- The Sovereign Signal

- Posts

- 🔥 No Shares Left to Borrow — The Fuse Is Lit

🔥 No Shares Left to Borrow — The Fuse Is Lit

Zero Shares Left, Signals Flashing: SLV Borrow Dries Up as Swap Spreads, SOFR‐OIS, and Sovereign Yields Telegraph The Bedrock Of Global Finance Under Increasing Strain

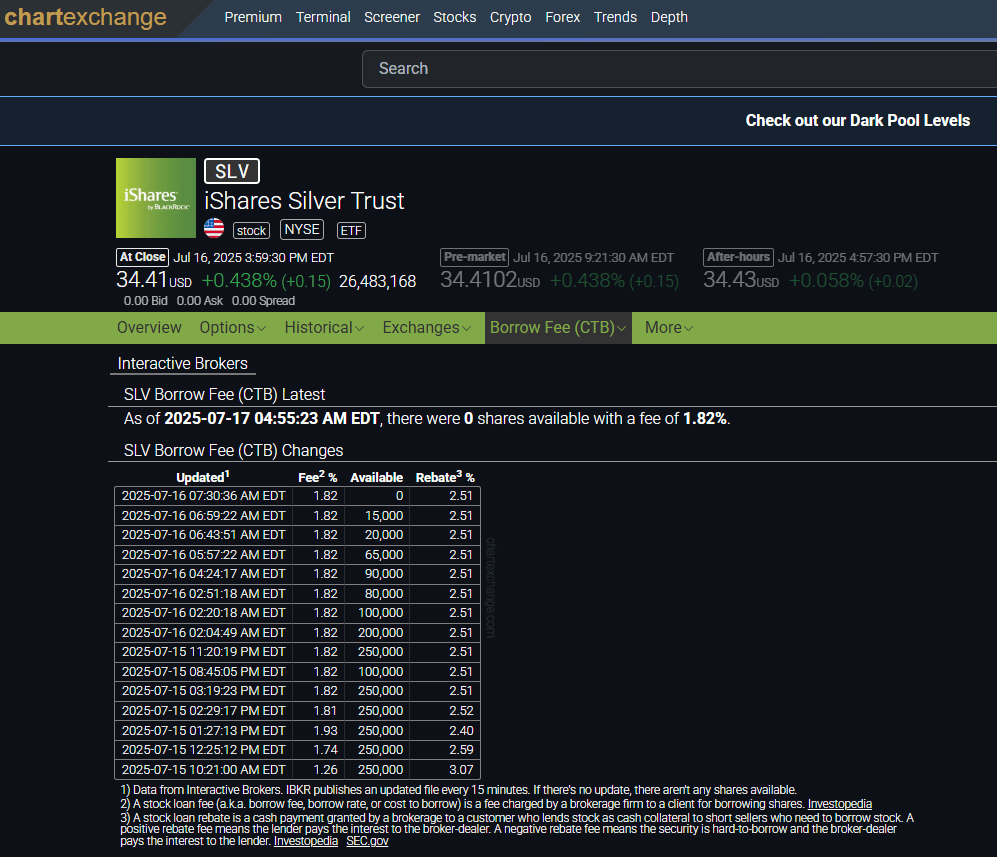

As of 7:30:36AM EDT yesterday morning, something extraordinary happened in plain sight:

📉 SLV shares available to borrow hit zero — and it has stayed there ever since.

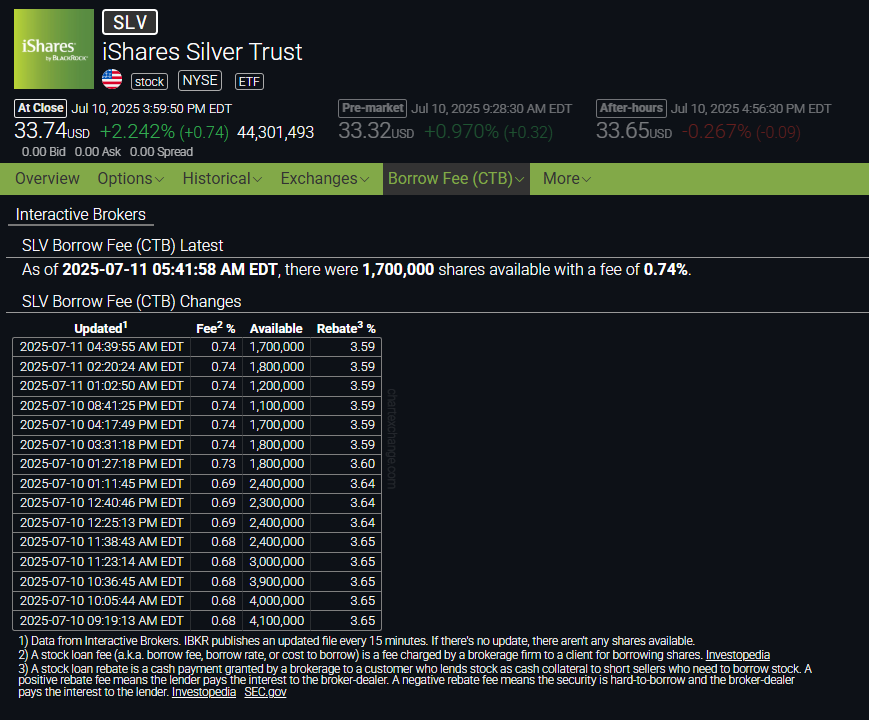

Borrow rates sat at just 0.68% with as much as 4.1M shares available on July 10th.

By Tuesday morning, they had already climbed to 1.03%…

Borrow costs continued to spike to 1.93%, settled at 1.82% and then the bottom fell out.

Zero shares to borrow.

Almost 24 hours later and still no shares available to short.

👉 This is not normal market behavior.

It is a flashing red warning that shorts are under mounting stress, scrambling to locate supply in a market with less and less slack.

It’s not just a chart tick — it’s the pressure valve of a much bigger system starting to hiss.

💡 Zoom out to the foundation of global finance:

The stress showing up in SLV is not isolated.

It’s happening against a backdrop where the base layer of the entire financial system — sovereign debt — is quietly fracturing.

For decades, two markets have been treated as immovable bedrock:

🇺🇸 U.S. Treasuries — the largest sovereign bond market and the collateral behind every repo, every derivative, every overnight funding operation.

🇯🇵 Japanese Government Bonds (JGBs) — the second largest sovereign bond market in the world, held by institutions that also hold more U.S. Treasuries than any other nation on Earth.

These are supposed to be the anchors.

But both are now slipping their moorings:

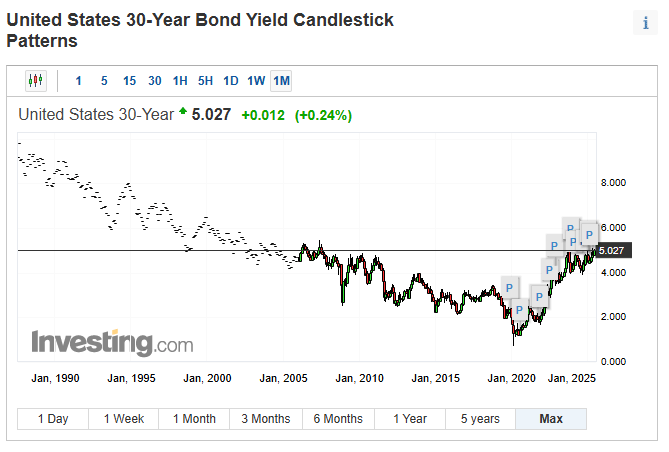

📈 U.S. 30‑Year Yield: recently surging above 5 and ~ 5.03% this morning.

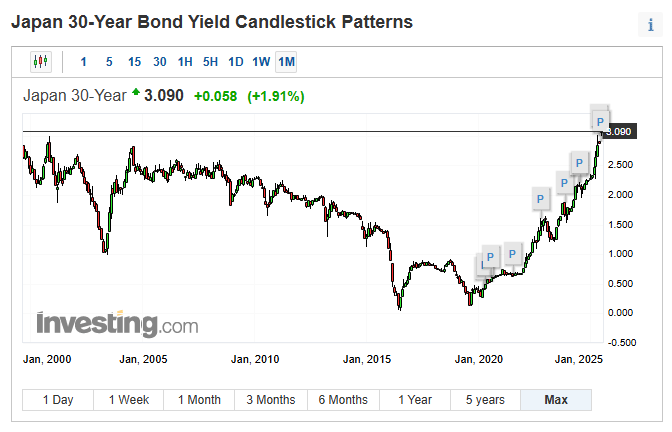

📈 Japan’s 30‑Year Yield: ripping to an all time high of 3.2% on July 14th and now hovering ~ 3.078% as the BOJ burns ammo to defend its own bond market.

⚠️ Why this matters:

When yields rise like this — and stay there — it’s not just “rates.”

It’s the very collateral chain of the global system straining under its own weight.

Every repo, every swap, every leveraged position built on those bonds becomes more fragile.

We’ve been watching the forward signals scream it:

🔻 10‑year swap spreads at –29.7 bps

🔻 3‑year SOFR‑OIS spread holding in the high 20s

Both have been quietly front‑running this stress.

And the higher these go, or the longer they stay elevated, the more pressure they exert on global equities.

Why?

Because rising sovereign yields force up discount rates, choke off cheap funding, and expose every leveraged structure built on those “safe” bonds.

📉 Valuations compress.

📉 Liquidity thins.

📉 The cost of capital climbs — until something breaks.

✨ And here’s where it ties directly back to silver:

When trust in sovereign collateral erodes, markets begin to quietly rotate into what has always been trusted: real value.

Gold leads.

Silver follows as the lagging pressure release valve.

📦 On COMEX:

There are 450,896 gold contracts open representing 45.09M ounces of paper claims… against only 20.193M registered ounces available for delivery.

👉 Just 44.8% of open interest standing for delivery would drain the vault.For silver, the math is even more extreme: only 22.8% of open contracts would be enough to drain all registered stocks (delivery is generally between 1-3%).

💥 Read between the lines:

SLV borrow rates exploding.

Zero shares left to short.

JGBs and U.S. Treasuries — the twin bedrocks of the global system — both cracking higher in yields.

Swap spreads and SOFR-OIS screaming stress for months in advance.

📌 We are watching the fault lines form in real time.

📌 And as synthetic collateral wobbles, the rotation into real collateral accelerates.

🥇 Gold quietly becomes the anchor.

🥈 Silver, the lagging release valve, starts to roar.

Signal | Latest Level | Interpretation | Zone |

|---|---|---|---|

10‑Year Swap Spread | –29.7 bps | Still deeply inverted. Market prefers synthetic hedges over actual Treasuries — a structural warning that trust in sovereign collateral is thinning. | 🔴 Red |

Reverse Repo (RRP) | $197.086 B | Stabilized for now. Watch out for a sustained dip below $100 Billion. | 🟠 Orange |

USD/JPY | 148.68 | Yen will likely continue to weaken as BOJ forced to defend its bond market. | 🟠 Orange |

USD/CHF | 0.8034 | Hovering near historic lows and recent global currency reserves have more than quadrupled into the Swiss Franc but back above .80 for now. | 🟠 Orange |

3‑Year SOFR–OIS Spread | 28.1 bps | A spread this wide signals the market expects ongoing liquidity strain and curve distortion. | 🟠 Orange |

SOFR Overnight Rate | 4.37% | 4 bps point jump up from Fed effective funds rate highlights a little greater perceived risk amongst institutions lending to one another in overnight funding market. | 🟡 Yellow |

SLV Borrow Rate | 1.82% | 🔥 Squeeze signals intensifying. Borrow availability plunged from 4.1M shares last week → ZERO since 7:30:36 AM EDT yesterday (and still zero). Shorts scrambling to source silver. | 🔴 Red |

GLD Borrow Rate | 0.54% | Stable but quietly elevated, indicating background stress in gold lending persists. | 🟡 Yellow |

COMEX Gold Inventory | 36,797,531.57 oz (20.193 M Registered) | Total inventory up slightly; registered deliverable down marginally. Open interest rose to 450,896 contracts, keeping cover ratios tight and leverage elevated. | 🟢 Green (surface‑level only) |

10Y UST – JGB Spread | 2.917% | Spread climbing. Rising yields in both Japan and the U.S. are moving in lockstep — Japan’s stress is transmitting into the U.S. base layer. | 🟠 Orange |

Japan 30‑Year JGB | 3.082% | Close to recent all time highs. BOJ aggressively defending bonds, letting yen slide. Signals structural strain in the world’s 2nd‑largest sovereign bond market. | 🔴 Red |

U.S. 30‑Year | ~ 5.03% | Rising in tandem with JGBs — the global cost of core collateral is climbing, shaking the foundation of leveraged markets. | 🔴 Red |

SOFRVOL (Repo Usage) | $2.784 T | Cyclically climbing. The system is leaning ever harder and harder on overnight funding to stay solvent — a hallmark of fragility. | 🟠 Orange |

COMEX Silver Inventory | 497,181,967.227 | 195.58M Registered and available for delivery. | 🟢 Green (surface‑level only) |

Now let’s dive deeper into the signals that have been front‑running this chaos — the 10‑Year Swap Spread and 3‑Year SOFR‑OIS — and why they’re telling us the next chapter in sovereign debt stress is already being written.

🌐 Signals That Will Continue To Front-Run Chaos In The Bond Markets: 10‑Year Swap Spread & 3‑Year SOFR‑OIS

At a 30,000‑foot level, the global financial system rests on two massive pillars:

U.S. Treasuries and Japanese Government Bonds (JGBs).

These are not just assets; they are the collateral base layer on which every derivative, every repo transaction, every overnight funding line is built.

When those pillars wobble, everything sitting on them — equities, credit, commodities, even real estate — begins to tremble.

🔎 The Swap Spread as a Warning Beacon

A healthy system should show a modestly positive 10‑year swap spread.

A swap spread is the difference between the fixed rate on an interest rate swap and the yield on a Treasury of the same maturity.

When the market trusts Treasury collateral, that spread tends to hover slightly positive: Treasuries trade as the safest instrument in the world.

But today?

✅ 10‑Year Swap Spread: –29.7 bps.

This started to go deeply negative September last year.

👉 It means the market is preferring synthetic exposure via swaps rather than holding the actual bonds.

👉 It suggests dealers and large players are increasingly unwilling to warehouse Treasuries on balance sheet — a sign of collateral distrust.

The message?

The foundation is wobbling.

🔎 SOFR‑OIS: The Forward Tell on Funding Stress

Next, look at the 3‑Year SOFR‑OIS spread.

SOFR = Secured Overnight Financing Rate (repo-based).

OIS = Overnight Index Swap, a proxy for expected policy rates.

In a smooth system, the spread between the two stays tight, reflecting low funding risk.

But we’ve been watching it grind into the mid‑20s, now 28.1 bps and holding.

That is not noise.

👉 It means the market is quietly pricing persistent funding stress years into the future.

👉 It’s the forward‑looking voice of repo markets saying: “We know the system is over‑levered and fragile.”

Historically, when this spread stays elevated, it precedes episodes of liquidity strain. Think:

Late 2019 repo crisis — SEVERE repo market stress PRECEDED COVID meltdown.

March 2020 COVID meltdown — SOFR‑OIS blew out before equity vol exploded.

🔗 Reading Between the Lines: Why These Two Indicators Matter Now

Put them together:

🔻 A negative swap spread signals mistrust in the foundation of the global financial system.

🔻 A stubbornly elevated SOFR‑OIS signals the cost of funding that collateral is structurally stressed.

This is not an academic footnote.

📌 These are the same dynamics that built up in 2007–2008 before sovereign collateral itself became a question.

📌 They are the same dynamics that exploded in March 2020 when the entire system sprinted into dollars and the Fed had to unleash what became a whole new era of stealth, perpetual QE via the repo markets.

🇯🇵 Overlay: Japan & U.S. Sovereign Debt Are Joined at the Hip

Now zoom out:

Japan’s 30‑Year just made a new all time high at 3.2% on July 14th.

The U.S. 30‑Year is climbing in tandem to ~ 5.03%

Japan is the single largest foreign holder of U.S. Treasuries.

The two markets are structurally linked.

👉 When Tokyo defends its bond market (printing yen, letting the yen weaken), it feeds the carry trade — cheap yen liquidity floods the world.

👉 But the larger and longer this dynamic persists, the more fragile the system becomes, because when Japan eventually has to defend its currency, that carry liquidity can pull the rug out from global equities quickly as we saw in late July-early August 2024.

This is the hidden plumbing behind why rising sovereign yields directly reverberate into U.S. Treasuries, repo markets, and risk assets.

🥈 Where Does Silver Come In?

Against this backdrop, silver isn’t just a chart — it’s a pressure release valve.

📉 Registered silver on COMEX: 195.58M ounces.

📈 Open interest: 171,905 contracts = ~859.5M ounces if all stood for delivery.

👉 ≈ 22.8% of open interest would have to stand for delivery to drain every single registered ounce.

Meanwhile:

✅ SLV borrow rate spiking from 0.75% → 1.82%.

✅ ZERO shares available to borrow since 7:30:36 AM EDT yesterday.

This is a sign of short stress building in real time.

When shorts can’t easily source silver, they pay more to borrow it — a market signal that tightness in the physical market is bleeding into the paper market.

🌌 The Big Picture: Reading the Signals

Swap spreads and SOFR‑OIS have been screaming for months that the foundation is cracking.

Japan’s bond market stress is a mirror of what’s coming for U.S. Treasuries, because they’re structurally intertwined.

Rising sovereign yields increase the weight on global equities and funding structures.

And in the background, as trust in sovereign collateral erodes, the system quietly rotates back to what it has always trusted: gold as the anchor, silver as the release valve.

⚠️ When the Base Layer Wobbles… Where Do You Want Your Wealth?

Even the CEO of JP Morgan said in late May/early June that the bond market is going to “crack” — and when it does, “you’re going to panic.”

I’m not sharing that to spark fear.

I’m sharing it because these signals — the deeply negative 10‑Year swap spread and the persistent mid‑20s 3‑Year SOFR–OIS spread — are the most organic, forward‑looking indicators we have of stress building in the foundation of the entire financial system.

U.S. Treasuries and JGBs are the base layer.

When that foundation wobbles, the entire structure above it becomes fragile.

And history shows what comes next: greater fractures in sovereign debt markets → more emergency liquidity injections → more currency debasement.

Ask yourself:

👉 What happens to the price of real, finite money when central banks are forced to flood the system again and again?

👉 What happens when the world rotates back to what worked for thousands of years before the greatest fiat experiment in recorded history began 54 years ago?

📌 This is why I’m so big on what I call “the old base layer”: gold and silver.

🥇 Gold — the timeless anchor.

🥈 Silver — the pressure‑release valve.

I can personally connect you with trusted referral partners — major U.S. precious metals dealers — to secure preferred pricing, fully insured delivery, or safe vaulted storage.

Only the most practical forms: bars, rounds, sovereign‑minted coins. No numismatics, no gimmicks. Just real metal.

💬 DM me or email [email protected] if you want to position yourself before those fractures widen.

Luke Lovett

📲 Cell: 704.497.7324

🌐 Undervalued Assets | Sovereign Signal

📧 Email: [email protected]

🔐 Legal Disclaimer 🔐

The content provided herein is for informational and educational purposes only and should not be construed as financial, investment, legal, or tax advice. I am not a licensed financial advisor, investment professional, or attorney. The views expressed are solely those of the author and are not intended to be relied upon for making investment decisions.

While every effort has been made to ensure the accuracy of the information presented, no guarantee is given that all content is free from error, omission, or misinterpretation. Market data, trends, and conditions are subject to rapid change, and past performance is not indicative of future results.

Some views expressed may reference public insights from respected analysts and commentators. Some third-party content may be paraphrased or summarized for educational purposes only, with attribution, and does not imply endorsement or affiliation. All rights remain with the original creators.

Always conduct your own research and consult with a licensed financial advisor or registered investment professional before making any investment decisions. By reading this publication, you agree not to hold the author liable for any losses or damages resulting from the use of this information.

I am not a metals dealer. All orders are processed directly by a licensed precious metals dealer. I do not hold funds, process transactions, or provide personalized investment advice.

Reply