- The Sovereign Signal

- Posts

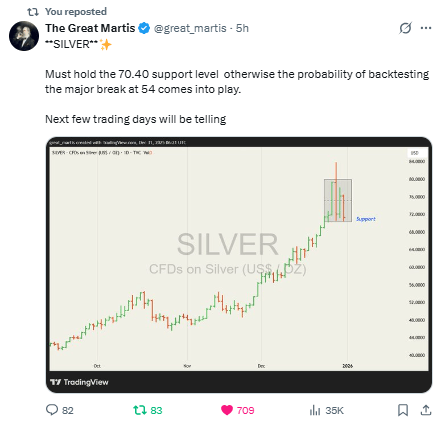

- "Silver isn't just rallying. It's breaking into a 'new reality' of price discovery..." Rumors Circulating Regarding Volatility In Silver, CME Hikes Margin Requirements in Silver AGAIN For The Second Time In 3 Trading Days, China To Control 60-70% Of Tradable Silver Supply, $70.40 Current Level That Needs To Hold

"Silver isn't just rallying. It's breaking into a 'new reality' of price discovery..." Rumors Circulating Regarding Volatility In Silver, CME Hikes Margin Requirements in Silver AGAIN For The Second Time In 3 Trading Days, China To Control 60-70% Of Tradable Silver Supply, $70.40 Current Level That Needs To Hold

Short-term price action is noise. Fundamentals are what matter, something mainstream financial media is blissfully ignorant of.

“Silver isn’t just rallying.

It’s breaking into a “new reality of price discovery after 50 years of suppression.”

We’re not saying it’s going to go up in a straight line. We’re saying the fundamentals are unparalleled.

Fifty years of underpricing a monetary metal is colliding with monetary decay and systemic stress, so price discovery will come in violent waves—smashes included.

The gold cross-breakout says the dam broke; margin bumps are side noise.

Volatility is simply the ticket at the door to a much higher equilibrium.

Strip out the rumors and you’re left with a monetary metal re-awakening after 54 years—right as a hyper-interconnected, debt-bloated system staggers.

Structural deficits for 5 consecutive years, Eastern premiums, and rising delivery preference aren’t narratives; they’re plumbing.

Price will lurch, headlines may mislead, but the direction of travel is set: capital is rediscovering silver’s monetary gravity.

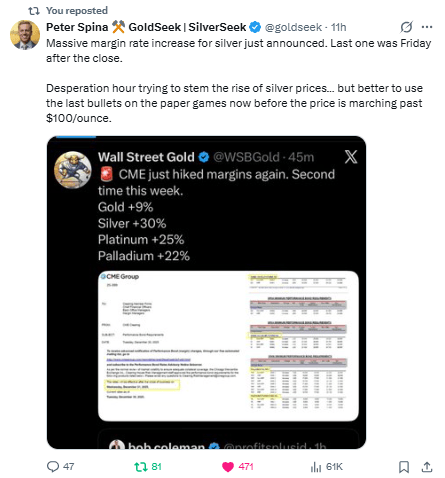

CME keeps hiking margins because the paper brakes are smoking.

That’s a volatility tax on speculators, not a fix for a structural shortage and a re-awakening monetary bid.

When a hyper-levered, hyper-interconnected system hits the most electrically conductive metal on the planet with tight supply and rising delivery demand, you don’t extinguish the fire—you raise the pressure.

These hikes are sandbags on a cracking dam; the flow is fundamentals: scarce units, east-led premiums, and a 54-year dormant monetary instinct snapping awake.

Price won’t move in a straight line, but the destination is north.

Cranking margins toward “SPAN territory” doesn’t fix silver—it starves the paper casino.

Hikes force weak hands to puke, shrink open interest, and accelerate the migration from futures to bars—right as we sit on a five-year structural deficit and a re-awakening monetary bid.

In a hyper-interconnected debt binge, higher margin is gasoline on basis stress: liquidity thins, premiums widen, and price discovery migrates to where metal actually moves.

Translation: every notch up in margin kills the contract’s illusion faster and hands the narrative to physical—where the fundamentals are uncompromising.

Margins are choking the paper side just as China turns the physical spigot into a licensing gate—and they refine the majority of global supply.

That combo forces price discovery out of the futures pit and into a five-year structural deficit with re-awakening monetary demand at the endgame of a hyper-levered cycle.

Translation: widening premiums, stubborn backwardation, and a scramble by Western manufacturers and policymakers to secure metal—via stockpiles, offtakes, and buying mines.

Weaponize supply in a debt supercycle and the chart doesn’t just go up; it changes venue.

Either way, doesn’t change which way it’s going the next 5-10 years.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply