- The Sovereign Signal

- Posts

- SHFE Silver Margin Hiked to 17% (COMEX Margins Hiked As Well) Yet Silver Recovers Within Minutes Of Asian Open Last Night. Short-Term Outlook Remains Very Bullish. Gold Just Broke Out Again To The Upside

SHFE Silver Margin Hiked to 17% (COMEX Margins Hiked As Well) Yet Silver Recovers Within Minutes Of Asian Open Last Night. Short-Term Outlook Remains Very Bullish. Gold Just Broke Out Again To The Upside

Expect a big green candle this week in both gold and silver.

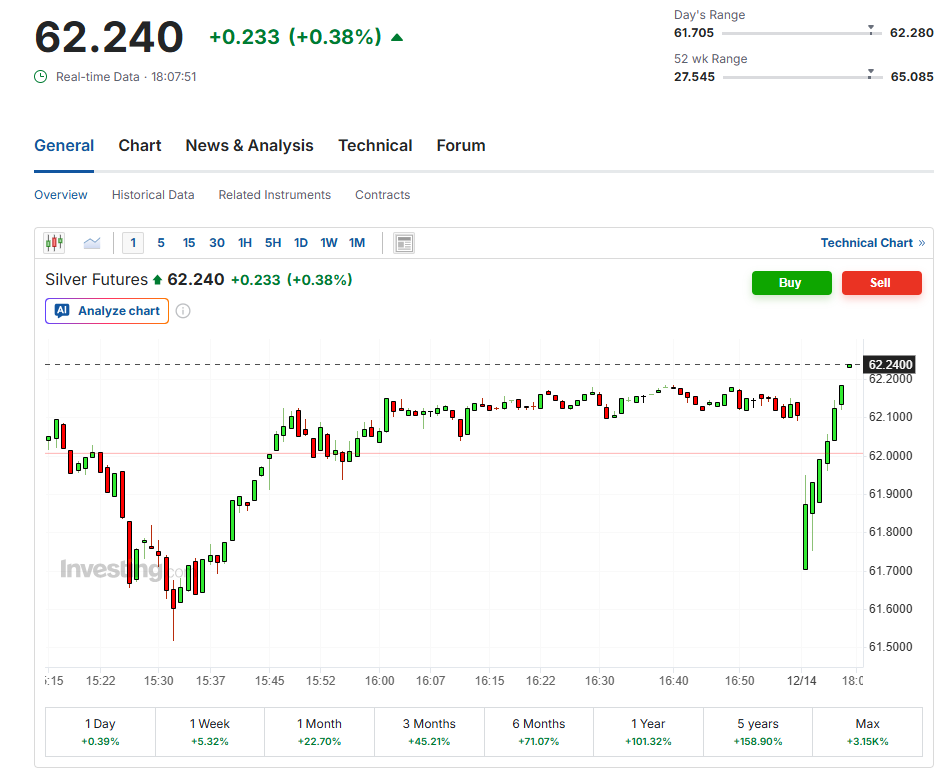

We expected the 6PM ET margin-hike flush last night after margin hikes were announced both on COMEX and SHFE since Friday.

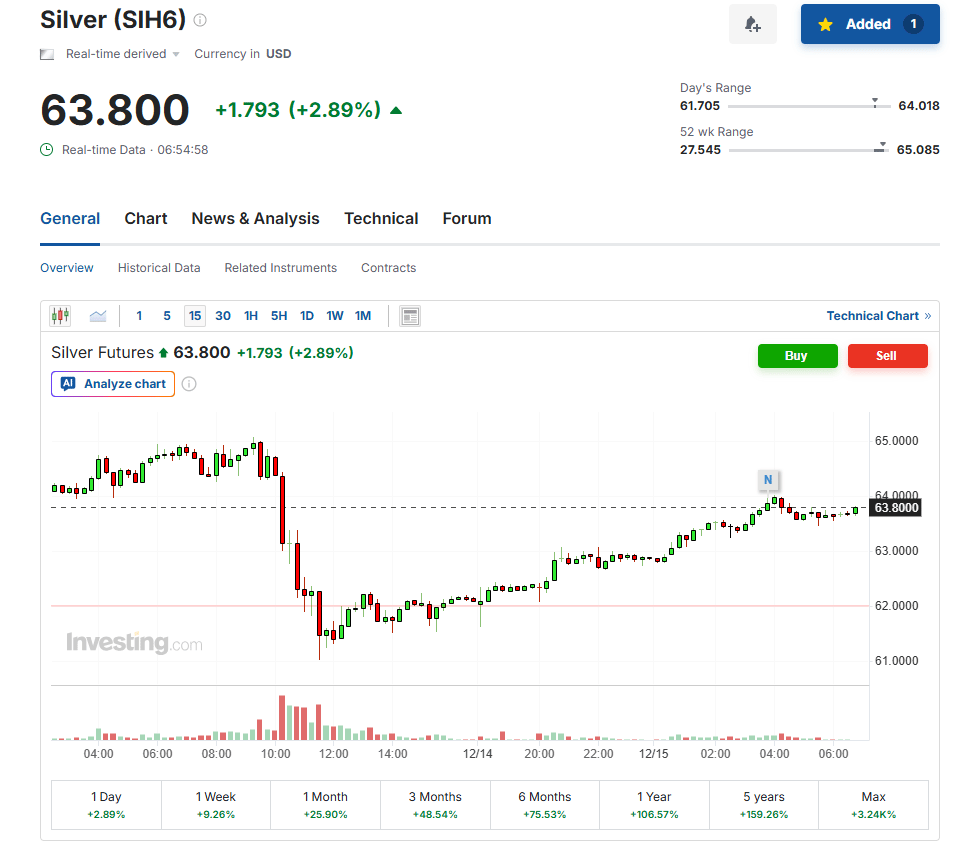

What we did not expect was a recovery within a few minutes and to be up almost a buck the following morning.

This bull market is strong.

Weak hands are largely gone.

We could see another massive green candle this week.

Spot > futures = backwardation.

Translation: people want silver now, not later—so badly they’ll pay a premium.

That screams near-term scarcity, tight inventories, and holders unwilling to part with bars, which raises roll costs for shorts and can fuel sharp upside bursts.

Volatility can still be expected, but this setup is classic pressure-cooker bullish.

Gold’s coiling under the lid is over—futures just pressed through the 4,357 ceiling.

Hold that level on a daily/weekly close and you’ve got price-discovery air above all prior highs: fresh ATHs, passive flows chasing, and beta leverage in quality miners.

Translation: the benchmark collateral is re-rating higher—again.

Exactly. Since ’08 we’ve been stacking IOUs faster than we’ve been creating output.

Each cycle needs more debt to buy the same unit of “stability,” so policy keeps doubling down—QE, buybacks, rate cuts, “temporary” facilities—because letting leverage deflate means markets crack.

This is not doom and gloom.

This is the beginning of a commodities super-cycle.

Gold and silver are leading the way.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply