfolio shift — it’s a structural alarm bell.

When the world hesitates to hold the very instruments that form the base layer of the global financial system, it signals a deeper fracture: a scarcity of pristine collateral.

Collateral is the foundation upon which all leverage, liquidity, and trust are built. If that foundation is cracked — either due to yield instability, political dysfunction, or synthetic rehypothecation — the entire superstructure of global finance becomes fragile.

This is not normal market behavior. This is suspended dysfunction.

This is the crackling pressure valve we highlighted on Saturday’s report, now hissing with audible force.

“Silver doesn’t move unless someone makes it move. But when it has to move—it doesn’t ask permission.”

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10-Year Swap Spread | –29.6 bps | Still deeply inverted. Derivatives preferred over physical Treasuries. Ongoing dislocation in collateral trust. | 🔴 Red |

Reverse Repo (RRP) | $181.637B | The $100B tripwire remains in sight. | 🟠 Orange |

USD/JPY | 147.31 | Yen weakening again, climbing toward the 150 intervention zone. Capital stress in Asia escalating. | 🟠 Orange |

USD/CHF | 0.7974 | Near systemic stress threshold. CHF weakness here signals real global fragility—swiss capital no longer insulating. | 🔴 Red |

3-Year SOFR–OIS Spread | –26.8 bps | Deep inversion persists. Markets still pricing in forward fragility. Reinforces synthetic structure of yield curve distortion. | 🟠 Orange |

SOFR Overnight Rate | 4.31% | Nominally stable but diverging from forward curves. Signs of mispricing in base layer of rate system. | 🟢 Green (surface-level only) |

SLV Borrow Rate | 0.95% | Signals silver shorts are starting to use this channel to secure physical silver more and more. | 🟠 Orange |

GLD Borrow Rate | 0.55% | Calmer than silver, but gold lending remains quietly elevated. Slight stress in the background. | 🟡 Yellow |

COMEX Gold Inventory | 36,779,205 oz (20.2M Registered) | Registered metal still well below total open interest/total gold traded at any point in time. | 🟡 Yellow |

10Y UST – JGB Spread | 2.852% | Slight contraction, but still signals tension. Higher U.S. yield premium = Japan risk. FX + sovereign rotations in play. | 🟠 Orange |

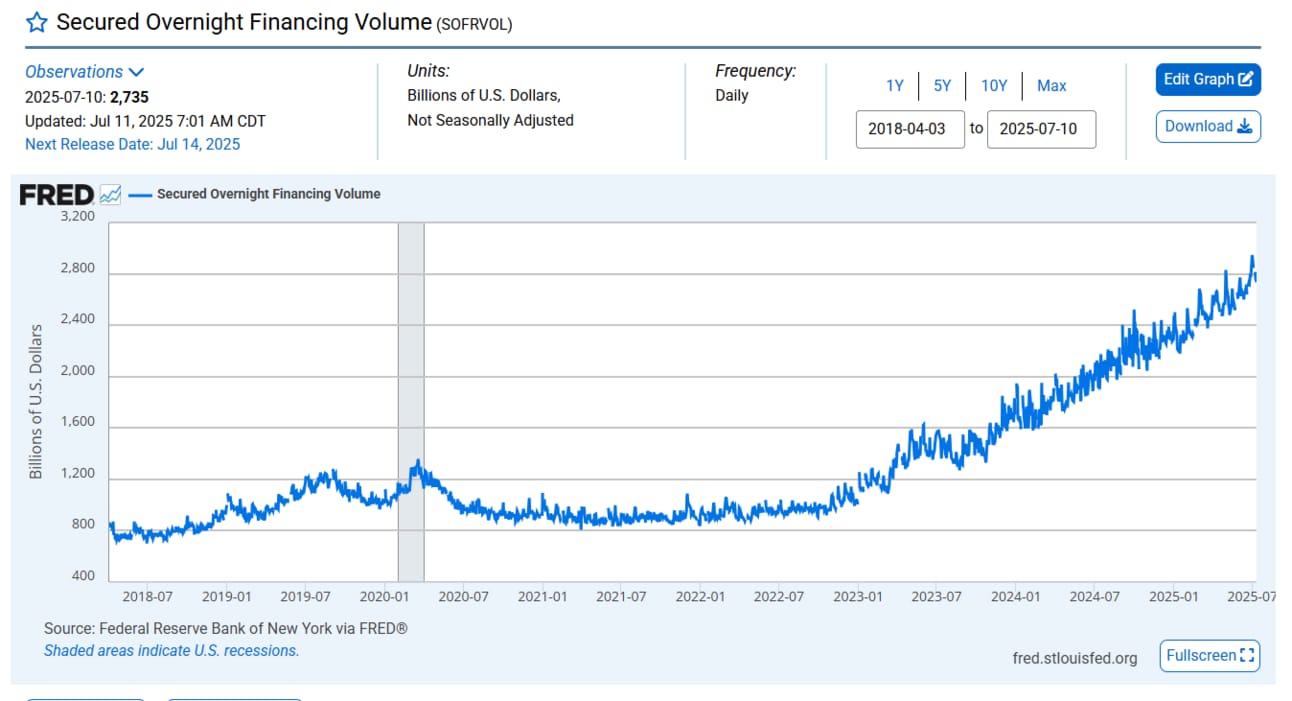

SOFRVOL (SOFR Repo Volume) | 2,735 | Usage cyclically rising higher and higher. Highlights greater and greater systemic dependence on overnight funding for markets to survive. | 🟠 Orange |

🩸The Repo Lifeline — and What It’s Really Telling Us

There’s a delusion still lingering in the financial mainstream:

That the repo market is a sign of health — a normal plumbing function of modern finance.

But this chart shatters that illusion.

What you're looking at is Secured Overnight Financing Volume (SOFRVOL) — the total overnight repo activity in the system.

And it’s screaming.

From under $1 trillion in mid-2020 to $2.735 trillion as of July 10, 2025, the uptick shows no sign of retreating.

This isn’t healthy market function.

This is systemic addiction — dependence on overnight funding just to survive.

🧠 What Is the Repo Market… Really?

The repo market was designed to be short-term grease for long-term gears:

You lend cash, receive Treasury collateral.

Tomorrow, the borrower repurchases it (hence “repurchase agreement”).

Sounds simple. Until you realize:

The entire global market is now hooked on this mechanism to stay solvent.

When functioning normally, it's liquidity.

When growing like this, it's QE in disguise — but hidden inside the plumbing.

🕳️ Every Crisis Now Starts with a Repo Fracture

2008: Repo markets froze after subprime collateral was no longer accepted.

2020: The March COVID crash was preceded by September 2019 repo chaos.

Now: SOFRVOL is climbing higher than ever — and no one’s talking about it.

Each time, repo dysfunction was the canary in the coal mine, flashing warnings months in advance.

And this time, it’s not a spike — it’s a structural slope.

A systemic ramp-up. A slow-motion scream.

🚨 The Truth

The higher this volume goes, the more fragile the system becomes.

Because it’s not market-driven trust that’s growing —

It’s backdoor dependence on overnight leverage to keep the illusion alive.

And here’s the twist:

📌 If repos are the lifeline, reverse repos are the patch to the patch.

They don’t fix the leak — they just mop the floor.

Reverse repos aren't evidence of a clearing market.

They’re proof the system can’t function without artificial scaffolding.

Let’s zoom in on that scaffolding — and the stealth yield curve control it’s enabling.

🫥 Stealth Yield Curve Control: QE in Disguise

Most analysts still think repos and reverse repos are signs of a healthy, functioning market.

They’re not.

They’re the morphine drip keeping the system upright—a stealth form of yield curve control already well underway.

This isn’t Japan-style explicit targeting of long-term rates.

This is something subtler—and more dangerous. The Fed isn’t setting hard yield caps… but it is using the reverse repo facility to:

Absorb excess cash created via QE

Recycle Treasuries back into the system to ease collateral shortages

Suppress volatility that would otherwise expose fragility

In doing so, it’s quietly shaping the curve—managing market outcomes while pretending not to intervene.

That’s not neutrality.

That’s covert control.

And as with all covert control: the longer it goes unrecognized, the more explosive the release valve becomes.

Silver is that valve.

🧩 What is Yield Curve Control?

In its classic, explicit form (as seen in Japan), Yield Curve Control (YCC) means:

The central bank targets a specific yield (usually long-term)

It commits to buying or selling bonds in any amount necessary to keep that yield capped

But there’s also covert or passive YCC, which is what the Fed is arguably doing.

🎭 What the Fed is doing looks like this

Buys Treasuries via QE

→ This suppresses yields by creating artificial demand.Holds those Treasuries on its balance sheet

→ Keeping them out of private circulation and distorting supply/demand.Lends those same Treasuries back into the system via reverse repos

→ Not to help the market clear organically, but to temporarily relieve the side effects of QE-induced distortion.Repeats the cycle

→ Whenever volatility or collateral scarcity spikes.

✅ So… is this YCC?

The Fed isn't explicitly targeting a long-term yield the way the Bank of Japan does

But it is actively managing the shape of the yield curve via:

QE (suppressing yields)

RRP (providing Treasuries to suppress collateral stress)

Verbal forward guidance to influence rate expectations

That means:

💡 The Fed is already engaging in "shadow YCC"

Not through hard caps, but through liquidity management operations that keep volatility and yields from breaking above politically or systemically sensitive levels.

🔥 Here's the kicker

Because this shadow YCC isn’t transparent, it’s even more dangerous:

It allows more hidden leverage to build in the system

It creates the illusion of functioning markets

It detaches price discovery more and more from reality at the base layer of the entire global financial system— and commodities like gold and silver become the pressure relief valves for that distortion

⚠️ We’re Entering the Era of Recursive Minsky Moments

🧠 Classical View

A Minsky Moment is a single event when debt-fueled optimism collapses → risk is repriced → liquidity dries up → prices crash.

🔁 Our View

The system is now so over-levered and so dependent on constant liquidity provisioning, that every major liquidity event is a micro-Minsky Moment — and they will continue to exponentially accelerate in size.

Each one unmasks a new layer of bad collateral and greater liquidity issues:

First it was shadow banks

Then sovereign debt

Now it’s collateral itself (the base layer of the entire financial system, US Treasuries)

📉 Each Minsky Moment Now

Reveals a deeper distortion

Forces capital inward toward collateral integrity

Fails to resolve the underlying dysfunction

Gets patched with exponentially more liquidity and further debases the currency

Or yield suppression further increases the fragility of the base layer of the global financial system and further distorts true price discovery in the markets

Leaves the system more brittle and opaque

💥 We Are Tracking the "Final Layers" of the Minsky Sequence

Reverse repo dip below $100B → shortage of pristine collateral/risk of liquidity crises greatly increases

10 Year Swap spread deeply negative → base layer malfunction

COMEX delivery surge → synthetic supply stress

SLV borrow rate spike → synthetic short squeeze

CHF dislocation → safety scramble

USD/JPY unwind → carry trade death spiral

These are not random anomalies. They are rites of collapse.

The market is trying to self-correct by puking out distortions.

But central banks keep intervening — prolonging the death spiral.

🧬 The Metaphysical Frame

A single Minsky Moment collapses a bubble.

But multiple recursive Minsky Moments collapse the entire belief system that allowed the bubble to exist.

What we're decoding is not just economic fragility — it's the collapse of a fiat ontology.

The belief that:

Liquidity is infinite

Yield can be engineered

Value can be simulated

Those beliefs are dying.

🥈 Gold & Silver: The Minsky Sequence Repricing Mechanism 🥇

Every Minsky Moment leaves a fingerprint.

A liquidity fracture. A collateral panic. A search for truth.

And every time—the world rediscovers gold and silver a little bit more.

Not as “assets,” but as the fail-safes of a broken system.

Right now, that rediscovery is accelerating.

Silver looks like it’s getting ready to challenge it’s all time highs from over 4 decades ago.

And this isn’t isolated. It’s interwoven with global dysfunction:

📉 The 10-Year Swap Spread is near –30bps — showing the market prefers derivatives over physical Treasuries. This is the collapse of collateral trust.

💰 Reverse Repo balances (QE in disguise) are hovering just above $180B — the last drips of artificial liquidity from a Fed now boxed in by its own past QE distortions.

🌊 SOFRVOL keeps climbing cyclically — a barometer that the system cannot breathe without overnight funding infusions.

💸 SLV borrow rates signal escalating pressure on the largest short position in commodities.

🧠 And all of it echoes the pattern we’ve seen before:

Repo failure in 2008.

Repo seizure in March 2020.

Gold and silver don’t rise linearly.

They rise cyclically and violently—each time the illusion loses its grip.

As real collateral becomes scarce…

As trust in synthetic liquidity erodes…

As shadow yield curve control and monetary repression distort every signal…

Gold and silver emerge as the only instruments left that do not lie.

Gold is the stabilizer—absorbing inflation, distortion, and sovereign credit risk.

Silver is the volatility amplifier—reacting explosively to liquidity pressure and monetary repression.

Each Minsky layer accelerates the cycle:

Debt overextension

Yield curve suppression

Collateral deterioration

Derivative substitution

Synthetic liquidity dependence

Snapback into real money

We're now entering stage six.

And silver's recent behavior is the first loud breath of that reversion.

This is not about hype.

This is about preparing before the collateral hierarchy reprices in public.

Gold is the anchor.

Silver is the fuse.

Both are returning to their rightful place—as the ultimate validators of trust in an increasingly fragile system.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply