- The Sovereign Signal

- Posts

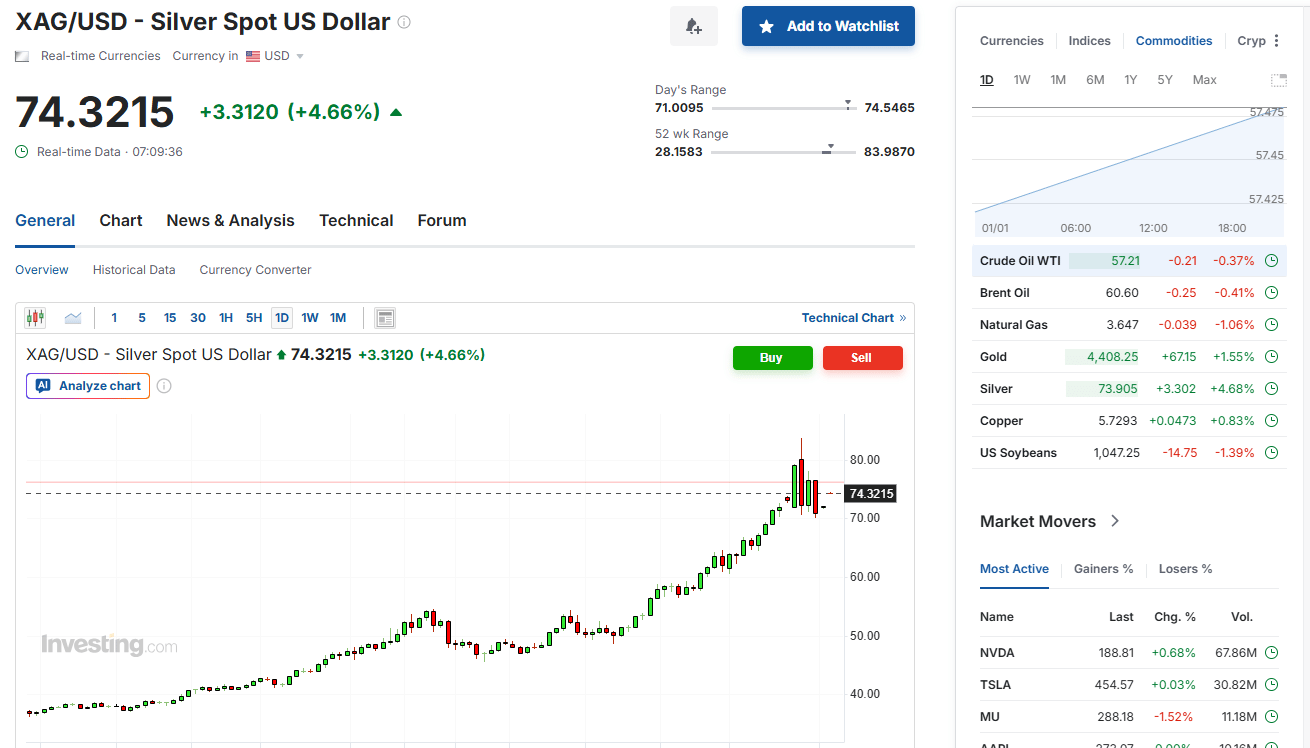

- J.M. Bullion Out Of Silver Kilo Bars, China and US Fighting To Secure Silver Supply Out Of Latin America, Michael Oliver Not Surprised To See Silver At $200, Possibly $500 In Next 6 Months or So, Silver Remains In Backwardation

J.M. Bullion Out Of Silver Kilo Bars, China and US Fighting To Secure Silver Supply Out Of Latin America, Michael Oliver Not Surprised To See Silver At $200, Possibly $500 In Next 6 Months or So, Silver Remains In Backwardation

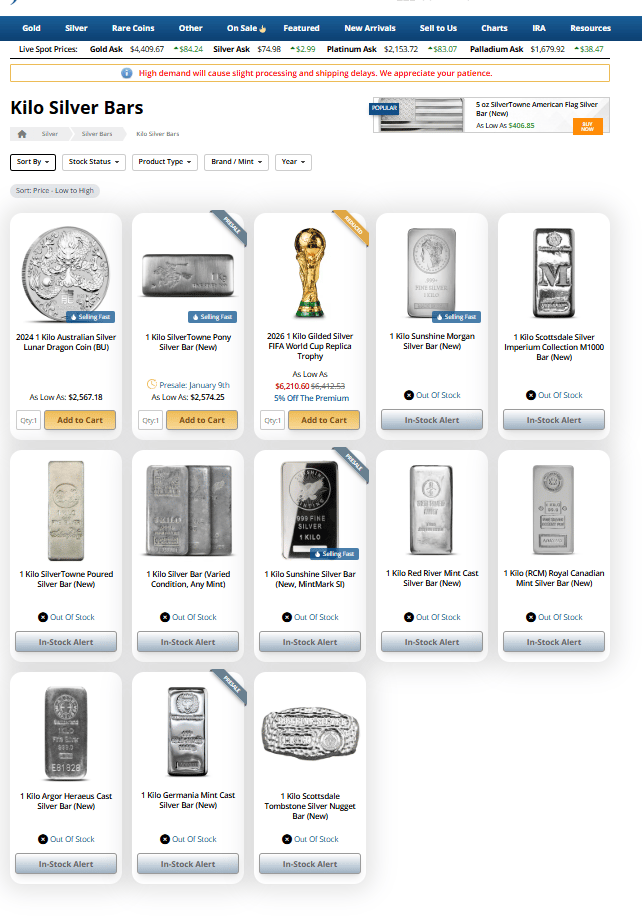

One of the largest bullion dealers in the United States (JM Bullion) is out of silver kilo bars.

Meanwhile, it’s rumored that in Japan panic is hitting the streets and retail is purchasing physical for up to $130 per ounce (USD equivalent).

If this keeps up while registered COMEX silver inventory keeps bleeding and SHFE/LBMA spreads stay wide, the path of least resistance is a stair-step repricing higher, punctuated by violent washouts as the paper side tries to slow the drain.

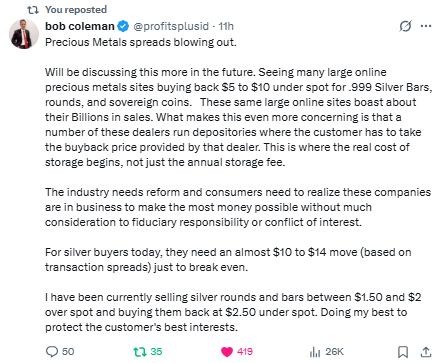

When big shops are bidding $5–$10 under spot and needing a $10–$14 move just to clear the round-trip, they’re not signaling “healthy market”—they’re protecting themselves in a storm.

Translation: volatility + tight wholesale supply = dealers shift risk to customers.

If you’re buying, focus on total round-trip cost and liquidity (who’ll pay you near spot fast), not just a shiny “over spot” banner.

In a squeeze, paper quotes are theater; the buyback window is what’s real.

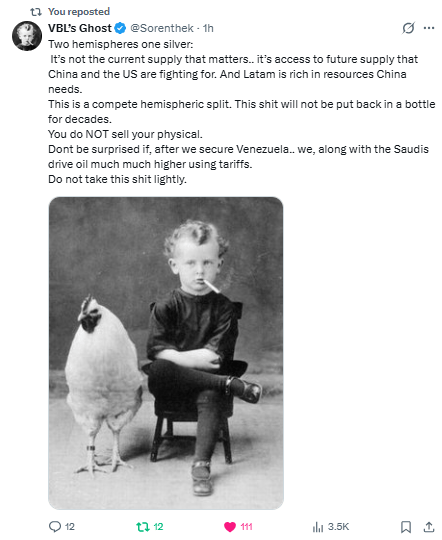

This isn’t about today’s ounces; it’s about who controls tomorrow’s mine mouths.

We’re sliding into a two-hemisphere commodity map—China locking Asia/LatAm flows, the U.S. scrambling for the rest—with tariffs and resource nationalism turning metal into policy.

If Venezuela gets “secured” and oil is tariffed higher alongside Chinese export controls, input costs rise, capital gets cautious, and future silver availability tightens by design.

That’s a structural bid, not a headline.

In a world splitting its supply chains for decades, you don’t flip your physical—you fortress it.

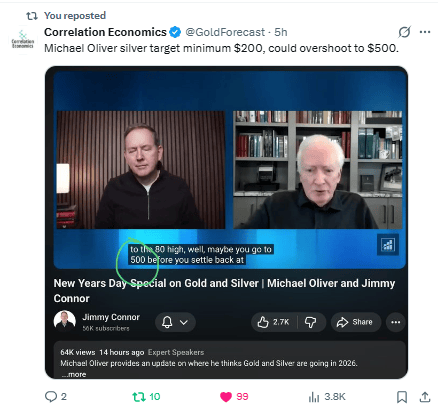

When a 50-year suppression cycle breaks under chronic deficits, weaponized supply chains, and monetary demand waking up, price doesn’t “rally,” it re-bases higher.

$200 is the new floor candidate; $500 is the panic-auction overshoot you get when paper yields to physics, then it settles back on scarcity, not sentiment.

In that path, volatility is a toll, temporary pain—own what can’t be rehypothecated, keep leverage on a leash, and let structural reality do the heavy lifting.

When spot silver > front-month silver futures, that’s backwardation, and it broadcasts one thing: “I want metal now.”

Near-term scarcity (or urgent hedging) is bidding up immediately available silver relative to paper that can be delivered later.

In precious metals, true backwardation is rare; when it shows up and persists, it’s usually a bullish tell for the short-run path.

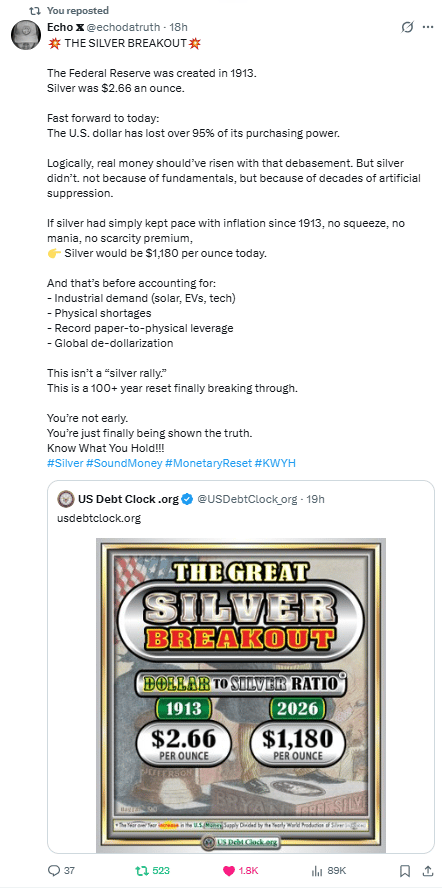

The math of $1,180.

Silver’s ceiling is partially a function of gold’s repricing and the gold-to-silver ratio (GSR).

Price ≈ Gold / GSR.

If gold is revalued to global prime collateral base at ~$20k and GSR compresses to 15 (historical average), silver ≈ $1,333.

If gold hits $12k and GSR 20, silver ≈ $600.

Today’s “industrial + deficit” world gives you $120–$300 (gold $2.4k–$6k, GSR 20–50).

So $1,180 lives in a reserve-reset + tight-GSR world, not just “EVs use more silver.”

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply