- The Sovereign Signal

- Posts

- Shanghai Silver Premium → Anchored Reality in the East, Michael Oliver’s T-Bond Warning, Central Banks Stockpiling Gold → Inside Knowledge on Currency Debasement, China’s Silver Exports to India Surge → Physical Drain on Bullion Intensifying, Japan’s Sovereign Debt Collapse → Canary in the Monetary Coal Mine

Shanghai Silver Premium → Anchored Reality in the East, Michael Oliver’s T-Bond Warning, Central Banks Stockpiling Gold → Inside Knowledge on Currency Debasement, China’s Silver Exports to India Surge → Physical Drain on Bullion Intensifying, Japan’s Sovereign Debt Collapse → Canary in the Monetary Coal Mine

The walls between real and synthetic pricing are eroding. Central banks, Asian markets, and the silver physical market are saying the same thing.

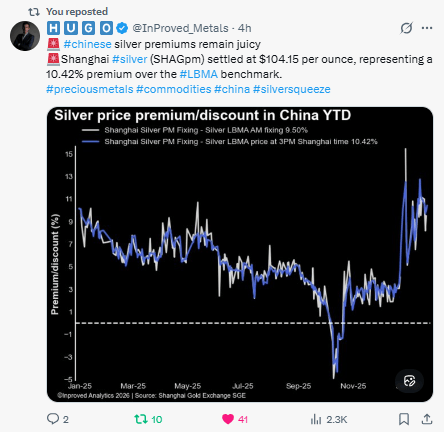

Shanghai Silver Premium → Anchored Reality in the East

A 10.42% premium on Shanghai silver over LBMA is not just a price anomaly — it’s a declaration from the largest silver-importing nation that Western paper pricing no longer reflects physical value.

This is the clearest tell that Eastern physical demand is beginning to dictate global pricing, not the synthetic paper-dominated COMEX/LBMA regime.

Implication:

Silver's "true" price is being revealed in the East — the West is playing catch-up.

Shanghai is the dog; LBMA is the tail.

Michael Oliver’s Nuclear T-Bond Panic → Liquidity Vacuum Warning

While "Silver to $500" might be attention-grabbing (it’s possible), the underlying thesis is: the T-bond market is losing its function as a stable collateral base.

If volatility accelerates in the global sovereign debt complex, it triggers forced liquidation, derivatives stress, and a flight to real collateral — not paper, but physical.

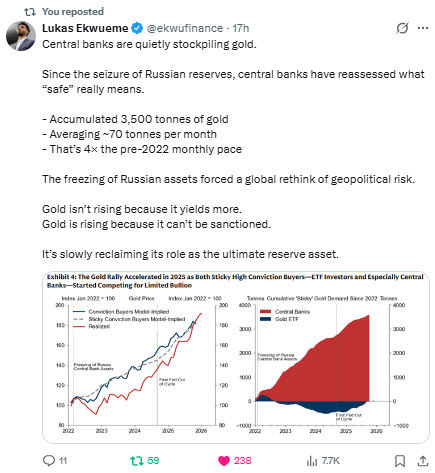

Central Banks Stockpiling Gold → Inside Knowledge on Currency Debasement

CBs, especially in BRICS and Asia, are front-running monetary disorder.

They aren’t stacking gold for yield.

They’re preparing for a world where they don’t rely on USD.

The velocity of central bank accumulation is 4x the pre-2022 average.

These aren’t retail FOMOs.

It’s strategic de-dollarization with gold as neutral settlement.

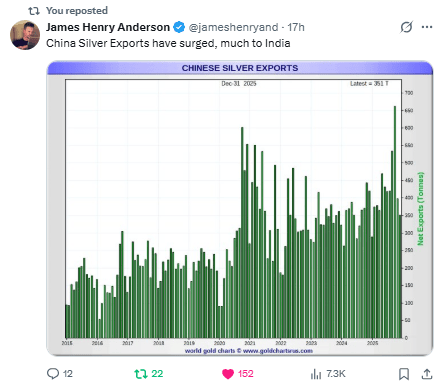

China’s Silver Exports to India Surge → Physical Drain on COMEX Bullion

This is critical: China isn’t just hoarding — it’s now offloading to India, which is ramping up industrial and monetary demand.

This could be a form of stealth arbitrage: dump overvalued domestic stock at a Shanghai premium, then reload at a relative LBMA discount, draining global supply.

Implication: Two largest silver demand centers (China + India) are recycling capital and product while exhausting Western vaults.

US-Iran Conflict Warning → Hard Asset Insurance

If war breaks out in the Middle East, energy price spikes, supply chain frictions, and safe-haven flight follow.

Gold and silver don’t just benefit from inflation — they benefit from risk repricing.

This becomes an accelerator.

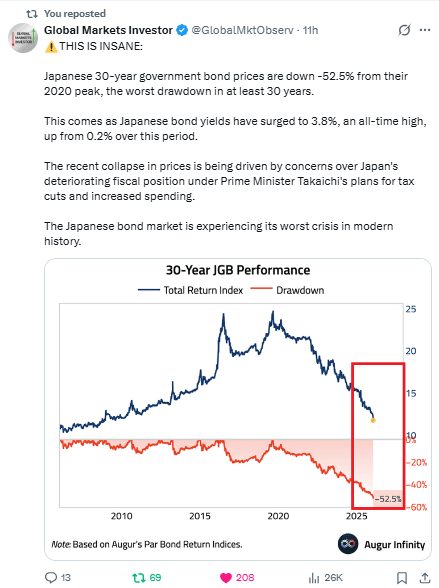

Japan’s Sovereign Debt Collapse → Canary in the Monetary Coal Mine

30Y JGBs down -52.5% from peak.

Japan is the largest foreign holder of U.S. Treasuries.

Their unwind = forced sales of U.S. debt, = spike in yields.

That pushes global cost of capital higher, deficits wider, and more QE inevitable.

The illusion of monetary control dies here.

If Japan fails, central banks globally may go full MMT (QE forever) — and hard assets go vertical.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply