- The Sovereign Signal

- Posts

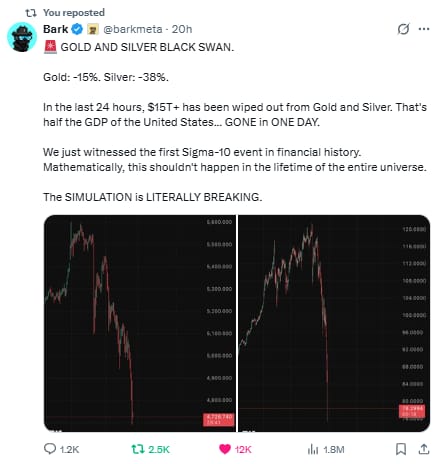

- "In the last 24 hours...half of the GDP of the United States" was liquidated from gold and silver. "We just witnessed the first Sigma-10 event in financial history. Mathematically, this shouldn't happen in the lifetime of the entire universe."

"In the last 24 hours...half of the GDP of the United States" was liquidated from gold and silver. "We just witnessed the first Sigma-10 event in financial history. Mathematically, this shouldn't happen in the lifetime of the entire universe."

In a single day, gold was smashed as much as -15%, and silver obliterated as much as -38% at the session lows.

Over $15 trillion in notional value vanished — nearly half the size of U.S. GDP.

These don’t look like organic moves.

They look engineered — high-frequency trading (HFT) hit jobs, circuit breakers ignored, and inventory distortions exposed in real time.

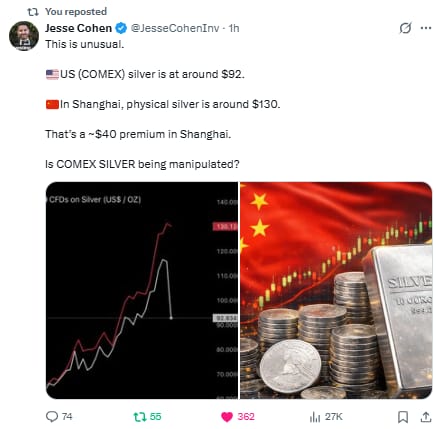

📉 Price Dislocations: COMEX silver crashed to $85 while Shanghai physical silver held near $130.

That’s a staggering ~$40 premium in China — a signal of physical tightness in the East clashing with synthetic pressure in the West.

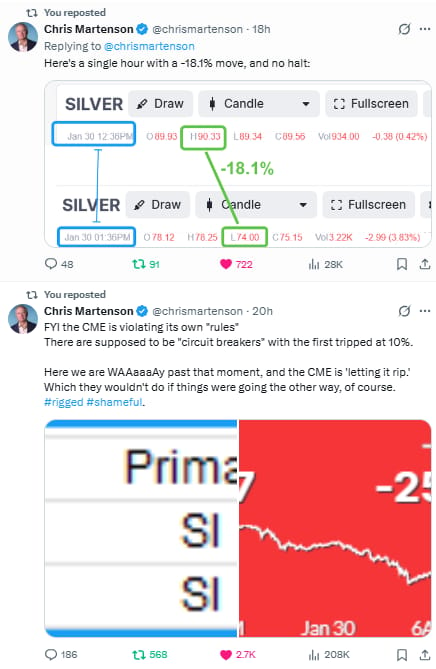

Silver on COMEX fell 18.1% in a single hour.

No halt. No circuit breaker. The rulebook was tossed.

💥 Derivative-Driven Mayhem: Borrow rates for $SLV surged, signaling aggressive short positioning.

Despite record demand, silver was sold off in size — 3.2Moz of COMEX’s “ready to deliver” inventory was dumped during the collapse.

The supposed market crash looks more like forced liquidation by design — a distortion to kill momentum and let the big shorts cover.

🧠 Massive Discrepancy Between Paper and Physical: Shanghai premiums surged to record levels.

Physical silver is being vacuumed out of COMEX, the Shanghai Futures Exchange, and vaults worldwide — even as spot prices flash a broken signal.

ETFs saw major inflows in gold (nearly 1 million oz added) while 3.2 million oz of silver were pulled out.

That’s not selling. That’s stacking.

…the big banks just got their chance to cover silver shorts at fire-sale prices during an orchestrated smash — possibly coordinated with suppressed COMEX circuit breakers and Fed market interventions.

Now that they've reset risk and reloaded long, a violent upside move ("to $500" plus) becomes not just possible but likely.

The question is when.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply