- The Sovereign Signal

- Posts

- Overnight Funding Liquidity Taps Aligning With Silver Price Direction, 50% Of COMEX Free-Float Silver Claimed In First 4 Days Of December, Japan Closer And Closer To Wreaking Havoc In Global Markets, 43% of Central Banks Set To Increase Gold Holdings Next Year

Overnight Funding Liquidity Taps Aligning With Silver Price Direction, 50% Of COMEX Free-Float Silver Claimed In First 4 Days Of December, Japan Closer And Closer To Wreaking Havoc In Global Markets, 43% of Central Banks Set To Increase Gold Holdings Next Year

The carry trade machine gets ready to seize while central banks hoard more and more bullion—overnight cash liquidity props the system as physical drains; silver leads the revaluation.

The implications of what’s going in silver cannot be understated.

SOFR (overnight funding volume) spikes every time silver rips = desks are borrowing overnight to defend short exposure (post more collateral, meet margin).

When silver cools, repo demand eases.

That’s not random—it’s the funding tail wagging the price dog.

Implications (short & sharp):

Silver strength is forcing cash needs in the plumbing; shorts are paying up just to hold lines.

The more this persists, the higher the odds of a disorderly squeeze (basis blowouts, backwardation, cash-settle risk).

In that setup, physical leads; paper follows. Gold anchors; silver has the torque.

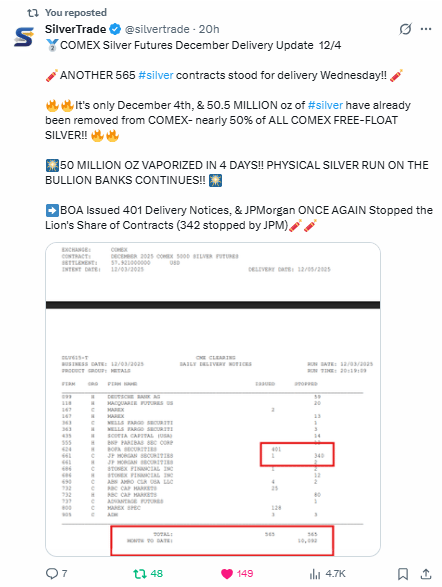

Half the COMEX free-float gone by Dec 4 = a real, physical run—not just paper shuffling.

BOA issuing, JPM stopping = big banks scrambling to source metal while another hoovers it up.

That’s stress at the core.

Each new delivery day tightens the noose:

borrow/lease rates rise → basis/EF P blowouts → premiums jump → backwardation risk.

When vault metal thins, price discovery shifts to physical.

Paper follows, violently.

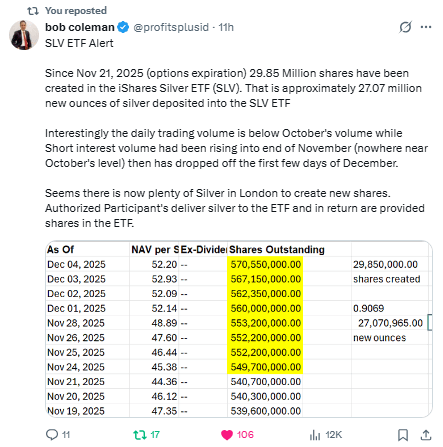

~30M new SLV shares (~27Moz) since Nov 21 = real demand.

That’s authorized participants (APs) finding/borrowing silver in London, swapping it into SLV baskets, and taking shares.

Rising shares outstanding while trading volume fades = quiet accumulation, not tourist FOMO.

This likely pulls metal from the same London pool that’s been backstopping everything—while COMEX is getting tapped for deliveries.

Pressure concentrates.

If LBMA tightens, ETFs are first to show it:

creations stall, NAV premiums pop, borrow/lease rates jump.

Japan is the wobble in the world’s Jenga tower.

10Y JGBs at 2007 highs = BOJ losing grip → yen carry snaps → forced de-risking everywhere.

And because Japan is the largest foreign holder of Treasuries, MOF defense of the yen = UST selling right into a thin market.

That means higher term premia, tighter dollar funding, and a faster march toward a global liquidity shock.

Translation: the weak point is Japan; the pressure spreads system-wide.

In that storm, gold anchors and silver explodes.

People are sleeping on Japan risk.

If JGBs crack, the yen-carry snaps and the largest foreign holder of Treasuries turns seller to defend the yen—term premia jump, dollar funding tightens, dealers pull risk.

That’s the transmission belt from Tokyo to USTs → credit → equities.

It won’t be a local wobble; it’s the kind of shock that ricochets through the whole system.

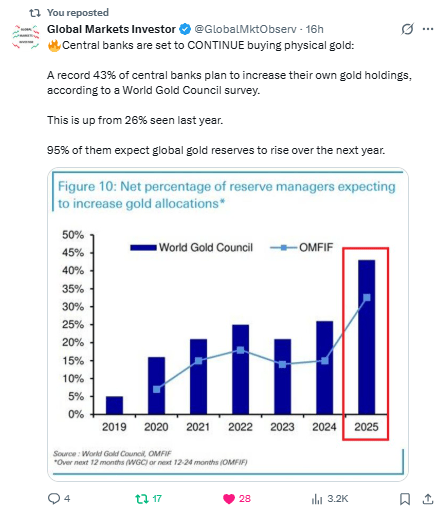

Central banks are the best-informed, deepest-pocketed traders on Earth—and they’re buying gold hand over fist.

Translation: they expect softer real rates, currency dilution, and sanction/settlement risk ahead, so they’re rotating reserves into base-layer collateral that no one can print or freeze.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply