- The Sovereign Signal

- Posts

- Silver Closes At Yet Another All-Time Weekly High While Shorts Standing for Physical Delivery, Western Retail Buyers Are Starting To Enter The Market, India's Central Bank Just Cut Rates, And Real Borrowing Costs Are No Longer Obeying Fed Rate Cuts

Silver Closes At Yet Another All-Time Weekly High While Shorts Standing for Physical Delivery, Western Retail Buyers Are Starting To Enter The Market, India's Central Bank Just Cut Rates, And Real Borrowing Costs Are No Longer Obeying Fed Rate Cuts

When rates cut but real yields won’t obey, capital flees paper; shorts grab bars, retail is waking up—silver leads the revaluation. M2 Money Supply makes yet another new all time high.

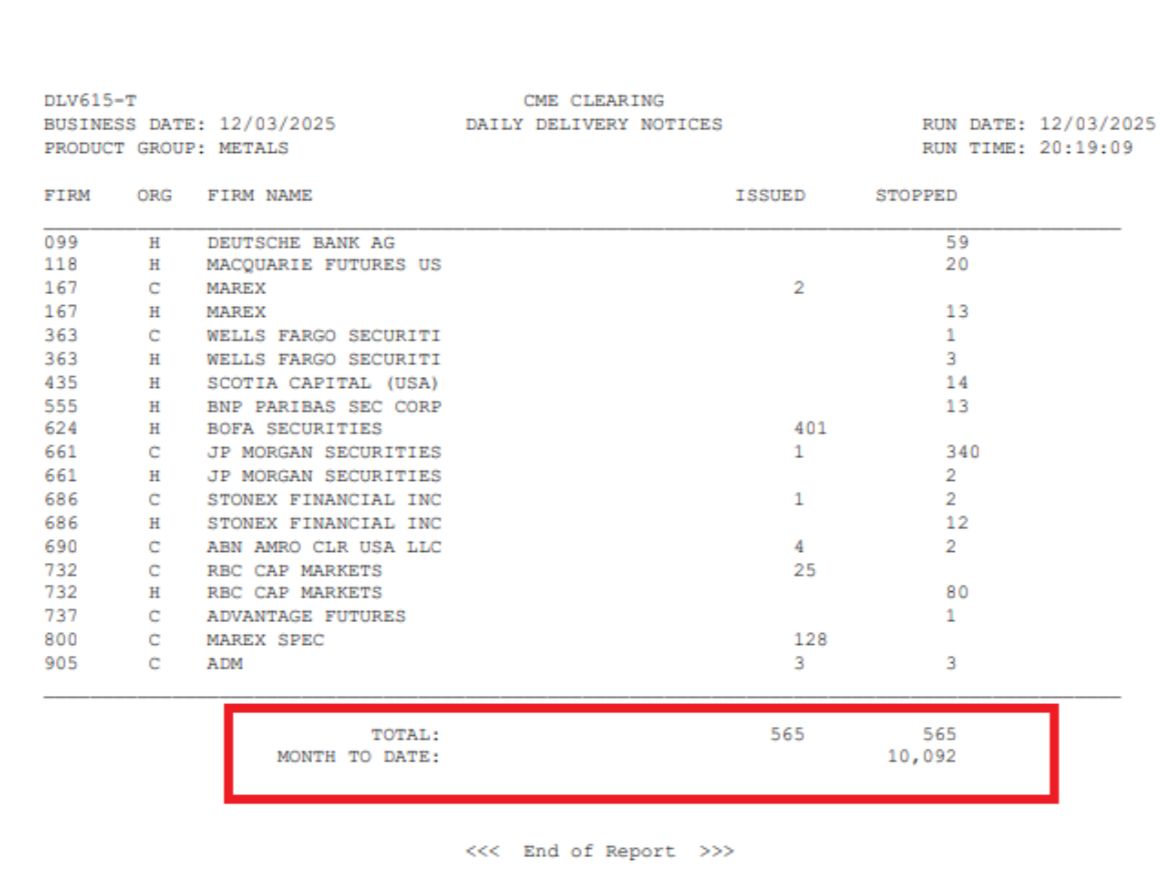

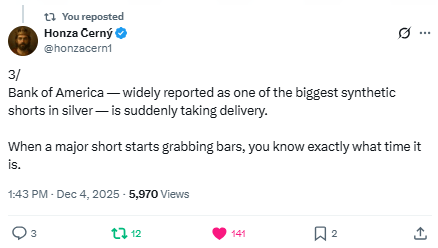

Bank of America—thought by some silver experts to have among the biggest short positions in silver—just stood for delivery of over 2 million ounces (401 × 5,000) of silver.

That’s not victory; that’s hedging a fire.

When a major short grabs bars, it means paper risk is too hot and collateral is king.

This tightens the float of available physical silver, pushes lease/borrow rates up, and raises the odds of basis blowouts/backwardation.

Add it to the stack:

COMEX metal flying out, London stretched, SOFR popping.

Translation: price discovery is migrating to physical.

Bottom line: the players who know the book best are securing ounces, not selling them.

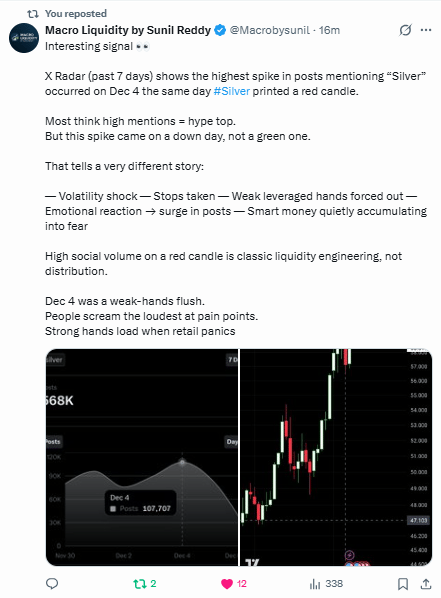

Spike in “silver” mentions on a red candle = weak-hands flush, not a top.

Stops tripped, shorts defended, social volume screamed; strong hands bought the fear.

Confirmation:

Silver futures just closed the week at 59.053 — the highest weekly close ever.

That’s demand absorbing the shakeout.

Plumbing backdrop: each squeeze forces overnight cash needs (SOFR pops) while physical keeps leaving vaults — the bid is real, not narrative.

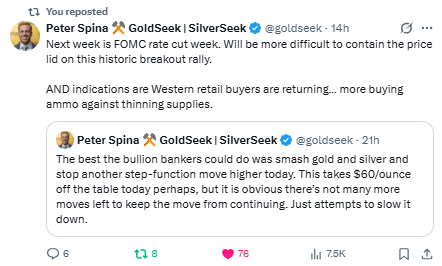

FOMC cut week + thinning supply = the lid gets harder to hold down.

Easier policy lowers real rates right as the metal pool shrinks.

“Smash” attempts are losing effect.

You don’t see step-function rallies get erased when physical’s tight and funding’s stressed.

Western retail trickling back adds a new buyer cohort on top of central banks and ETFs—more flow into fewer ounces.

It’s a global race to the bottom.

When growth falters, central banks—India included—reach for the same lever:

Cut, liquefy, devalue.

Given today’s debt load, they’ll always risk inflation over a hard stop.

That choice weakens currencies → boosts domestic gold/silver demand → drives more imports → adds FX pressure → invites more easing.

It’s a reflexive loop.

The tighter and more leveraged the system gets, the harder the balancing act—and the louder the bid for base-layer collateral.

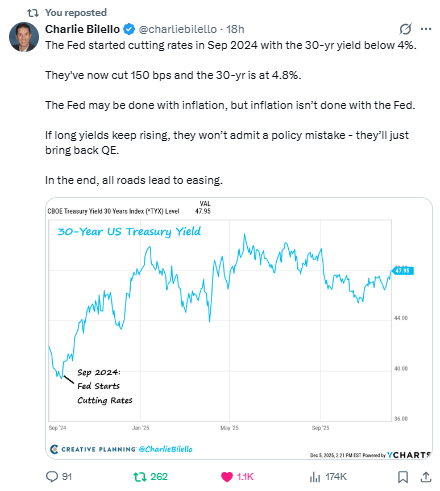

Fed rate cuts don’t control borrowing costs in the real economy.

The Fed moves effective federal funds rate (EFFR).

There is no guarantee the 10 Year Yield (benchmark for real borrowing costs) will follow.

Now the curve is rebelling.

With record issuance, QT, Japan wobbling (and selling USTs to defend the yen), the long bond says: “Pay me more.”

More debt = more duration risk.

As leverage swells, buyers demand higher real yields even as the Fed eases.

That’s how you get rate cuts with rising long rates.

When the long end won’t play ball, they don’t admit a mistake—they roll out QE/“balance-sheet flexibility.”

Translation: The market keeps pretending Fed cuts = lower rates.

The 10Y is the bouncer at the door, and he’s not impressed. This is why gold climbs…and why silver rips when the easing meets a duration revolt.

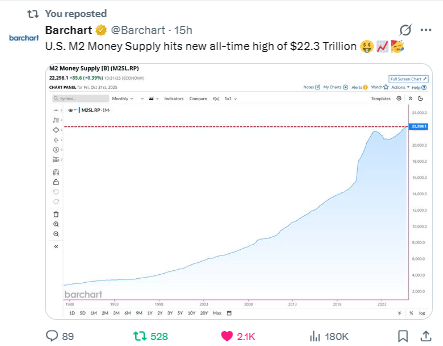

Money supply at a new ATH while real productivity lags = the economy’s gains are coming from credit creation, not output.

Debt and GDP are inflating together; productivity isn’t.

That gap forces one of two valves: higher real growth (we don’t have it) or financial repression—cuts, QE, curve-control, stealth inflation.

Policymakers always choose Door #2 in a debt super-cycle.

Result: a duration revolt at the long end (investors demand more yield), rising term premia, and recurring funding stress (more reliance on overnight).

Paper needs constant rescue.

Translation for capital: price discovery migrates to scarce, non-liability assets.

Gold anchors purchasing power; silver—tiny float, industrial pull—delivers the torque.

Next ring out: copper (electrification/AI power build-out) and selective energy.

In short: M2 up ≠ prosperity up.

It’s the tell that the system is leaning on money and leverage, not productivity—an environment that historically rewards real assets over financial promises.

Why I Use HardAssets Alliance

HardAssets Alliance provides:

100% insurance of metals for market value

Institutional-grade daily audits and security

Best pricing — live bids from global wholesalers

Fully allocated metal — in your name, your bars

Delivery anytime or vault-secured across 5 global hubs

Luke Lovett

Cell: 704.497.7324

Undervalued Assets | Sovereign Signal

Email: [email protected]

Disclaimer:

This content is for educational purposes only—not financial, legal, tax, or investment advice. I’m not a licensed advisor, and nothing herein should be relied upon to make investment decisions. Markets change fast. While accuracy is the goal, no guarantees are made. Past performance ≠ future results. Some insights paraphrase third-party experts for commentary—without endorsement or affiliation. Always do your own research and consult a licensed professional before investing. I do not sell metals, process transactions, or hold funds. All orders go directly through licensed dealers.

Reply