- The Sovereign Signal

- Posts

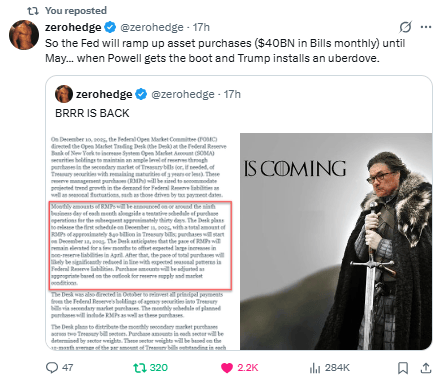

- QE Begins With Markets At All-Time Highs, Shiller PE Hits New All Time Record, Fed Begins Buying 40 Billion In Treasuries On Friday, "Uberdove" Arrives In May, 7 Fed Officials See No Cuts In 2026 (No Chance), And Silver Rips To Another All Time High

QE Begins With Markets At All-Time Highs, Shiller PE Hits New All Time Record, Fed Begins Buying 40 Billion In Treasuries On Friday, "Uberdove" Arrives In May, 7 Fed Officials See No Cuts In 2026 (No Chance), And Silver Rips To Another All Time High

The Fed’s buybacks/QE tame Treasury supply and term premium, keep funding/plumbing stable (repo/SOFR/collateral), and force bond yields lower to manage a $34T+ debt load.

Because stocks aren’t the patient—the bond market is.

It’s financial repression: stabilize bonds, cap borrowing costs—equities get stabilized.

The Shiller P/E just climbed to a 25-year high.

Translation: investors are paying near-dot-com prices for each dollar of cyclically adjusted earnings.

Back then, the Fed was hiking into the bubble; today it’s cutting into it.

That cocktail—very high valuations + easier money—usually means one of two things must adjust: prices or earnings.

History favors mean reversion in valuations.

Why it’s dicey:

The earnings yield (the inverse of P/E) is now tiny relative to long bonds, so stocks have very little cushion if growth cools or inflation pops.

Leadership is narrow and leverage is everywhere (options, margin, corporate buybacks).

When funding wobbles, crowded trades de-gross fast.

What tends to follow?

Either a choppy, low-return grind while profits catch up, or an abrupt repricing when the macro slips.

In a debt-heavy, cut-and-cap world, policy will try to paper it over (QE, lower real rates), which is exactly why hard collateral—gold for ballast, silver for torque—keeps attracting serious capital.

Read: the Fed is backstopping the bond market, not “stimulating” stocks.

Buybacks at $40–45B/month say Treasury supply and term premium are too hot for the system.

This caps borrowing costs, soaks up collateral stress (repo/SOFR), and leans into financial repression—lower real yields by policy, not growth.

Net effect: extends the debt super-cycle, fattens asset multiples, weakens the currency path. That’s bullish for gold and silver.

$40B/month in bill buybacks through May = stealth QE to steady funding and cap rates.

Then an uber-dove takes the helm = overt easing, softer real yields, bigger balance sheet.

That combo supercharges risk assets on the surface, but underneath it’s classic financial repression—and that’s where the asymmetry lives: gold and silver will go ballistic.

They all admit inflation’s still too hot and job risk is rising, yet the dots disagree on hike/hold/cut.

With debt saturated and leverage woven through collateral plumbing, every choice risks breaking something.

Powell’s “unique position” is just the point-of-no-return of financial repression—policy can only juggle which pain shows up first.

In that regime, the market starts pricing scarce collateral over promises.

Exactly.

Powell speaks, the market hears repression, and silver rips to fresh ATHs.

That’s the tell: when policy gets cornered, price discovery migrates to hard collateral first.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply