- The Sovereign Signal

- Posts

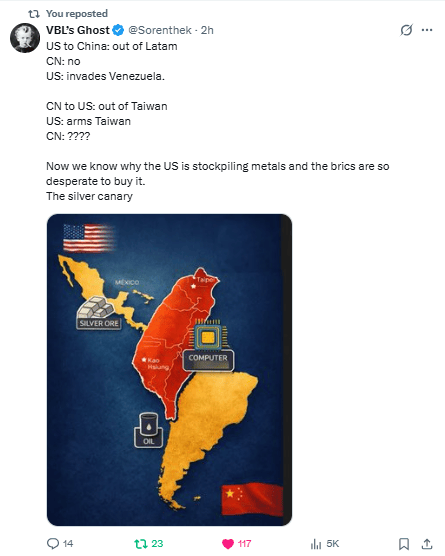

- Maduro Removed From Power Shortly After Chinese Diplomats Arrive In Venezuela As Collateral War Intensifies, Retail Silver Shortages Increasing In US, Silver Google Searches At An All Time High, Silver Long Positions Still Weak

Maduro Removed From Power Shortly After Chinese Diplomats Arrive In Venezuela As Collateral War Intensifies, Retail Silver Shortages Increasing In US, Silver Google Searches At An All Time High, Silver Long Positions Still Weak

Maduro is out.

This screams “resource war, hemispheric edition.”

The U.S. doesn’t need Venezuela for oil alone—it needs control over the Western Hemisphere’s metal supply lines as China tightens the spigot in the East.

Silver is the canary because it sits at the choke point of energy transition and defense: solar cells, power electronics, missiles, comms, datacenter hardware—every watt and weapon wants silver.

With China licensing exports and BRICS hoarding, Washington’s best countermove is to lock down logistics, ports, refining, and political allegiance across LatAm so Mexico/Peru/Bolivia flows don’t get rerouted or priced in Shanghai terms.

Caracas has been drifting into the China/Russia orbit; flipping or neutralizing that node protects Gulf/Caribbean routes, helps ring-fence Mexican refining and Andean concentrates, and gives the U.S. leverage over BRICS settlement schemes that would siphon bullion away from Western buyers.

This isn’t about one country’s mines so much as who sets the terms for Western supply while COMEX inventories thin and backwardation keeps flashing “tight.”

This isn’t just flags and photo-ops—it’s a hard signal about the base layer of money.

Right as China arrives in Venezuela to talk with Maduro…

Washington responds by drawing a bright line around the Western Hemisphere’s bullion and critical-metal corridors.

Gold and silver are the collateral that lets blocs run sanctions-resistant trade:

Asia is locking metal behind licensing walls, COMEX floats on fumes, and LatAm is the swing theater for ore, refining, and logistics.

Control the silver stream out of Mexico/Peru/Bolivia and the gold lifeline through Venezuela, and you control who prices energy, chips, and missiles.

That’s why diplomats moved first and marines follow—this is a custody fight over the monetary plumbing.

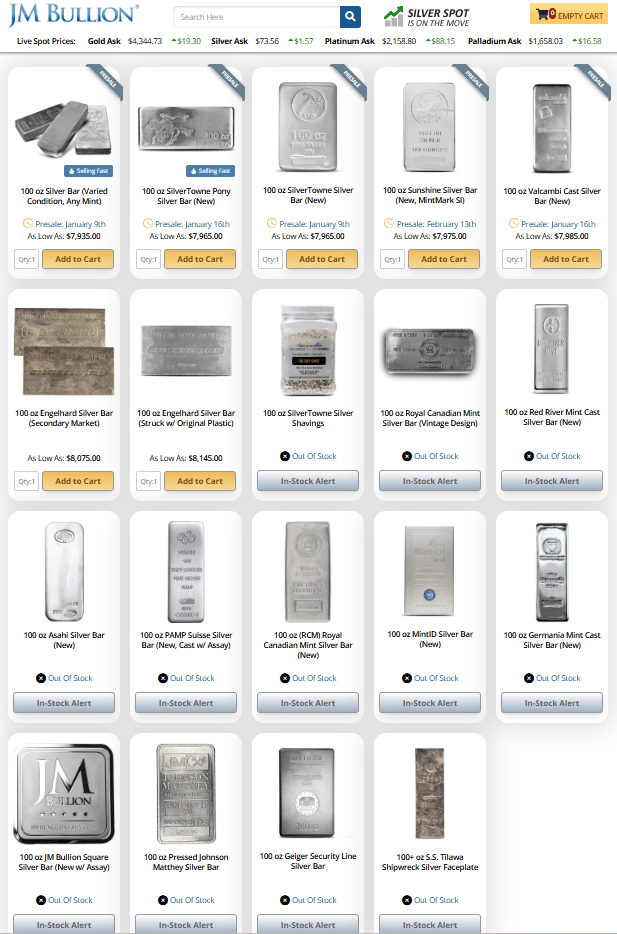

JM Bullion is one of the largest gold & silver dealers in the United States.

They are sold out of all but two kinds of 100 ounce bars. And there are massive premiums on what is available.

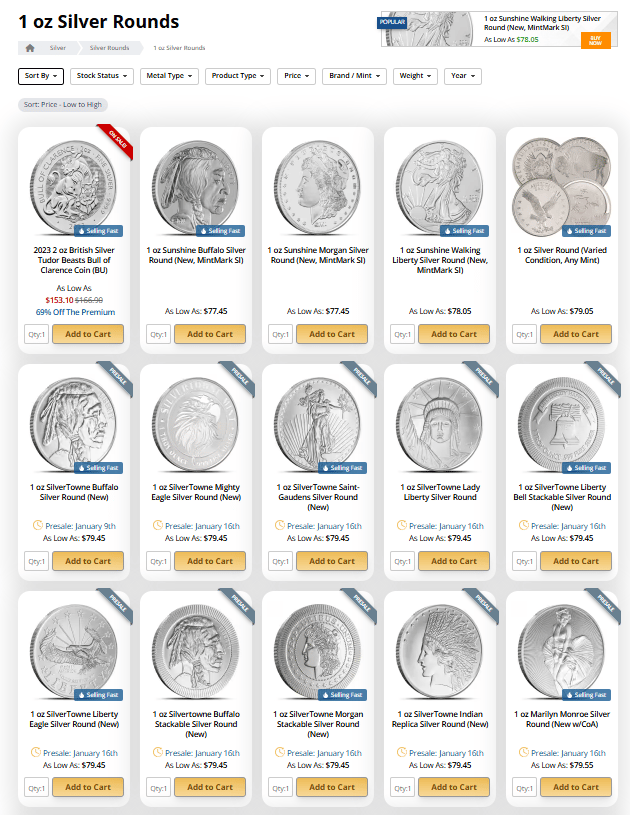

Notice that the premium on the only available one ounce silver rounds is much smaller than the premium on the only available 100 ounce silver bars.

Wholesale-sized metal is vanishing first, so dealers jack 100-oz bar premiums above 1-oz rounds because the risk isn’t retail—it’s delivery.

If vaults/refiners can’t promise restock dates, a 100-oz promise is scarier to make than a 1-oz trinket, so price protection shifts to the big bars and presale “dates” become hopium.

That upside-down premium curve means the real squeeze is at the commercial interface, not the coin counter.

Translation: Inventory stress.

Searches just went vertical right as wholesale bars disappeared and presales turned into prayers.

That’s the classic sequence: supply gets strangled first, then the crowd shows up and pays the panic tax.

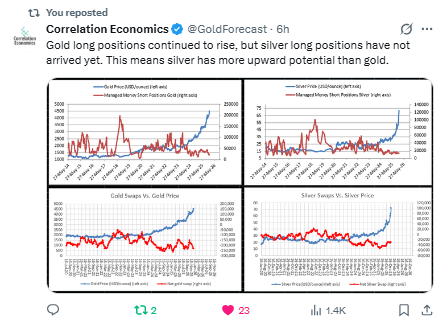

Retail just found the door, but the big money hasn’t walked in yet.

Gold’s party just got started; silver’s dance floor is wide open with the DJ turning up the volume.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply