- The Sovereign Signal

- Posts

- One Of The Largest US Precious Metals' Dealers Puts $10,000 Minimum Order Amount In Place, Chinese Silver USD Equivalent Now Trading 13% Higher Than US Silver, Silver Price Adjusted for M2 Money Supply is $744 Per Ounce, Top Putin Advisor Threatens Nuking Germany And The UK, Uranium Ready To Rocket

One Of The Largest US Precious Metals' Dealers Puts $10,000 Minimum Order Amount In Place, Chinese Silver USD Equivalent Now Trading 13% Higher Than US Silver, Silver Price Adjusted for M2 Money Supply is $744 Per Ounce, Top Putin Advisor Threatens Nuking Germany And The UK, Uranium Ready To Rocket

Tesla's Lithium refinery is the beginning of a new trend as big players rush to secure strategic commodity supply.

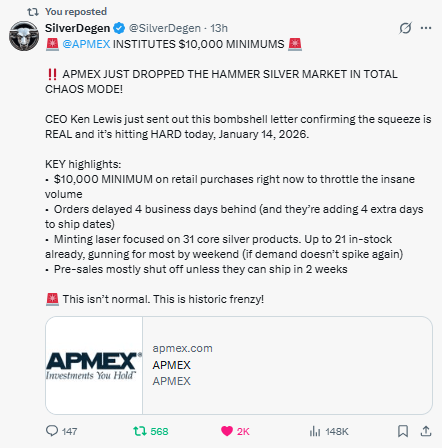

The retail silver market is breaking—this is what price failure starts to look like in its early stages.

$10,000 minimums aren’t about luxury—they’re a firewall.

APMEX is overwhelmed.

They’re triaging supply with blunt instruments: volume thresholds, shipping bottlenecks, and selective product access.

Delivery delays and product cutoffs are code red signals.

When a bullion dealer delays fulfillment and caps minting focus to just 31 SKUs, it means one thing: they’ve entered preservation mode.

The real price of silver is no longer on your screen.

It’s not $80. It’s not even $90.

It’s whatever price can actually clear a real ounce—if you can find one.

This isn’t demand hype. This is physical default.

Pre-sales getting shut off?

That’s code for: we can’t guarantee anything beyond two weeks.

When your dealer puts up a "whales only" sign, the window is closing.

What comes next isn’t a higher premium. It’s no bid, no offer.

…maybe the West isn’t mispricing silver. Maybe it simply doesn’t have it.

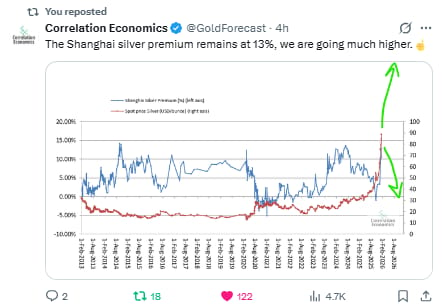

Because when Shanghai’s paying a 13% premium for physical, that’s not a prediction—it’s a signal.

The Western paper market isn’t just out of sync—it might be running out of metal.

That 13% gap isn’t a trading anomaly—it’s a geographic fracture in price discovery.

East versus West. Physical versus paper. Reality versus narrative.

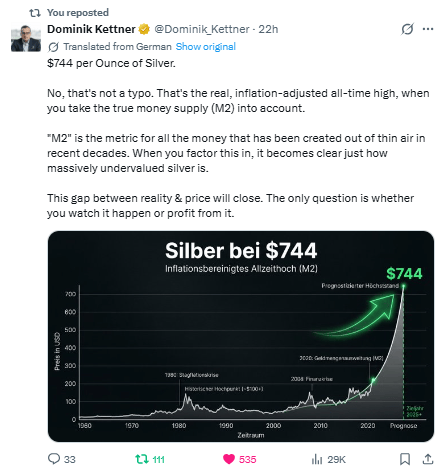

A $744 inflation-adjusted silver price isn't an exaggeration.

It's a forensic reconstruction of what silver should be if priced against real monetary debasement.

Not CPI inflation—M2. The actual money supply. The tsunami of fiat that’s been conjured out of nothing for decades.

Now cross-reference that with the Shanghai premium and APMEX lockouts.

The physical market is screaming that the gap between price and reality is no longer sustainable.

This isn’t theory—it’s convergence. And convergence isn’t slow. It’s a snapback.

Silver at $744 isn’t a moonshot. It’s reversion to mean under broken monetary regimes.

A recalibration when fake price discovery finally collides with hard physical limits.

This isn’t just bluster. It’s a dead serious tell about how close we are to the edge.

When a top Kremlin advisor threatens to nuke Germany and the UK over Ukraine, it’s not about military advantage—it’s about signaling that diplomacy is falling apart, red lines are burned, and containment is failing.

Russia is broadcasting that it sees total war as a live option.

This is how great power dynamics unravel—not with orderly negotiations, but with raw desperation wrapped in threats.

When nuclear powers start drawing maps with missiles, it means the geopolitical floor is cracking.

Anyone still treating markets, supply chains, and security assumptions as business-as-usual is asleep at the wheel.

The world is moving fast, and it’s not rotating back to normal soon.

What’s being revealed here isn’t just the price action of uranium—it's a pattern repeating across the entire commodity space: underinvested and now surging in sync.

The fact that uranium is setting up to explode higher right as threats of nuclear escalation hit the headlines is not just ironic—it’s prophetic.

War planning, energy insecurity, supply chain fragility—uranium sits at the intersection of them all.

This is about real assets repricing to reflect real risk in a world abandoning the illusion of geopolitical stability and monetary control.

The bid isn't just for uranium—it's for everything real, everything scarce, everything the West assumed would always be cheap and available.

Long the periodic table isn’t a meme anymore. It’s the macro.

This isn’t just Tesla building a lithium refinery.

It’s the early tremor of a seismic shift: the end of globalization’s cheap resource pipeline and the birth of nationalized, vertically integrated commodity empires.

When Elon Musk starts locking down lithium supply on U.S. soil, he’s not chasing ESG points — he’s front-running a global scramble for control over hard assets.

The rules of the game are changing. Countries and corporations alike are realizing that whoever controls the inputs controls the future.

First lithium. Then copper. Then nickel, silver, uranium — the entire periodic table is going strategic.

We’re witnessing the redrawing of supply chains not as an efficiency play, but as a survival mechanism in a world fragmenting along geopolitical, financial, and energy lines.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply