- The Sovereign Signal

- Posts

- How Close Is Japan To Blowing Up The Global Bond Market And Ushering In The Greatest Ever Round of Quantitative Easing?

How Close Is Japan To Blowing Up The Global Bond Market And Ushering In The Greatest Ever Round of Quantitative Easing?

Tick-tock.

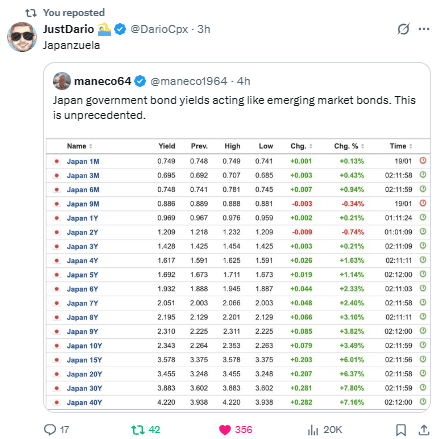

Japan’s bond market ≠ “just local drama.”

Japan is:

One of the largest sovereign debtors on Earth

A major holder of foreign assets including U.S. Treasuries

A key participant in global carry trades

A liquidity provider for derivatives via cross‑margin flows

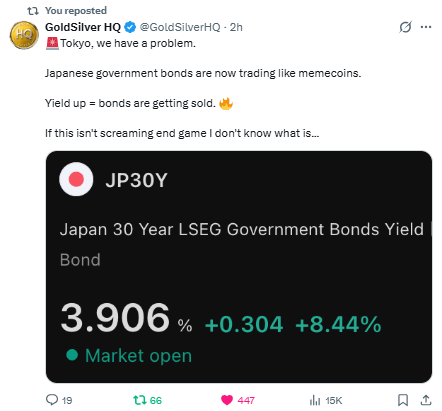

When Japanese yields spike, that tells you:

🔹 QE inventories are being questioned

🔹 Confidence in fiat bonds is breaking

🔹 The cost of capital is rising where it cannot afford to rise

🔹 A sovereign with massive balance sheet risk is repricing

This isn’t mere “emerging market behavior.”

It is systemic leverage shedding.

And remember: Japan has been leaking deflationary fiat for decades.

The fact that this bond repricing looks violent instead of “controlled” is itself a stress marker.

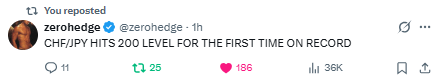

This is a risk–sentiment currency signal, not an FX price signal.

CHF = safe haven anti‑fiat deflationary currency

JPY = terminal liquidity provider in a fiat‑debtor regime

When CHF strengthens sharply against JPY:

✔️ Risk assets get sold

✔ Liquidity drains from carry trades

✔ Safe‑haven flows intensify

✔ Capital rejects fiat liquidity in favor of monetary certainty

That’s not random. That’s system stress transmission.

This will not stay isolated in Japan.

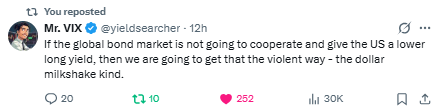

When somebody says “the bond market won’t give the U.S. a lower long yield,” they’re recognizing a structural break:

Instead of yield curve control, we’re seeing:

📉 Rising yields on long bonds

📈 Rising yields on sovereign risk

📊 Dissonance in monetary policy expectations

This is exactly the type of signal that precedes forced central bank intervention — not in moderation, but in escalation.

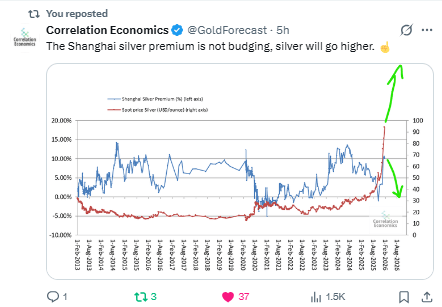

A rising Shanghai silver premium means:

✔️ Physical demand is outstripping official paper pricing

✔️ The anchor of price discovery (COMEX/SLV) is weakening

✔️ Real liquid supply is tightening globally

This is not “just Asia demand.”

It’s global price discovery stress.

Even if ETFs sold during the price run (as one chart noted), the real physical market is signaling unmet demand, not liquidity exhaustion.

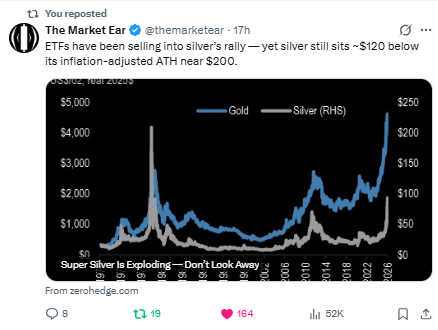

If silver is far below its inflation‑adjusted norm, and that divergence is widening — this signals systemic undervaluation relative to capital supply.

This is not a cyclical undervaluation — it is a regime undervaluation.

Commodities don’t go through these distortions without bursting them eventually.

This is not just another ‘commodity rally’

This is not traditional mean reversion.

What you’re seeing is a monetary stress event where:

➡️ Fiat confidence is degrading

➡️ Bond markets are losing their role as safe assets

➡️ Central banks are being forced into reactive QE

➡️ Price discovery is moving out of old paper conduits

➡️ Real physical scarcity is breaking through paper pricing mechanisms

These forces do not act in isolation — they feed back on each other.

That’s why gold and silver are acting like “anti‑fiat currencies” and why bonds are finally repricing.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply