- The Sovereign Signal

- Posts

- $58.80 Is The Trigger Right Now In Silver, 2nd Largest Silver Producer Implementing Export Restrictions on Jan 1st, Japan Continues To Move Markets Towards Global Margin Call, Hedge Funds Overcrowding AI Trade More and More, U.S. Debt Has Increased 1,100% Since 1990, Consumer Credit Tightening

$58.80 Is The Trigger Right Now In Silver, 2nd Largest Silver Producer Implementing Export Restrictions on Jan 1st, Japan Continues To Move Markets Towards Global Margin Call, Hedge Funds Overcrowding AI Trade More and More, U.S. Debt Has Increased 1,100% Since 1990, Consumer Credit Tightening

Japan continues to inch markets closer and closer to a global margin call. Can we guess which assets will benefit the most from next cycle of easing?

58.80 is the trigger.

Hold above it and the flag confirms—fuel loads, stops flip, and we slingshot higher fast.

Lose it and we cool off, but as long as 58.80 keeps acting like a floor, the path of least resistance is up.

Add this to the squeeze math:

5th straight year of deficit + China tightening exports shrinks the tradable float.

India remonetizing (using silver as collateral) turns savers into price-insensitive balance-sheet demand.

Russia signaling state-reserve buys invites BRICS copycat policies—official-sector flows that don’t flip on dips.

Net: more metal pulled off market and locked on balance sheets just as supply thins.

That’s how you get premiums up, lease/borrow up, basis blowouts, backwardation risk—and price discovery migrating to physical.

Gold anchors; silver compresses the gold to silver ratio and does the violent catch-up.

Japan’s 20Y screaming toward 3% isn’t a local story—it’s the fuse.

When the biggest foreign holder of Treasuries wobbles, the yen carry trade snaps, USTs get sold to defend the yen, and a global margin call ripples through everything.

The worse the leverage strain, the louder the policy response.

Translation: another, bigger easing cycle is loading—sending precious metals’ that much higher.

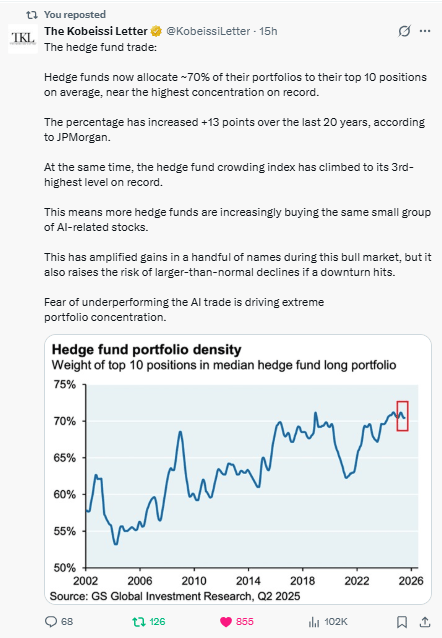

AI trade = glass tower.

Crowding:

Hedge funds jam ~70% into their top 10—mostly the same AI darlings.

Circular cash:

Vendors, customers, and partners buy each other’s stock (buybacks, credits, SB-comp) → self-reinforcing valuations.

Leverage layer:

Options/gamma, margin, and basis trades amplify every tick.

When funding tightens (SOFR/overnight funding rate pops), or JGB/UST vol spikes, this concentration + leverage becomes a global margin call: de-grossing, forced selling, gap risk.

Translation: markets priced to perfection on a reflexive AI loop; this will eventually unwind.

The more leverage and the more crowded this trade gets, the more vicious the unwind will be.

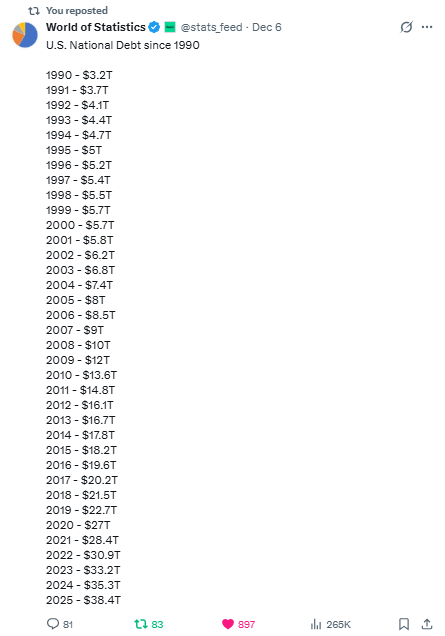

The curve of debt won’t flatten; politics won’t fix math.

In a system this leveraged, the only durable path is re-collateralization—linking liabilities to the best base-layer collateral.

How that shift actually shows up:

Gold revaluation / reserve build:

central banks keep stacking; balance sheets are quietly migrating to hard collateral.

Gold-linked paper:

sovereign “gold-indexed” bonds, repo eligibility for bullion, wider collateral haircuts on weak IOUs.

Price discovery to physical:

the more debt outruns GDP, the more markets pay for assets with no counterparty risk.

Endgame: the system either keeps inflating promises—or it re-bases on scarce collateral.

History votes for the latter. Gold leads; silver explodes behind it.

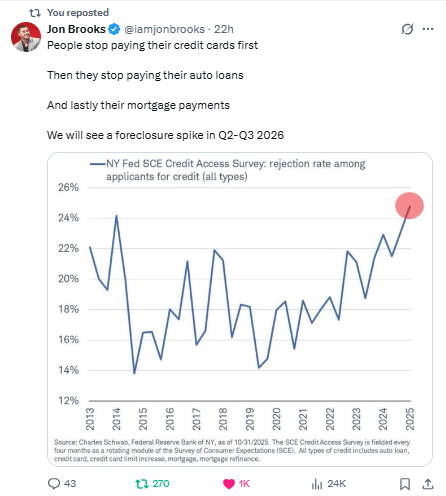

Credit is shutting off.

Rejection rates near decade highs = consumers are tapped and lenders are tightening.

The sequence is ugly: miss cards → miss autos → miss mortgages.

That lag points to housing stress peaking 2026.

Tight credit → consumption down, used-car and lower-tier housing under pressure, bank losses up.

Policy reflex is predictable: to cushion the hit, we get easier money and new facilities—financial repression, not austerity.

Bottom line: the squeeze is on, the defaults come in waves, and the response is more liquidity.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply