- The Sovereign Signal

- Posts

- Rumors of Massive Asian Silver Buyer Refusing Cash Offers For End of Year Silver Delivery, COMEX Physical Silver Raid Slows But Continues, Bloomberg Says Silver May Test $63, Japanese Yields Continue To Soar, Fed Announces $45 Billion In Monthly Debt Buybacks Starting In January

Rumors of Massive Asian Silver Buyer Refusing Cash Offers For End of Year Silver Delivery, COMEX Physical Silver Raid Slows But Continues, Bloomberg Says Silver May Test $63, Japanese Yields Continue To Soar, Fed Announces $45 Billion In Monthly Debt Buybacks Starting In January

Physical is king, funding is fragile: real buyers want bars, not cash; vaults thin as Japan wobbles and the Fed turns the hose back on—silver leads the repricing.

Someone wants real metal, not cash—and wants it fast.

That kind of bid forces shorts to scramble for ounces, not offsets.

Translation: physical tightness → futures pop → higher odds of squeezes, premiums, and backwardation.

Read: physical run continues.

Another 64 stand → 51.3 Moz stand for delivery this month (only 136Moz available for delivery before those are claimed).

JPM issuing and stopping = big players both sourcing and hoarding metal.

That shrinks the tradable float, pushes borrow/lease up, and raises odds of basis blowouts/backwardation.

London was thin enough to need a lifeline.

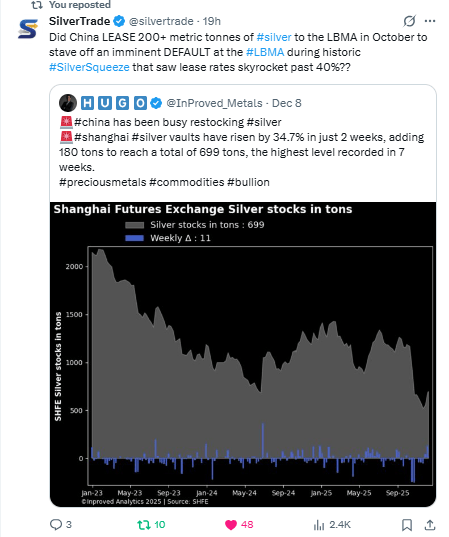

If China really leased ~200+ tonnes to LBMA during the squeeze (lease rates spiking ~40%), that screams collateral shortage—not healthy markets.

Implications, tight and human:

East holds the swing metal → East gains pricing power.

LBMA on borrowed ounces = higher odds of future premiums/backwardation if that lifeline is pulled.

SHFE stocks refilled while COMEX/LBMA drain = price discovery keeps shifting East and physical.

With China tightening exports Jan 1 and India/Russia stepping up demand, the next squeeze bites harder.

Read: shortage, not story.

With inventories thin, deliveries ripping, and export curbs looming, bids don’t need much to push price into uncharted $63.

Hold the breakout (58.8+), and premiums/backwardation risk ramps—industrial + investment demand chasing fewer ounces.

Only real caveat: a hard break <54.40 cools the squeeze. Otherwise, melt-up math favors silver.

Read: Japan is the fault line.

JGB yields ripping = BOJ losing the leash → yen carry snaps → Japan (the biggest foreign UST holder) sells Treasuries to defend the yen.

In a hyper-levered, hyper-connected system, that cascade tightens dollar funding and ricochets through credit and equities.

Translation: the weak point’s cracking—and capital sprints to real collateral (gold for ballast, silver for torque).

Translation and stakes:

Back to the hose.

If the Fed’s buying ~$45B/month, that’s quiet monetization—admission the system can’t digest issuance or rising term premia without help.

Global leverage gets a hall pass.

QE (even “not-QE”) suppresses real yields, props collateral values, and delays deleveraging—until the next, bigger wobble.

Dollar → softer over time.

More balance-sheet elasticity = financial repression (inflate debts away, don’t pay them down).

Asset map:

Gold: direct winner.

Lower real rates + policy backstop + reserve diversification = structural bid.

Silver: winner with torque.

Same macro tailwind plus a shrinking tradable float, rising industrial pull, and shorts needing metal.

Upside is non-linear when liquidity meets shortage.

Net: easing into a debt super-cycle doesn’t fix leverage; it reprices money.

That’s gold’s moment—and silver’s slingshot.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply