- The Sovereign Signal

- Posts

- New Record $142 Trillion Global Money Supply, Record CMBS Defaults, Extreme Fear Returns To Markets' Near All Time Highs, Silver Primed To Go Parabolic

New Record $142 Trillion Global Money Supply, Record CMBS Defaults, Extreme Fear Returns To Markets' Near All Time Highs, Silver Primed To Go Parabolic

Global liquidity surged +6.7% YoY to a record $142T, while commercial mortgage delinquencies hit all-time highs, and fear indexes plunged to 17 (extreme fear). At the same time, silver vault holdings fell to ~825M oz amid five straight years of supply deficits—just as Washington labeled it a critical mineral. After 54 years of global fiat money, leverage is gasping for real collateral. The era of speculation is ending; the age of intrinsic value is awakening.

Silver just moved from “nice-to-have” to “national-security hardware.”

Here’s the quiet thunder:

Policy shock:

The U.S. just labeled silver a critical mineral—which unlocks federal funding, stockpiling, procurement priority, and potential export controls.

That puts governments in the same checkout line as manufacturers.

No substitute, everywhere:

Silver is the best conductor of heat/electricity.

It’s the bloodstream for solar, chips/AI, defense, medicine, water, and grids.

You can swap battery chemistries; you can’t swap silver.

Structural squeeze:

We’re in the 5th straight annual deficit, and ~70% of supply is by-product—even big price moves can’t quickly create new mines.

Leverage (why it bites):

Paper claims (ETFs, futures, leases) multiplied faster than metal in vaults.

As governments and industry compete for atoms, anyone short paper must buy metal—or get run over.

Leverage turns tightness into air-pocket squeezes.

Why now:

Higher rates killed “free money” narratives; capital is rotating to real collateral.

Energy transition + datacenter buildout = demand that doesn’t care about stories.

Implication: Price discovery is migrating from promises to bars.

With policy tailwinds, inelastic supply, and systemic under-ownership, silver’s upside is HIGHLY asymmetric—the kind that doesn’t need hype, only delivery.

The Age of Illusion Meets Gravity

We’re 54 years into the first global fiat experiment—every major economy running on artificially cheap debt and the illusion of infinite liquidity.

Decades of easy money turned debt into dopamine and speculation into a lifestyle.

LEVERAGE is the illusion of mastery over time.

Every asset class—stocks, real estate, even “innovation”—has been priced as if money would stay nearly free forever.

But when central banks hit the wall and can no longer conjure exponentially more liquidity without the risk of hyperinflating the currencies, gravity returns.

The air comes out of valuations built on leverage, not productivity.

This isn’t the end—it’s the rebirth.

Real value, real productivity, and real builders are coming back.

As more and more leverage cyclically unwinds, the market will find true equilibrium once again—and will be rebuild on a rock solid foundation.

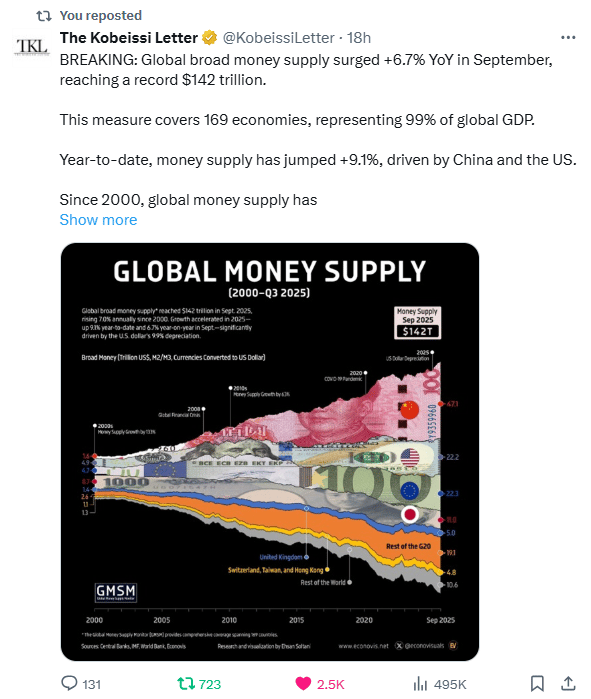

The Debasement Engine

Global money supply just hit $142T, up +6.7% YoY and +9.1% YTD.

That’s not growth; that’s dilution. When more units chase the same real stuff, each unit buys less. Welcome to the fiat super-cycle.

Why now:

Debt math broke.

Deficits don’t self-heal at high rates; they demand more issuance.

Leverage needs lubrication.

To stop cracks in banks, bonds, and credit, policymakers ease the spigots—quietly or loudly.

Geopolitics tax the system.

Re-shoring, war budgets, and industrial policy are inflationary by design.

LEVERAGE, plain:

Governments borrow → banks create credit → assets go up → collateral “supports” more borrowing.

When interest costs bite, the loop requires exponentially more currency to keep collateral afloat. That’s why money supply rises even with “tight” talk.

Implications:

Term premium up, real yields unstable.

More debt supply competes for buyers.

Multiple expansion gets rationed.

Expensive stories sag; cash flow and collateral earn a premium.

Hard assets catch a bid.

Gold/silver/commodities are the anti-leverage—they don’t multiply with keystrokes.

Translation: the system is choosing dilution over default. Position for a world where nominal prints look fine, but purchasing power is the scoreboard that matters.

Fragile Euphoria

Stocks hover near highs while the Fear & Greed Index sits at 17 (Extreme Fear).

That combo screams one thing: the market is built on leverage, not comfort.

Why it feels unstable:

Debt stacked on debt.

Options on margin + structured products mean tiny dips trigger forced selling (brokers call, funds de-risk).

Narrow leadership.

When a few giants stumble, indices fall together as hedges and algos yank exposure.

Funding is pricier.

Higher rates raise the cost of carry, so volatility shocks hit harder and last longer.

LEVERAGE, plain English: borrowed money makes gains look smooth—until prices slip.

Then lenders demand cash, and selling begets more selling.

Implications: a routine –5% becomes –10% fast, with correlation spikes and credit spreads widening.

The flip side? This is the moment quality wins: real cash flow, clean balance sheets, and hard collateral (gold/silver) soak up capital when story-stocks wobble.

Bottom line: the tape isn’t broken—it’s tightly wound. Expect sharper air pockets and quicker rotations as the market detoxes from excess leverage.

The Canary Just Screamed — and It’s Echoing Through the Economy

Record-high CMBS delinquencies aren’t just a real estate problem—they’re a credit system tremor.

Here’s why this matters:

Commercial mortgage-backed securities are a major part of the plumbing of the U.S. financial system.

They sit in pension funds, insurance portfolios, banks, and money markets—the “safe yield” bucket that anchors trillions in institutional capital.

When those bonds crack, it pressures balance sheets everywhere.

Why now:

Rates reset higher → debt costs double or triple.

Vacancies rise → cash flow collapses.

Result: borrowers can’t roll, lenders can’t extend, and defaults cascade through structured debt.

LEVERAGE, plain English:

Every skyscraper, office park, and shopping center was financed on cheap debt.

When rates rose, the value of that collateral fell—leverage flipped from amplifier to detonator.

One building’s missed payment ripples through bond tranches, bank liquidity, and credit spreads, tightening conditions across the economy.

Systemic significance:

CMBS isn’t isolated—it’s the bonded tissue linking real estate, credit markets, and bank solvency.

Rising delinquencies force lenders to hoard cash, pull back lending, and dump risk assets.

That’s how a “property problem” morphs into a liquidity crunch.

The silver lining:

This is leverage being purified.

The weak hands are being flushed out so real capital—patient, unlevered, productive—can step in.

As paper credit burns off, real collateral (gold, silver, hard assets) becomes the new foundation. The reset is painful, but it’s how systems heal.

Silver’s Quiet Revolt

Facts with teeth:

We’re in year 5 of global silver deficits.

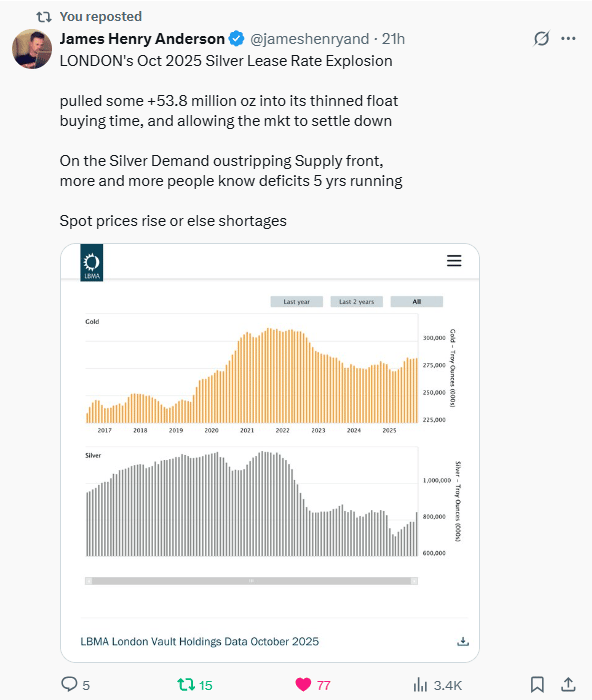

London lease rates spiked, pulling ~53.8 Moz into a thinned float—temporary breathing room, not new supply.

Vault holdings keep sliding while industrial pull (solar/EV/chips) grinds higher.

After millennia as money, silver spent the last ~50+ years demonetized. That amnesia is ending.

Why this matters now (LEVERAGE!):

Paper claims—futures, swaps, rehypothecated bars—scaled far faster than deliverable ounces.

In a debt-soaked, high-rate world, collateral beats narrative. Each missing bar forces buy-backs and rolls, turning small supply gaps into air-pocket rallies.

Mechanics in one breath:

Deficits shrink the tradable float → lease rates jump → shorts pay more to borrow metal → some cover, some roll → basis tightens → spot leads.

If deficits persist, paper must chase atoms.

Implication:

Price doesn’t need a legend; it needs delivery.

With five years of deficits, falling inventories, and policy/industry hoarding, the path of least resistance is up—convexly.

The longer silver remains the cheapest “former money” with rising industrial demand, the more likely the market re-prices it as collateral again, not just a commodity.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply