- The Sovereign Signal

- Posts

- Has Another Repo Market Crisis Just Begun?

Has Another Repo Market Crisis Just Begun?

From record SLV short interest to repo panic, scarce reserves, and China locking down silver exports — every signal screams the same truth: the system is stretched thin. Funding costs are spiking, balance sheets are full, and policymakers are guessing where “ample” ends. Paper leverage is hitting its natural limit — and physical assets are quietly reclaiming power.

The more leverage stacks up, the thinner the margin for error gets.

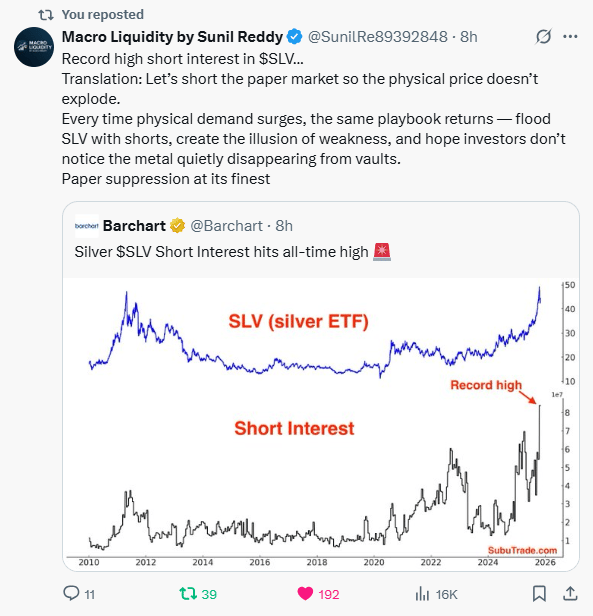

What record SLV short interest is really saying

Paper is leaning hard against metal. When SLV gets shorted to the rafters, it does two things at once:

(1) makes the screen price look heavy, and (2) piles up a future buy obligation in a market where real bars are getting harder to source.

That’s leverage—many paper claims chasing a shrinking pool of ounces.

Why now:

…funding’s tight, backwardation keeps flashing “want it now,” and a record monthly close just turned the algos pro-silver.

Dealers hedge, basis traders press, and shorts try to cap momentum. But every new short is tomorrow’s bid—and if vault drawdowns persist, covering into thin float turns “pressure” into propellant.

Simple punchline: you can short the ticker, but you still owe the metal. If scarcity keeps tightening, the paper cap becomes the launch pad.

Tells: SLV NAV discounts, borrow fees, vault outflows, backwardation staying sticky.

Every dollar in the system is already spoken for ten times over — so when liquidity drains even a little, the Fed loses its grip on the wheel.

What used to be “ample” suddenly feels scarce, and policy turns from planned to reactive.

That’s why they keep getting blindsided.

Leverage makes the system non-linear: small moves cause big reactions, and the Fed’s “map” of where stability ends is constantly shifting under its feet.

Simple truth: the more debt and leverage the system carries, the faster “control” becomes “catch-up.”

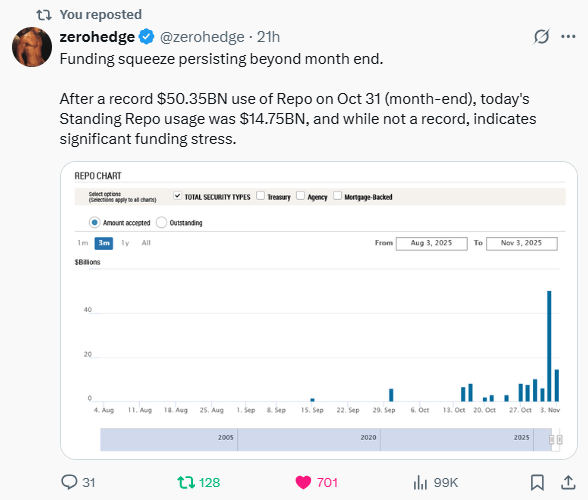

Month-end didn’t fix it—the squeeze is still on.

After a record $50.3B repo tap, banks still grabbed $14.8B the next session.

That means the system needs cash now, not just for calendar optics.

Why it’s biting: balance sheets are stuffed with long assets funded by short cash.

The same dollar is pledged again and again. QT drained the pool, Treasury issuance vacuumed more, and deposits chased yield into money-market funds.

When that thin cushion gets poked, the price of overnight cash jumps and positions get cut mechanically.

Implication: funding stress leads, headlines follow. Expect tighter lending, faster de-risking on wobbles, and a stronger bid for clean collateral—on-the-run Treasuries and base-layer metal (gold/silver)—that doesn’t beg a lender for air.

Simple punchline: the gas light is still on. Manage leverage before it manages you.

The SOFR–IORB spike means the system is running hot—banks are paying extra just to borrow cash overnight.

That only happens when leverage fills every corner of the balance sheet and there’s no breathing room left.

QT drained the pool, Treasury issuance pulled more water out, and now the market’s fighting for what’s left. The Fed’s “ample reserves” suddenly aren’t.

This isn’t panic—it’s physics. When every dollar is already spoken for, even a small squeeze feels like a punch. The price of cash goes up, leverage gets forced out, and liquidity becomes truth again.

Banks just tapped the Fed’s standing repo for $22B in one day. That’s not “month-end noise.” That’s balance sheets saying: we’re short oxygen.

When a system is stuffed with leverage—long assets funded by short cash—the same dollar is promised to too many people. QT drained the pool, Treasury issuance vacuumed more, and deposits chased yield into money-market funds.

Result: the overnight dollar gets scarce, funding costs jump, and banks run to the Fed’s window to swap bonds for cash before the bell.

Why now? The refi wall is creeping closer, year-end collateral checks are tighter, and SOFR spreads already flashed stress. SRF usage is the fire hose—useful, but it tells you the room is hot.

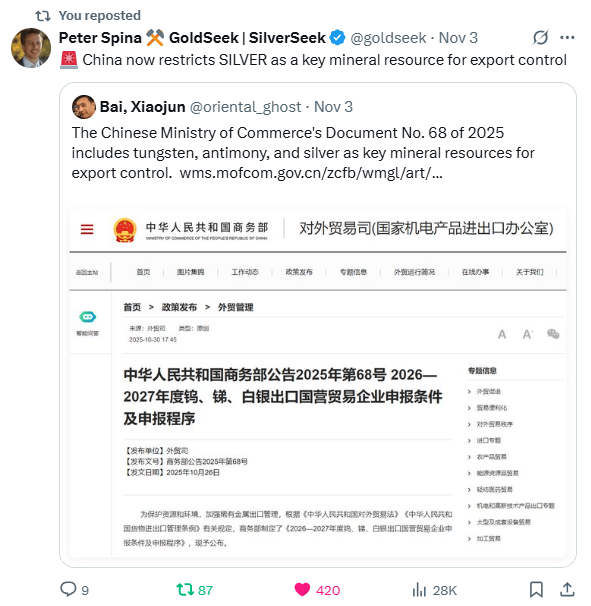

China just put SILVER behind a gate. Here’s the punchline:

When the world’s factory restricts silver exports, the free float shrinks.

Fewer bars leave the East → less metal for LBMA/COMEX → spot premia/backwardation stickier → paper shorts must hunt real ounces in a thinner pool.

Why now: Beijing is prioritizing domestic needs (solar/EV/electronics) and optionality in geopolitics.

Pair that with tight global funding and already-drained Western inventories, and you’ve got less supply meeting more “must-have” demand.

LEVERAGE, simply: The paper market stacks claims on the same ounce.

When physical outflow is gated, those claims crowd the same door. Borrow fees rise, hedges chase, and “cap the price” trades become fuel.

Implication (simple and bullish): This accelerates the shift to a physical-dominant tape where atoms set price.

Expect more persistent premia, sharper squeezes on wobbles, and a credibility bid for holders who own metal that settles on contact.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply